Microsoft, Apple, Amazon, Tesla, Alphabet (Google), Facebook, and Nvidia now account for 26.4% of the S&P500 and a whopping 50.7% of the $QQQ.

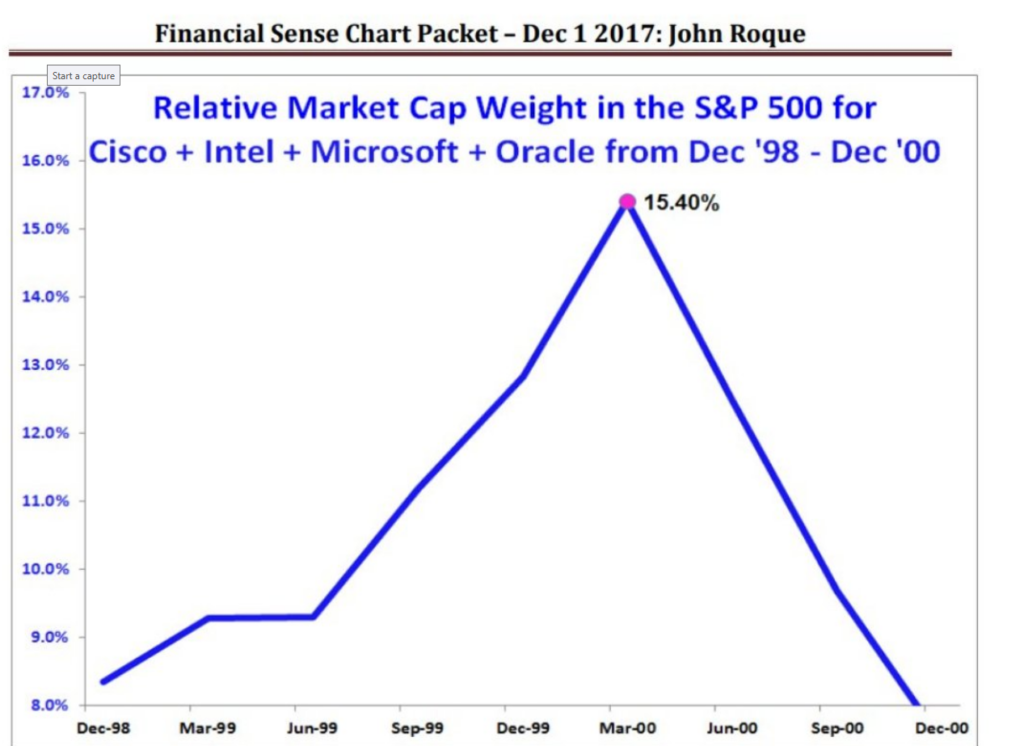

To put that in perspective, at the height of the internet bubble, the four horsemen of that time were; CISCO, INTEL, MICROSOFT, and ORACLE.

At their peak, they accounted for 15.40% of the S&P 500.

Now that you know this, it is easy to see how the market of stocks peaked in February, yet the indices continued their march higher without a hiccup.

The FAATMAN’s masked what was going on with most stocks underneath the surface for most of the year; they were struggling.

Check out these four charts; you have stocks above their 40-day moving average, stocks above their 200-day moving average, and you have the S&P 500 and the Nasdaq 100. You will notice that breadth (most stocks) trending down for a big part of the year versus the indices trending higher, thanks to FAATMAN.

Before you start comparing the four horsemen of 1999 that led to a market peak to today’s 7-horsemen, understand that negative divergence is a condition, NOT a SIGNAL.

The stocks in the S&P 500 and the Nasdaq 100 are weighted by market capitalization.

You literally cannot short the SPY or the QQQ for longer than a cup of coffee unless these stocks break down.

History says they probably will, but you don’t want to anticipate this; you are better off reacting.

Stay connected;

You can find Stocks Before They Breakout Here and here

You can view over 400 of my trades here https://www.tradervue.com/shared/users/8059.

This information is issued solely for informational and educational purposes and does not constitute an offer to sell or a solicitation of an offer to buy securities. None of the information contained in this blog constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. From time to time, the content creator or its affiliates may hold positions or other interests in securities mentioned in this blog. The stocks presented are not to be considered a recommendation to buy any stock. This material does not take into account your particular investment objectives. Investors should consult their own financial or investment adviser before trading or acting upon any information provided. Past performance is not indicative of future results.