The SP500 has had a massive rally from oversold levels, and a sentiment shift is now taking place.

- 8/24/15 It’s 1987 all again, get me out!

- 9/28/15 Carl Icahn’s Danger Ahead video, I can’t go through 2008 again, get me out!

- 10/8/15 FOMO, the SP500 just rallied 7%, I can’t afford to miss this train.

The Fear Of Missing Out is real, especially for professionals. Here’s when things get pushed to the limit in fear of losing the clients who want all the upside but none of the downside. “Nothing teaches you what a dread disease short-terminism can be quite like getting to the 20th of a particular month and feeling that you need to make something special happen in your portfolio in the next 10 days”.–Why This Hedgefund is Shutting Down

A lot of things can go right here for the bulls after some digestion.

A lot of things can go right here for the bulls after some digestion.

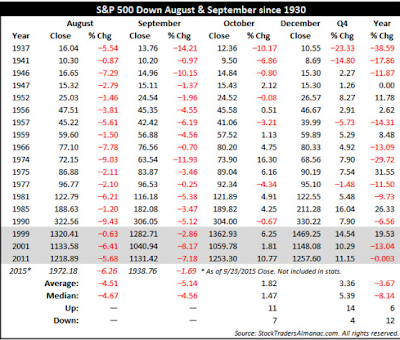

1. Seasonality, the fourth quarter tends to be very strong especially after a down August and down September. Source Jeff Hirsch

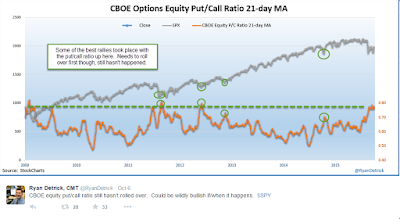

2. You have the potential rollover of the CBOE equity put to call ratio; this is in the past has bode well for the market. Source Ryan Detrick

3. NAAIM; National Association of Active Managers. Quite frankly, these managers have been spot on about the market in the last few months. They were reducing their market exposure on a consistent basis since April. But, just last week they increased their long exposure by 100%, and there is plenty of room to go before they’re fully invested. This increase of exposure bodes well for the future. Source Ryan Detrick

We are entering earnings season, so far we have seen more weak reports than strong ones. This can possibly derail the market. We also have a lot of overhead supply above that starts right around the 2040 level on the SP500. However, the fear of missing out is much bigger than any rational argument you can come up with. What I want you to do is remember the above points when the market pulls back. Many tend to talk about all the bullish points only when the market goes up and forget about them when the market goes down for multiple days in a row.

In the short term with McClellan Oscillator at +236 the market is overheated, chasing what is already up 5,6 days in a row is probably not prudent. And, yes, the market can remain overbought, this is usually said by the same people who told you that the market can remain oversold on 8/24 and 9/28. At the end of the day, the market goes up and down not up or down.

This information is issued solely for informational and educational purposes and does not constitute an offer to sell or a solicitation of an offer to buy securities. None of the information contained in this blog constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. From time to time, the content creator or its affiliates may hold positions or other interests in securities mentioned in this blog. The stocks presented are not to be considered a recommendation to buy any stock. This material does not take into account your particular investment objectives. Investors should consult their own financial or investment adviser before trading or acting upon any information provided. Past performance is not indicative of future results.

Leave A Comment