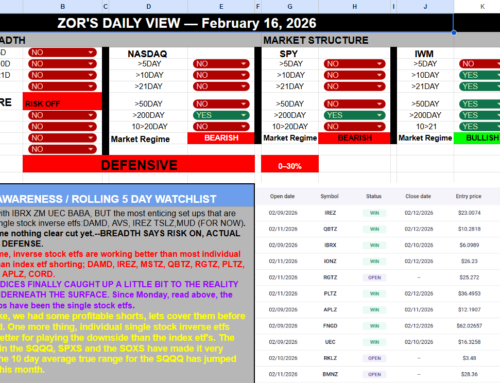

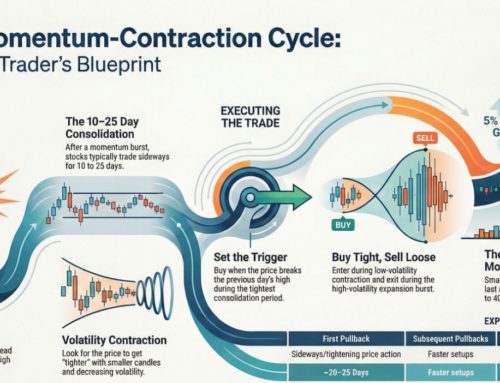

I’m always focused on bases. Not because they’re pretty on a chart, but because compression is what funds expansion. Markets don’t move in straight lines—they coil first. Long-term bases, especially multi-year ones, are where some of the most powerful trend moves are born.

We’ve talked about bases extensively here because they remain one of my highest-conviction technical setups.

Stan Weinstein, in Secrets for Profiting in Bull and Bear Markets, defines a basing area like this:

“After a stock has been declining for several months, it eventually will lose downside momentum and start to trend sideways. What’s actually taking place is that buyers and sellers are starting to move into equilibrium… Volume will usually dry up as a base forms. Later in Stage 1, volume often begins to expand even though price remains little changed—this signals that forced selling is finally being absorbed by willing buyers.”

That last part matters. When price stops falling despite continued supply, it means ownership is transferring from weak hands to strong ones.

Now look at what’s setting up today:

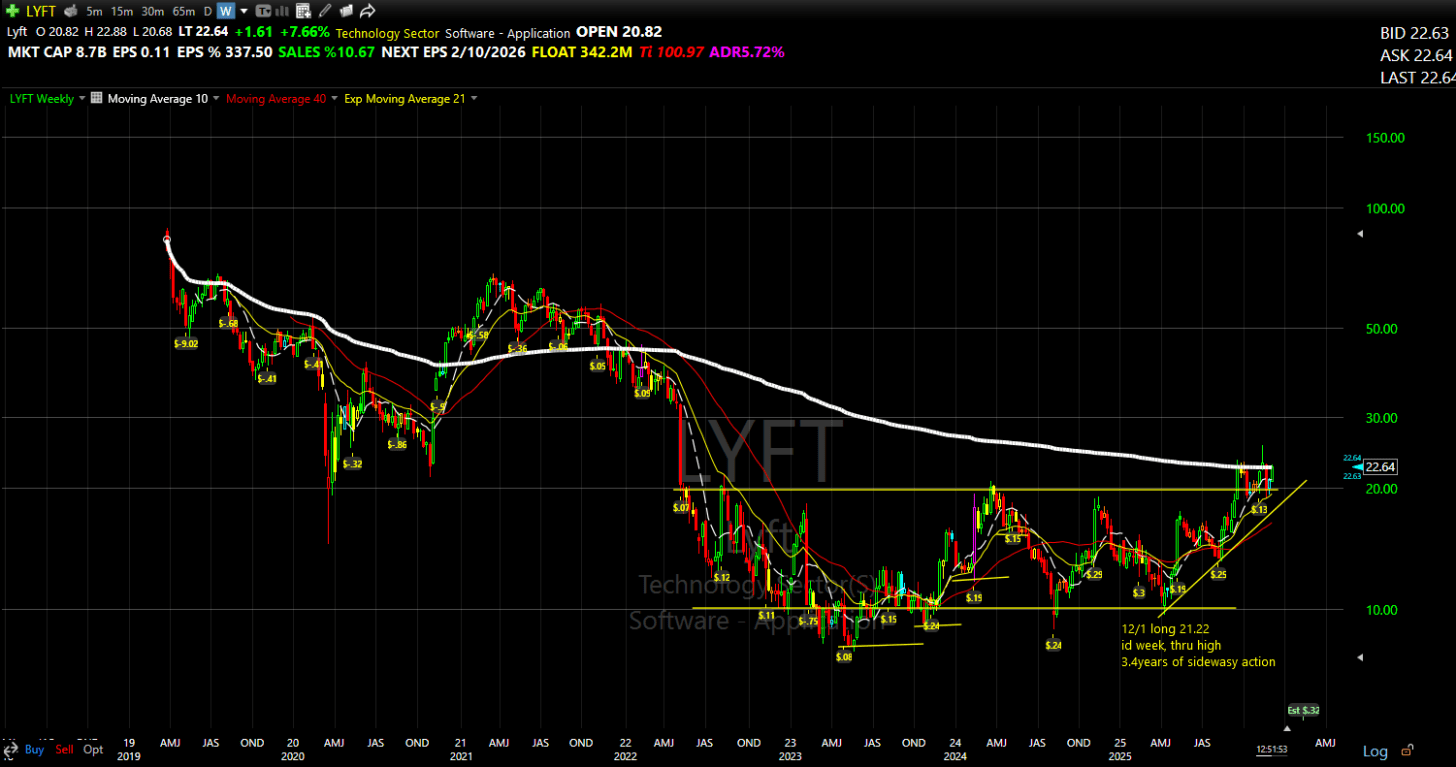

LYFT

LYFT has been trading sideways for three years. Recently, a sequence of higher lows has emerged. That’s not random. It tells you buyers are no longer willing to wait for the bottom of the range—and sellers are running out of inventory. That’s classic late-stage basing behavior.

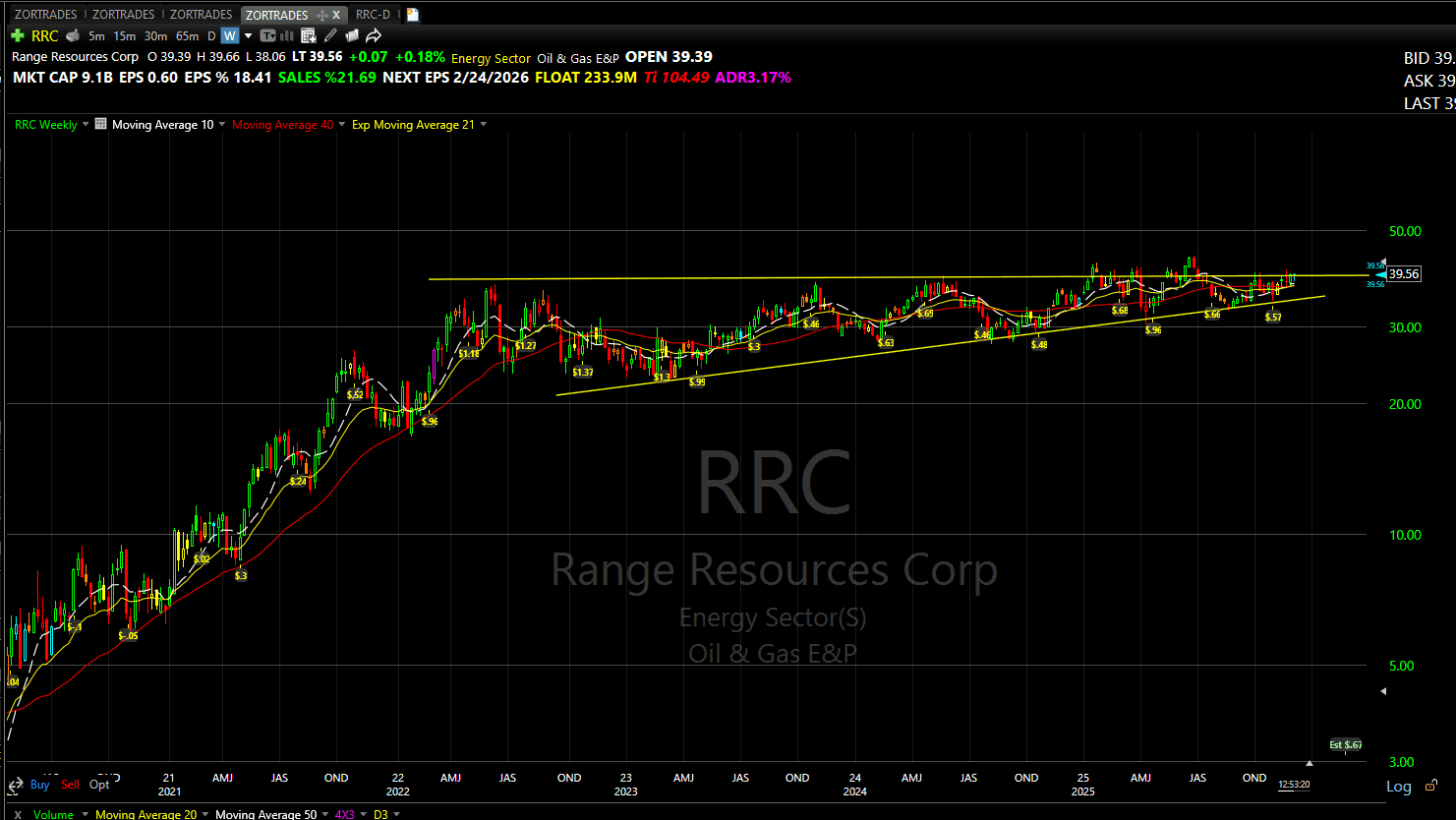

RRC

Range Resources has been moving sideways for 3.5 years—same story: higher lows, tightening structure, pressure building. Long bases in cyclicals tend to precede some of the most violent upside resolutions when they finally break.

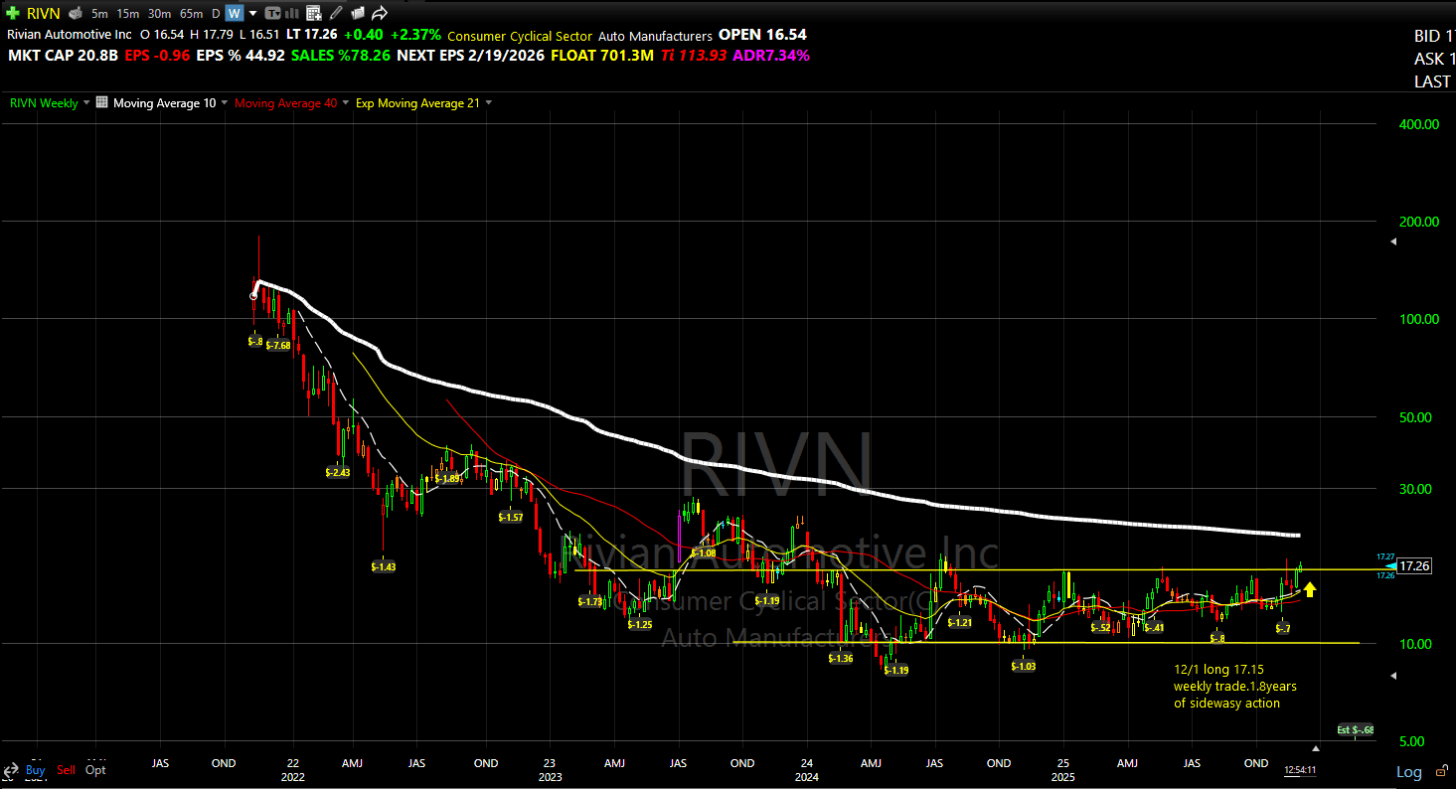

RIVN

RIVN has been stuck in a range for about 1.8 years. The recent Amazon-related news may serve as the external catalyst, but the technical groundwork was already in place. News doesn’t create trends—it releases them.

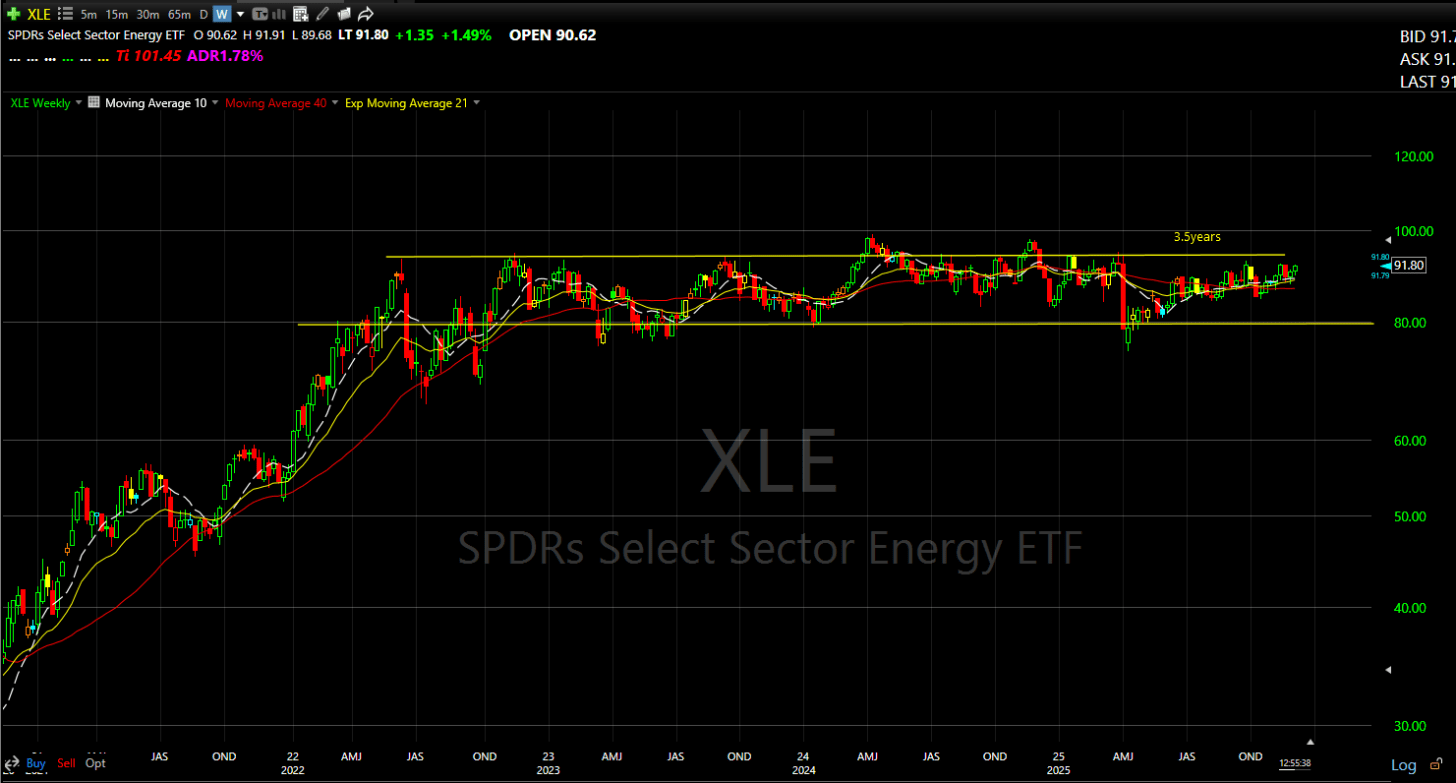

XLE (Energy Sector)

Energy has been digesting gains for roughly 3.5 years. This is a sector-level base, not just a single-stock setup. That’s significant. When an entire sector breaks out of a multi-year range, leadership can persist far longer than most expect.

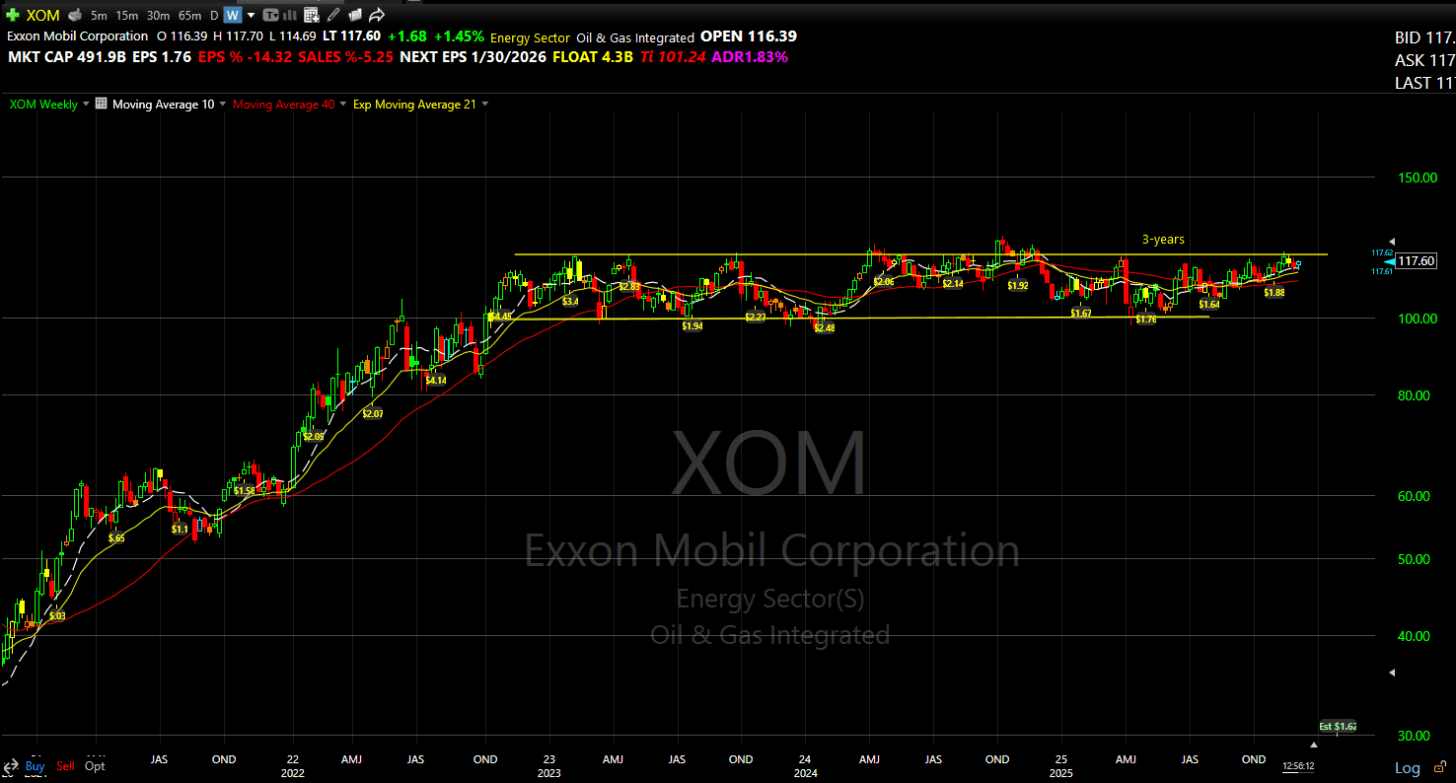

XOM

XOM continues to track that same long-term energy base. Large caps don’t coil for years to move 10%. When they resolve, it usually reflects a structural shift in capital flows rather than just a trade.

1Private Alpha members received this setup on Sunday, before confirmation.

Managed Assets Clients are already involved in the names that validated.