We had a solid midday rebound in the works, but sellers regained control into the close, erasing most of the gains.

Some data of interest:

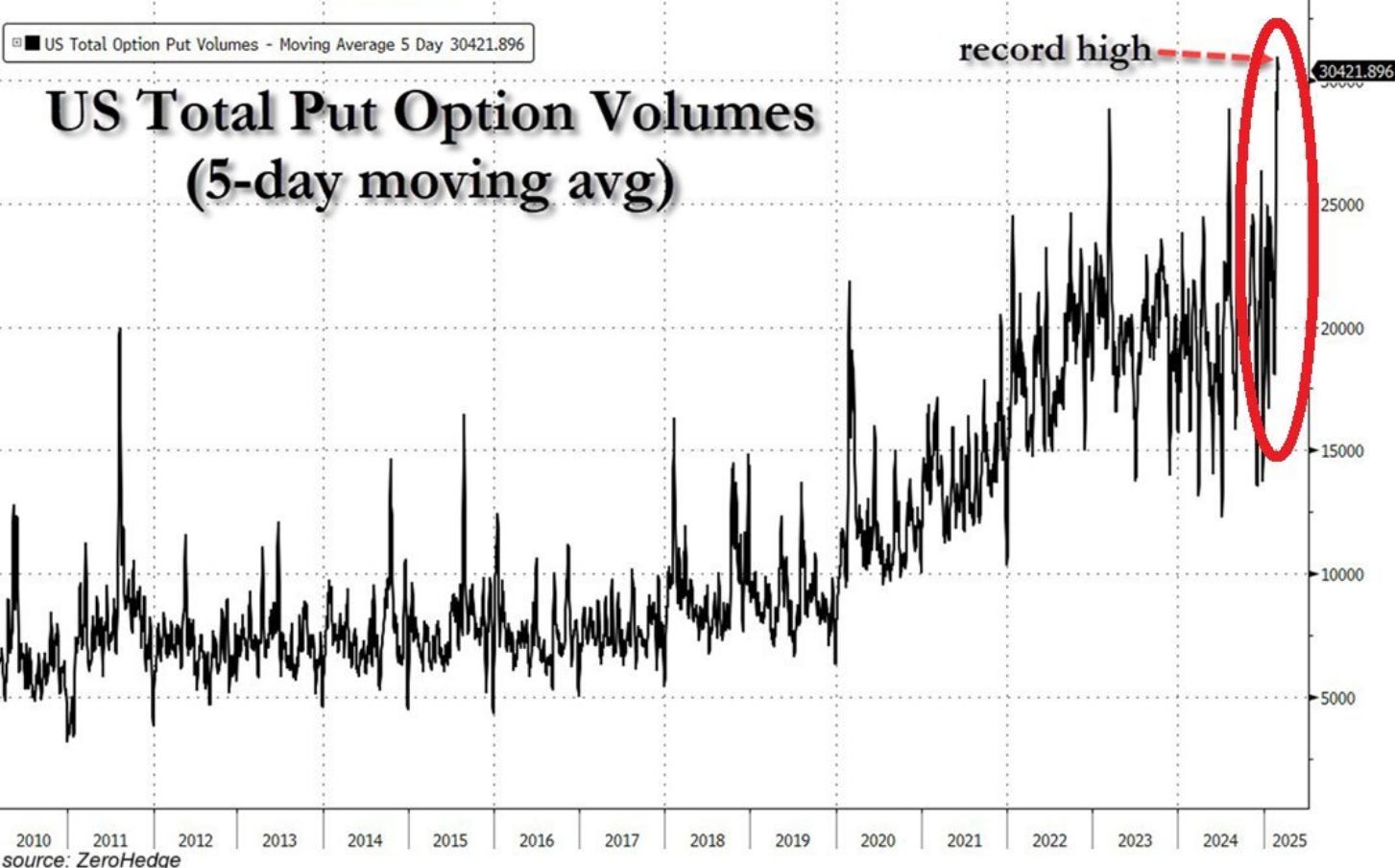

The U.S. total Put Option Volume hit a record high. To put that in context, it is higher now than during COVID-19 and the great financial crisis.

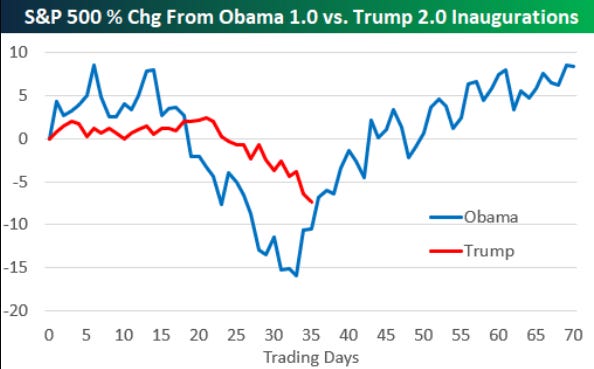

Obama 1.0 vs Trump 2.0

Source: Bespoke

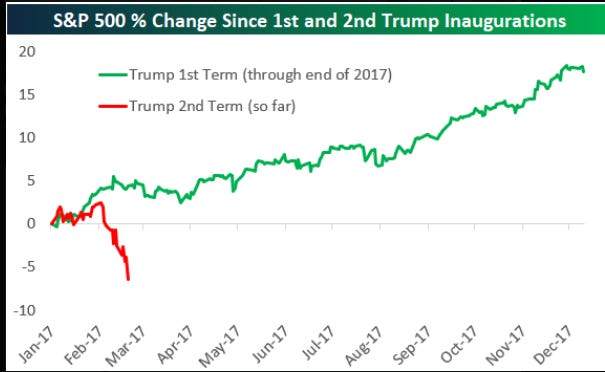

Trump 1.0 vs Trump 2.0

Source: Bespoke

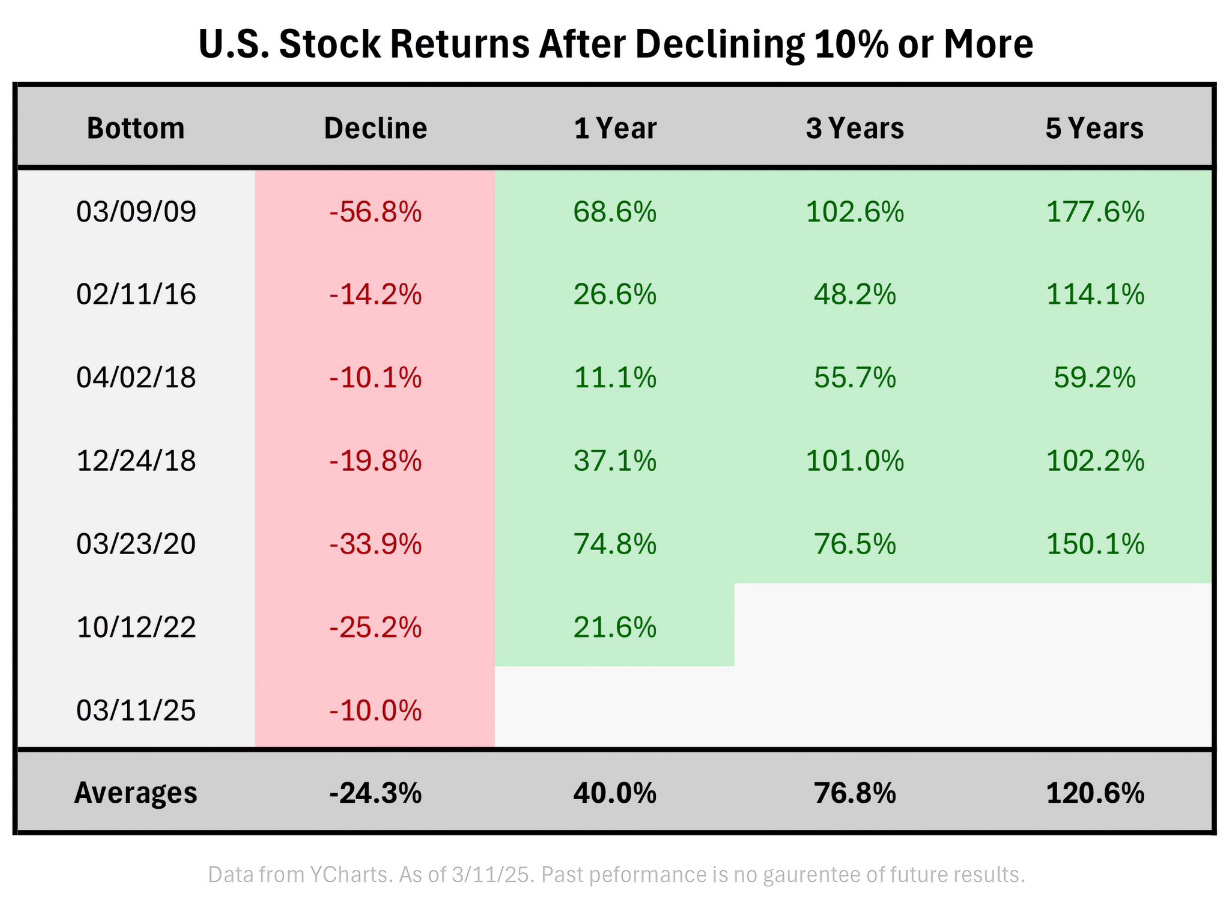

U.S. Stock Returns After Declining 10% or More.

The key here is the return of the market, the S&P 500, not a random individual common stock.

Time is your friend.

Here’s what I’m watching in the short term that could spark a bounce.

• Breadth > 5-day ma. ❌ We are close but not quite there.

• 30-min chart, moving averages flattening out, price above. ❌

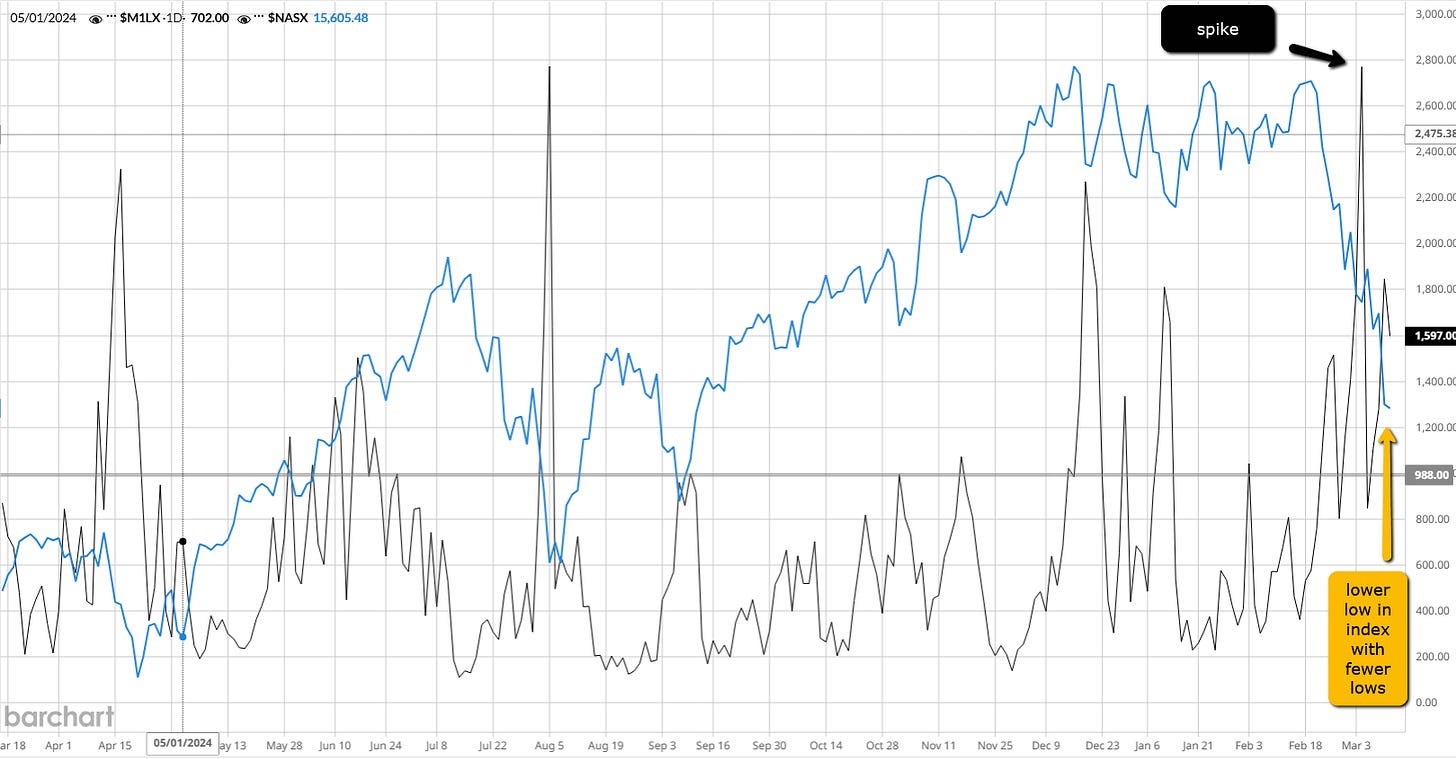

• A spike in one-month lows. ✔

• Lower low in SPY-COMPQ with fewer 1-month lows.✅

• Capitulation‼❓ Sentiment is pretty washed out, but very little signs of panic.

• Oversold via T2106, T2108 ❌. Close but no cigar.

$SPY 10-day ATR below its 5-day moving average ❌

Tomorrow’s Key Events 📋

📊 Economic Data:

-

CPI Report (8:30 AM ET)

-

Canada Rate Decision (9:45 AM)

-

Bank of Canada Press Conference (10:30 AM)

-

EIA Energy Inventories (10:30 AM)

💰 Pre-Market Earnings:

$EH, $IRBT, $MOMO, $ZIM, $VRA, $DTC

🌙 After-Hours Earnings:

$ADBE, $S, $PATH, $LOGC, $AEO,

GET IN TOUCH:

Book a call, Calendly.

ZorTrades_Alpha actionable trade ideas.

On X ZorTrades

YouTube (tons of educational videos, many detailing my favorite scans).