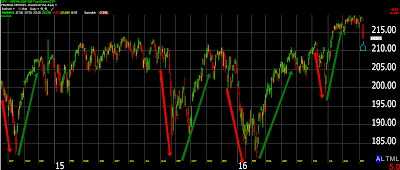

Contraction leads to expansion typically in the direction of the preceding trend. It took the SP500 over 50 days to decline more than 1%, and it traded in a very small range in the last two months, we had not seen such tightness since 1928. Unfortunately for many the expansion was to the downside. It took just a few hours to dissipated what took us 43 days to make as you can see in the chart below.

September historically is a weak month for the SP500 and a very strong month for volatility index (VIX) as we noted here (Doom and Gloom for September). The 38th week which is the upcoming week is usually a negative week for the market and the 2nd strongest week for the volatility index, follow through selling is not of the question (the SP500 tends to have an inverse relationship with VIX).

The selling was severe on many counts; down volume, the number of stocks down 4% for the day, 96% of the issues on the NYSE were down, etc. You couple that with the huge VIX spike (40%) and they all suggest a dead cat bounce but a lower low 10-20 days out,

A few things continue to pop up when I think about what can possibly happen over the next few weeks.

1. A V-rally, over the last couple of years every time the market sold off hard it was followed by relentless buying that would last weeks not allowing you to jump back in without having a feeling that you were chasing a trap. I believe due to seasonality, elections, and hedge fund exposure a V-rally is not a high probability outcome.

2. Coming into the week hedge funds had a very high exposure to stocks, along with a record amount of shorts on the VIX and an all-time record $65 billion net long exposure to index futures. My feeling is that these have to be unwound before we can think about having a sustained rally. The unwinding could be quick.

My opinion and outlook are subject to change as new information comes in.

Frank Zorrilla, Registered Advisor In New York. If you need a second opinion, suggestions, and or feedback in regards to the market feel free to reach me at fzorrilla@zorcapital.com or 646-480-7463.

Leave A Comment