You’ve heard the saying: “It’s not a stock market, it’s a market of stocks.”

The last month and a half couldn’t have made that statement truer.

Breadth, by many measures, has not been great. The numbers are flat, unimpressive, and definitely not representative of the action happening underneath the surface.

Take a look:

📊 SPY vs. Stocks Above Their 40-Day Moving Average

In the first chart, SPY has been in a steady uptrend, but the breadth figure (T2108) has been flatlining. That divergence has been irrelevant.

Sometimes you have to stop listening to the indices and start listening to the stocks themselves. Last month was a perfect example with the Quantum, Drone, and Nuclear names leading the charge; we nailed them all: See for yourself HERE.

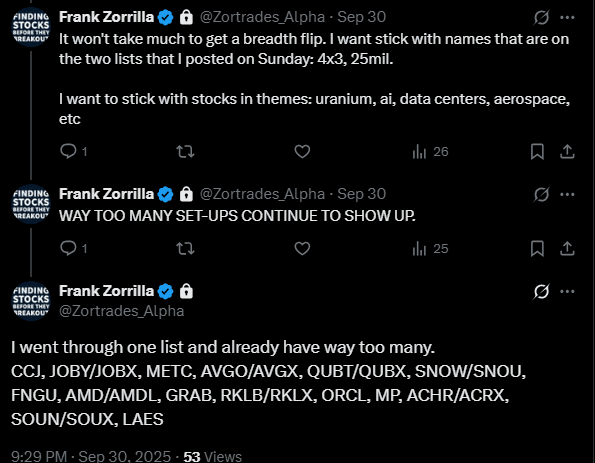

Way Too Many Setups

Take a look at my X feed (screenshot below).

Just look at the overnight performance of our watchlist:

Want In?

If getting this type of list before the market opens interests you, now is the time.

I’m building an army of hungry traders who want to work together so we don’t miss opportunities like this.

👉 Check out the promo we’re running right now:

$100 for the entire year (normally $299).

That’s less than $ 9 per month for daily watchlists, scans, setups, and direct access to me.