There’s absolutely no reason why you should try to avoid the unavoidable. Losses, draw-downs, are part of the game, they happen on a consistent basis. You can do all the research, all the work humanly possible and you still cannot avoid losses and draw-downs. Stop wasting your time trying to do it. That does not mean you ride everything down, take your losses, live to fight another day, but don’t waste your valuable time trying to find the perfect system that tries to avoid the unavoidable. “Buy green, sell red, we never lost money,” etc… is all a fantasy

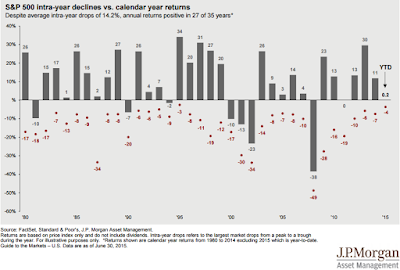

In case you forgot, the average intra-year pullback in the SP500 since 1980 has been roughly 14%, a little less since 2009. Despite the 14% intra-year decline, the SP500 has closed positive 27 out 34 years, 79%. Draw-downs are painful but unavoidable, means to an end. The market is doing what it is supposed to do, go up AND down not up OR down, stay thirsty.

David Tepper;

Believe it or not, Tepper attributes his success to these drawdowns. He has been quoted as saying that his fund’s returns are “consistently inconsistent.” And that “it’s one of the cornerstones of our success.” Every year he lost 20% or more, he came back with at least a 60% return the following year (in two of those years, 100% plus).

This information is issued solely for informational and educational purposes and does not constitute an offer to sell or a solicitation of an offer to buy securities. None of the information contained in this blog constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. From time to time, the content creator or its affiliates may hold positions or other interests in securities mentioned in this blog. The stocks presented are not to be considered a recommendation to buy any stock. This material does not take into account your particular investment objectives. Investors should consult their own financial or investment adviser before trading or acting upon any information provided. Past performance is not indicative of future results.

Leave A Comment