It’s simply too late to short. With SP500 down 11%, QQQ -13%, IWM -15%, since their 12/30/2015 high, it is simply too late. If you believe that this will be 2008 all over again, chances are high that you might get an opportunity to short at better prices. As you can see in the chart below, 2008 started with a 14% decline that was followed by a 10% dead cat bounce that led to some sideways action.

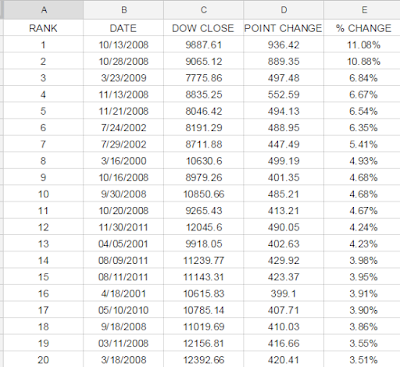

The largest rallies have happened in bear/corrective markets that are below the 200-day moving average as you can see below:

Be patient, you will get your chance.

Frank Zorrilla, Registered Advisor In New York

If you need a second opinion, suggestions, and or feedback in regards to the market feel free to reach me at fzorrilla@zorcapital.com or 646-480-7463.

This information is issued solely for informational and educational purposes and does not constitute an offer to sell or a solicitation of an offer to buy securities. None of the information contained in this blog constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. From time to time, the content creator or its affiliates may hold positions or other interests in securities mentioned in this blog. The stocks presented are not to be considered a recommendation to buy any stock. This material does not take into account your particular investment objectives. Investors should consult their own financial or investment adviser before trading or acting upon any information provided. Past performance is not indicative of future results.

Leave A Comment