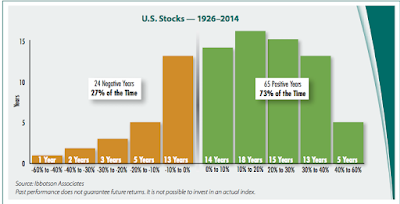

When it comes to investing, time is your most valuable commodity. The Indices have a tendency to trade higher over time. In the last 89 years, the SP500 has been up 73% of the time with an annual gain of 21%. Negative years have occurred 27% of the time averaging an annual loss of -14.29%. This doesn’t mean that pullbacks are not painful, stressful, stomach churning, etc. In hindsight, they are a walk in the park, but when you are going through a drawdown, your behavioral flaws will fail you almost everytime. Hence, the importance of knowing the history of the market (SP500).

Another important note is to recognize that individual stocks are not the “market”. Most companies fail, “The Russell 3000 index measures the performance of the largest 3000 U.S. companies, 98% of the investable U.S. equity market. 40% of the stocks had a negative return over their lifetime, 20% of stocks lost nearly all of their value, 10% of stocks recorded huge wins over 500%. 80% of the gains are a function of 20% of the stocks. –The Ivy Portfolio

Leave A Comment