There has been a lot of talk lately on the twitter stream about the market rallying into options expiration and then giving up all the gains. There is some truth to that, and the fact that we are at or near resistance levels (read) one should be aware of what has happened after options expiration.

Underneath what you are looking at is the SPY starting the Monday after options expiration through the next ten days. Every month has shown some weakness after expiration and the context of every month has been the same, a rally up to expiration. August was the only month that we did not see a rally leading up to options expiration.

Opex Front Run Rallies h/t NorthmanTrader

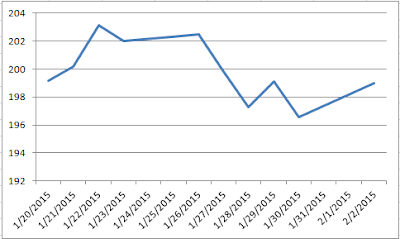

10-day closing trough after expiration.

Visual of the 10 days after expiration.

This information is issued solely for informational and educational purposes and does not constitute an offer to sell or a solicitation of an offer to buy securities. None of the information contained in this blog constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. From time to time, the content creator or its affiliates may hold positions or other interests in securities mentioned in this blog. The stocks presented are not to be considered a recommendation to buy any stock. This material does not take into account your particular investment objectives. Investors should consult their own financial or investment adviser before trading or acting upon any information provided. Past performance is not indicative of future results.

Leave A Comment