The shorter your timeframe, the more entries matter.

In the short term, if you chase, you lose.

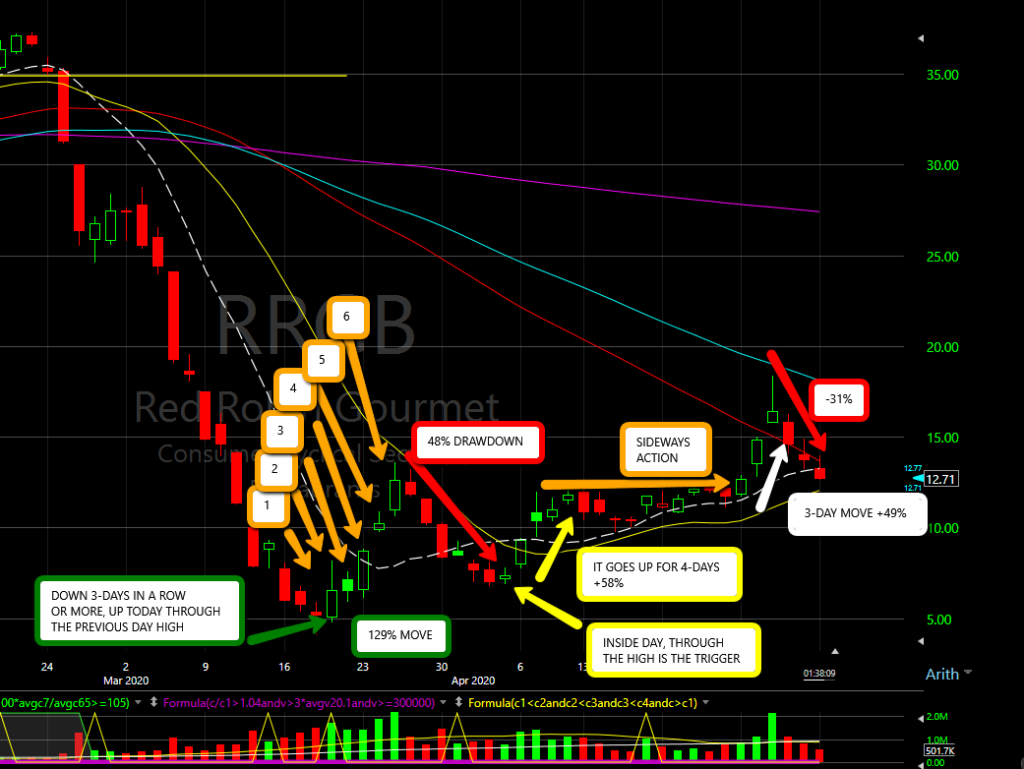

Your goal as a short-term trader is to get involved on the first day of a potential multi-day move.

If you are buying something already up 4-5 days in a row or trending on StockTwits or Twitter, you are too late for the party.

$SHOP is a perfect example. The stock was trending on the social platforms after being up a few days in a row.

$SHOP entry;

There’s no doubt that every now and then, you will get lucky and buy something up five days in a row, and it continues to go higher, but in a series of trades, the odds are against you.

You want to start studying stocks differently from what you learn in the books.

Start looking at charts and pinpointing where moves are starting from.

If you follow my advice, then you will view charts differently and will be able to create your own scans based on your new findings.

You can view hundreds of REAL trade examples (FOCUS ON THE ENTRIES) here; SHARED TRADES.

This information is issued solely for informational and educational purposes and does not constitute an offer to sell or a solicitation of an offer to buy securities. None of the information contained in this blog constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. From time to time, the content creator or its affiliates may hold positions or other interests in securities mentioned in this blog. The stocks presented are not to be considered a recommendation to buy any stock. This material does not take into account your particular investment objectives. Investors should consult their own financial or investment adviser before trading or acting upon any information provided. Past performance is not indicative of future results.