Individual stock set-ups are there, they are ready, all they need is a little push and help from the market. The sideways action in the last six weeks is the reason why I have so many names on my list, however not many have been triggering. The trigger rule is simple; the stock has to go through the previous day plus .10-cents.

Tomorrow we have the NFP number due at 8:30 am and that can dictate the action for a few days. At the same time, breadth is and has been deteriorating to the point in which I think will impact the market in the short term.

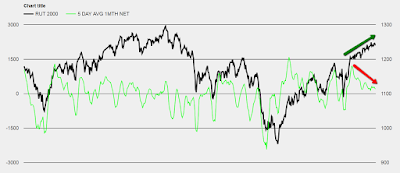

Below you have the 5-day average of the difference of 1-month highs versus 1-month lows.

Here you have the average of SP500 stocks above their 3, 5, 10-day moving average.

The question becomes; ignore the indices and breadth and just take the set-ups? There’s never a clear sign and the outcome will always tell you the answer in hindsight.

NSM, XPO, TTMI, CRUS, ZAGG, NVRO, TWOU, JACK, OSK, ROST, MIDD, SON, CPHD, MGT, VZ, ERII, MITK, YNDX, CGNX, ICON, LC, CHGG, ELLI, TWLO, HLF, TZA, SOXS.

My opinion and outlook are subject to change as new information comes in.

Frank Zorrilla, Registered Advisor In New York. If you need a second opinion, suggestions, and or feedback in regards to the market feel free to reach me at fzorrilla@zorcapital.com or 646-480-7463.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

This information is issued solely for informational and educational purposes and does not constitute an offer to sell or a solicitation of an offer to buy securities. None of the information contained in this blog constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. From time to time, the content creator or its affiliates may hold positions or other interests in securities mentioned in this blog. The stocks presented are not to be considered a recommendation to buy any stock. This material does not take into account your particular investment objectives. Investors should consult their own financial or investment adviser before trading or acting upon any information provided. Past performance is not indicative of future results.

Leave A Comment