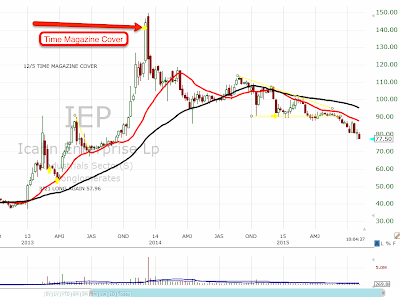

Going through some charts, I came across Ichan Enterprises $IEP; a master limited partnership (run primarily by Carl Ichan), is a diversified holding company engaged in ten primary business segments: Investment, Automotive, Energy, Metals, Railcar, Gaming, Mining, Food Packaging, Real Estate, and Home Fashion.

Ichan Enterprises is down nearly 50% since Time Magazine (December 2013) put him on the cover of “The Original Wolf Of Wall Street Returns.”

You can only imagine how many people jumped on that runaway train due to looking at what IEP had just done, thinking that type of performance could be easily replicated again immediately after they bought in, basically counting the chickens before they hatch.

This reminds me of a similar situation that happened years ago with Ken Heebner. Fortune ran an article “America’s Hottest Investor” (May 2008). Investors literally tripped over themselves to throw money at Heebner after an incredible 80% year. Even though Heebner had the best 10-year track record of any mutual fund as of November 30, 2009, the typical CGM focus fund lost 11% annually in the 10 years ending November 30, 2009.

WSJ; The gap between CGM Focus’s 10-year investor returns and total returns is among the worst of any fund tracked by Morningstar. The fund’s hot-and-cold performance likely widened that gap. The fund surged 80% in 2007. Investors poured $2.6 billion into CGM Focus the following year, only to see the fund sink 48%. Investors then yanked more than $750 million from the fund in the first eleven months of 2009, though it is up about 11% for the year through Tuesday.

The moral of the story is; DON’T CHASE. All we have to do now is wait until we get the magazine cover that says, “The Death of Carl.”

Today’s Wall Street Darling is $ARKK (12/28/2020), CHECKOUT THIS THREAD

You can find Stocks Before They Breakout Here https://bit.ly/2Cuh784 and Here https://bit.ly/2JZ3JNR

You can view over 400 of my trades here https://www.tradervue.com/shared/users/8059

Leave A Comment