It’s Too Late To Short/Sell

Originally posted Wednesday, January 20, 2016

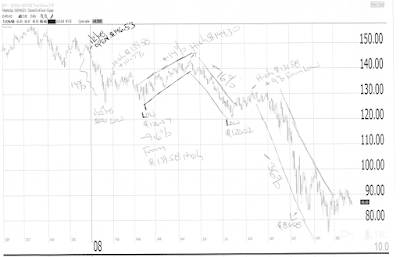

It’s simply too late to short. With SP500 down 11%, QQQ -13%, IWM -15%, since their 12/30/2015 high, it is simply too late. If you believe that this will be 2008 all over again, chances are high that you might get an opportunity to short at better prices. As you can see in the chart below, 2008 started with a 14% decline that was followed by a 10% dead cat bounce that led to some sideways action.

The largest rallies have happened in bear/corrective markets that are below the 200-day moving average as you can see below:

Be patient, you will get your chance.

Update 1/23/16, if you were panicking, if you believe this 2008 all over again, then take this 5% rally and get your house in order. Don’t wait until the market falls under pressure again.

Frank Zorrilla, Registered Advisor In New York

If you need a second opinion, suggestions, and or feedback in regards to the market feel free to reach me at fzorrilla@zorcapital.com or 646-480-7463.

Leave A Comment