Same tune, just another day. The market has certainly forgotten what a down day is, we continue to grind higher making it difficult to buy aggressively. We all know that a down day is coming, everyone expects it, but I’m sure when it comes they’ll be shocked.

As I go through my scans, I’ve noticed that many small biotech stocks are holding up well, a lot better than the sentiment surrounding the sector. Stocks like XON, AMAG, ZIOP, have been trading sideways for a few months and are just emerging from their possible first stage bases. Biotechs like AERI, CLCD, have been immune to the recent biotech sell-off. The one issue that I have with biotechs is obviously the fact that on any given day you can walk into a huge gap down making owning the ETF a much safer bet.

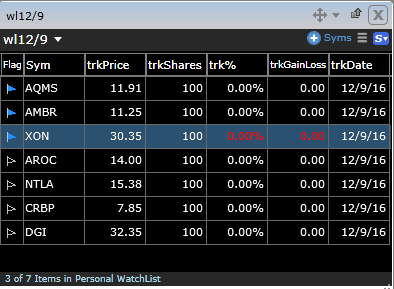

Below are the stocks on my list today; I have an interest in these stocks if and only if they go through yesterday’s highs.

Frank Zorrilla, Registered Advisor In New York. If you need a second opinion, suggestions, and or feedback in regards to the market feel free to reach me at fzorrilla@zorcapital.com or 646-480-7463.

We live in a world in which we are bombarded with information, tweets, blogs, etc., content is the new salesman, content is the new marketing, content is the new networking. With information being so readily available, bloggers try to differentiate themselves with their writing skills, volume, and consistency, putting out blog posts to meet quotas. We are seeking to stand out from the crowd by showing performance, by taking all the information and seeking alpha, that’s the sole purpose of the blog. It won’t always be pretty; it’s never easy, and performance is spotty, but we seek superior risk-adjusted returns, not notoriety for our writing skills. If this is something you can relate to, then this blog is for you.

This information is issued solely for informational and educational purposes and does not constitute an offer to sell or a solicitation of an offer to buy securities. None of the information contained in this blog constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. From time to time, the content creator or its affiliates may hold positions or other interests in securities mentioned in this blog. The stocks presented are not to be considered a recommendation to buy any stock. This material does not take into account your particular investment objectives. Investors should consult their own financial or investment adviser before trading or acting upon any information provided. Past performance is not indicative of future results.

Leave A Comment