When it comes to exits you are always going to feel some type of remorse, you sold to soon, you should’ve sold all the shares earlier, etc.

What you need is clarity; are you a trader or an investor.

What are you looking to accomplish with your trading?

To keep the selling remorse to a minimal level, I suggest clarity, and I suggest diversifying your sales; sell some on the way up, trail a piece 2x ATR, sell some when it breaks the 10-day, sell some when it violates the 20-day, etc. But be consistent with this approach, you just can’t do it with one stock or cherry-pick to do it only with a few, you have to do it with all of them because I the end the day you are not going to know beforehand which ones will be the big winners.

After a series of trades where you diversify your selling as I mention above you will realize that this selling strategy will work differently in different market environments. In certain market environments holding a little bit longer will pay off and it others it won’t and here is where the issues arise. The March 2020 environment is different from the one we are experiencing now, and soon we will go to a different market environment.

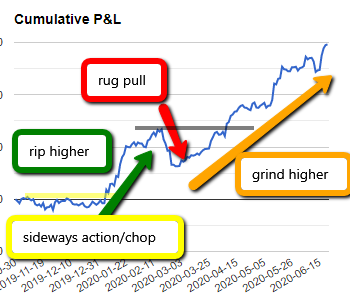

The chart below shows the different market environments. Correction, rip higher, sideways chop, grind higher. The problem arises when you use the same exit strategies from rip higher move like the one we are experiencing in corrective and or sideways environment.

And usually when you finally realize that it’s time for a change the market environment changes and it throws you into a loop.

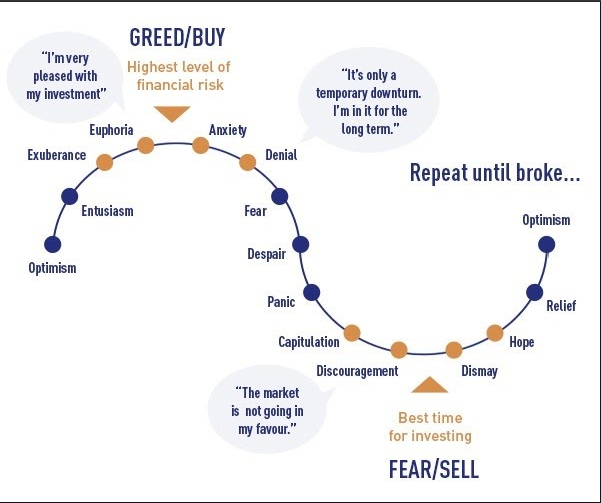

It does not matter who you are or what stock it is, you will notice the same cycle, and it will repeat itself over and over again. The market at one point will fall in love with your strategy, and at one point, it will hate your strategy.

“The psychology of the investing public changes–cycling from the most blissed-out euphoria about equities to the most abject terror and then back again, always at the wrong times.”

You can find stocks before the breakout here (Managed Assets)

A lot of Do It Yourself traders work with me at the trading room

You can view over 300 shared trades including all the ones from last week here

This information is issued solely for informational and educational purposes and does not constitute an offer to sell or a solicitation of an offer to buy securities. None of the information contained in this blog constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. From time to time, the content creator or its affiliates may hold positions or other interests in securities mentioned in this blog. The stocks presented are not to be considered a recommendation to buy any stock. This material does not take into account your particular investment objectives. Investors should consult their own financial or investment adviser before trading or acting upon any information provided. Past performance is not indicative of future results.

Leave A Comment