Finding Stocks Before They Breakout

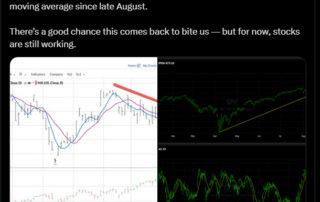

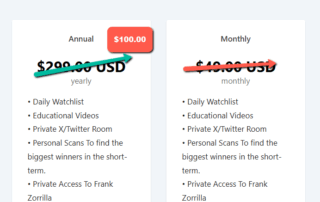

On December 3rd, I posted that OKLO and ASTS were stabilizing after deep drawdowns. No hype.No chasing.Just finding stocks before the breakout. This Is Exactly How These Trades Are Spotted These weren’t random momentum spikes. They came from: Drawdown stabilization Situational awareness Volatility compression Single-stock ETF exposure And We’re Already Tracking the Next Wave While most traders wait for confirmation, my Private Alpha Group is already positioned in: The next stabilization setups The next volatility expansions The next asymmetric opportunities Some people are too busy to trade during the day, and others don’t fully trust their execution. That’s why I [...]