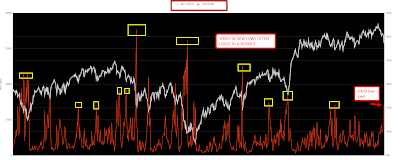

BOOM! just like that the market takes back 75% of the losses it dished out last week. We showed the chart below on Friday of last week, what we saw was a spike in 1-month lows. Typically these short-term spikes lead to dead cat bounces that lately have been turning into V-shape rallies.

Here’s the chart; SPIKES IN 1-MONTH LOWS.

The hardest part about these quick sell-offs is finding stocks to buy that are technically set-up properly. The easiest thing to do is to buy the indices. You won’t miss the bounce if you buy the SPY, QQQ, DIA, or IWM, and if you have some index ETF exposure you won’t feel like the market is running away from you, your back won’t be against the wall to put on some positions just to keep up with the Joneses (SP500). The index ETF’s will give the necessary exposure you need until stocks technically set-up again which can be days to weeks later.

I only have a few stocks on my swing trading watch-list today, it looks like my index exposure will have to do for now.

I have an interest in the stocks above if and only if they can get through yesterday’s high plus .10 cents.

STOCK OF THE WEEK RECAP

Frank Zorrilla, Registered Advisor In New York. If you need a second opinion, suggestions, and or feedback in regards to the market feel free to reach me at fzorrilla@zorcapital.com or 646-480-7463.

We live in a world in which we are bombarded with information, tweets, blogs, etc., content is the new salesman, content is the new marketing, content is the new networking. With information being so readily available, bloggers try to differentiate themselves with their writing skills, volume, and consistency, putting out blog posts to meet quotas. We are seeking to stand out from the crowd by showing performance, by taking all the information and seeking alpha, that’s the sole purpose of the blog. It won’t always be pretty; it’s never easy, and performance is spotty, but we seek superior risk-adjusted returns, not notoriety for our writing skills. If this is something you can relate to, then this blog is for you.

This information is issued solely for informational and educational purposes and does not constitute an offer to sell or a solicitation of an offer to buy securities. None of the information contained in this blog constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. From time to time, the content creator or its affiliates may hold positions or other interests in securities mentioned in this blog. The stocks presented are not to be considered a recommendation to buy any stock. This material does not take into account your particular investment objectives. Investors should consult their own financial or investment adviser before trading or acting upon any information provided. Past performance is not indicative of future results.

Leave A Comment