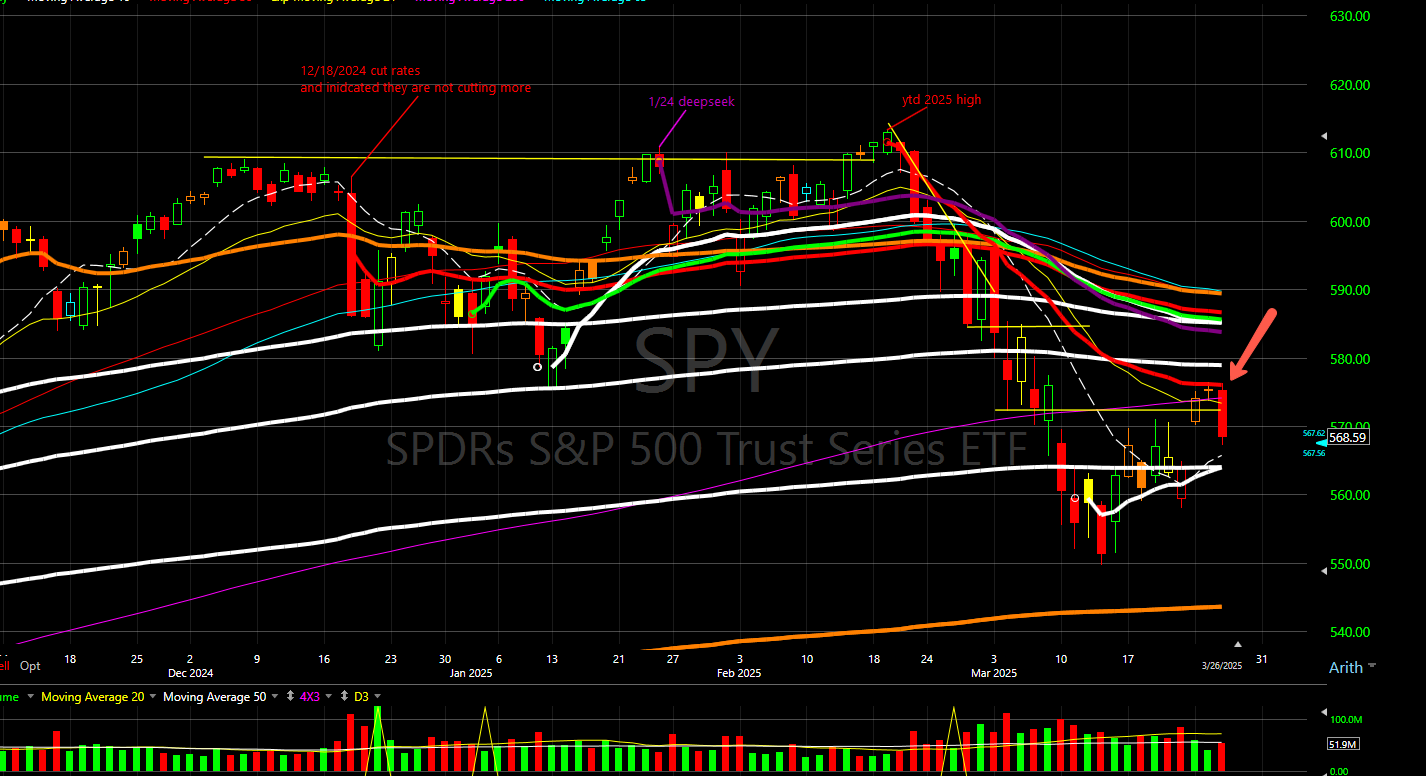

The SPY and Nasdaq 100 were rejected right where you’d expect: at the confluence of the year-to-date anchored VWAP and the 21-day moving average. The bounce off the lows could be over for now.

The Microsoft/NVDA and the possible April 2nd tariffs were to blame.

“There are more jitters in the AI sector Wednesday after analysts at TD Cowen highlighted that their channel checks show Microsoft is canceling data center leases in the U.S. and Europe, following up on his earlier finding.”

“President Trump made good on his promise to impose tariffs on foreign automakers, imposing 25% duties on all cars and light trucks not made in the United States, as well as “certain auto parts.”

“This will continue to spur growth that you’ve never seen before,” Trump said from the White House on Wednesday, signing an executive order putting the tariffs in place.

The 25% tariffs are set to take effect April 2 and add to existing tariffs. The White House estimates that $100 billion in annual duties will be collected.-yahoo finance.

Today’s Heat Map:

-

$WOR (+23.76%) surged after reporting strong quarterly earnings, exceeding analyst expectations.

-

$GME (+11.65%) rallied amid renewed retail investor interest and speculation of a potential short squeeze.

-

$XNGSY (+10.91%) climbed following reports of robust earnings and positive guidance from ENN Energy Holdings.

-

$DOOO (+7.57%) rose as BRP Inc. announced a new line of recreational vehicles, boosting investor confidence.

-

$CTAS (+5.82%) gained after Cintas Corporation released better-than-expected earnings and upbeat future outlook.

-

$BKRKY (+5.61%) increased due to positive earnings reports and growth in Indonesia’s banking sector.

-

$VNET (+4.95%) advanced as VNET Group reported strong revenue growth and expansion plans.

-

$ASH (+4.90%) rose following Ashland Inc.’s announcement of a strategic acquisition to enhance its product portfolio.

-

$QFIN (+4.84%) climbed after Qifu Technology reported strong earnings and user growth in its financial services platform.

-

$PAYX (+4.20%) gained as Paychex Inc. posted solid quarterly results and raised its full-year guidance.

-

$MOH (+4.16%) increased after Molina Healthcare announced a new contract win, expanding its market presence.

-

$TLK (+4.12%) advanced due to positive earnings and growth in Indonesia’s telecommunications sector.

-

$SOMMY (+3.52%) rose following Sumitomo Chemical’s announcement of a new product line and positive earnings.

-

$CAR (+3.45%) gained as Avis Budget Group reported increased demand for car rentals and improved financial performance.

🔌⚠️ $NVDA got clipped (-5%) after China signaled it wants more energy-efficient chips.

• $VRT -10.9%: Data center slowdown = cooling demand for cooling tech

• $ROOT -10.3%: Pullback after sharp rally, profit-taking

• $CLS -10.0%: AI euphoria cooling, valuation concerns

• $HIMS -9.9%: Downgrade + high expectations weighing

• $TEM -9.1%: Post-AI app hype fade

• $SMCI -8.9%: AI leaders hit with broader selloff

• $CRDO -8.6%: Riding AI wave… now reversing

• $DJT -8.4%: Meme stock unwind continues

GET IN TOUCH:

Book a call, Calendly.

ZorTrades_Alpha actionable trade ideas.

On X ZorTrades

YouTube (tons of educational videos, many detailing my favorite scans).