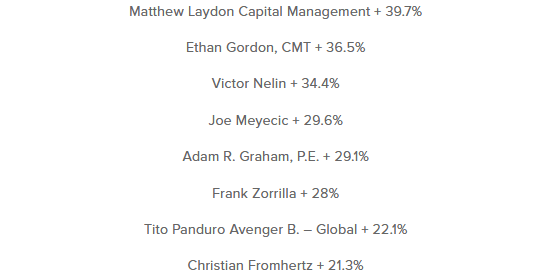

In 2025, I entered the U.S. Investing Championship.

-

579 entrants

-

Tracked for 11 months

-

Ranked #42

-

Return: +28%

That’s the result. Here’s what matters more.

This Was Not a YOLO account.

I did not trade differently than I trade client capital.

No leverage games.

No leaderboard chasing.

No style drift.

Same process. Same risk rules.

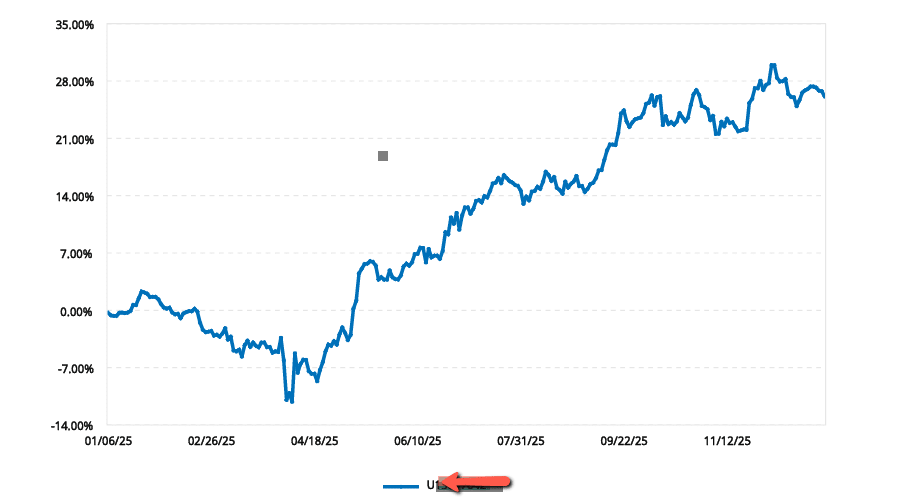

Risk and Recovery

Returns without context are meaningless.

-

Max drawdown

-

My account: 13.14%

-

S&P 500: 18.76%

-

-

Recovery time

-

My account: 24 days

-

S&P 500: 57 days

-

Largest percentage winners

-

STSS entry date (9/8)

-

DFLI (10/13)

-

ETHA (4/24)

-

LDI (9/5)

-

QUBX (9/17)

-

IONZ (11/19)

-

UPXI (7/17)

Largest dollar contributors

-

NVTS (7/17)

-

IONZ (9/23, 11/19)

-

ETHA (6/4)

-

QUBX (9/17)

-

RGTZ (9/9)

-

QBTZ (10/16)

-

YOU (12/9)

-

SMR (9/18)

-

APLD (9/9)

No single trade carried the year.

Performance came from multiple positions working, not one big bet.

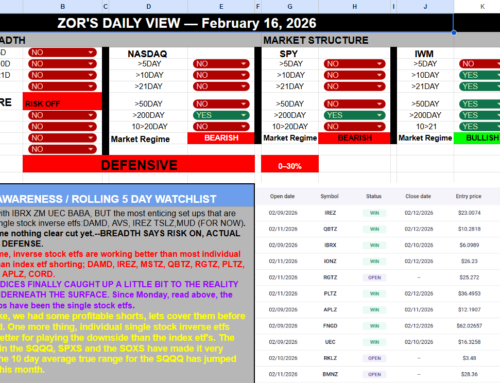

What I’m Tightening in the future

Results were solid. Still room to improve.

Execution

-

No buying specific instruments before 10:00 am.

-

No stops triggered before 10:00 am.

-

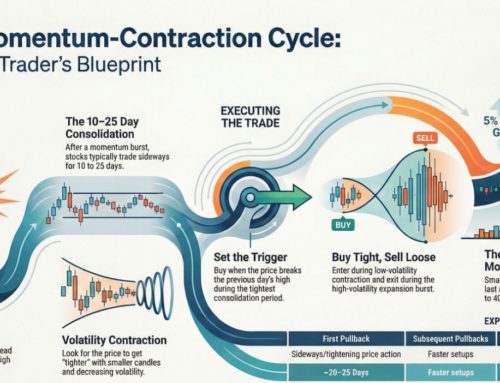

Making sure that when I nail a theme, I put the pedal to the metal. I nailed the Quantum theme, spotted it before they moved:

Personal

-

Energy matters: sleep, food, training, it all makes a difference.

-

If energy drops, decision-making degrades.

-

You have to find a way to be on your best game every day; either you bring it, or you stay home.

Bottom Line:

• I joined the U.S. Investing Championship again.

• I believe the small personal and trading changes I plan to make will make a positive difference.