In markets, sometimes the biggest wins come from asking the right questions before the move happens.

On July 16th, I posed one to my private X feed that unlocked a 40%+ gainer for those paying attention: “What stocks hold $SOL.X in their treasury?”

Let’s walk through how that simple question turned into a high-conviction trade — and a 40%+ move in $UPXI.

🧠 The Set-Up: Crypto Rotation Playbook

The digital asset space often moves in predictable waves. This time was no different.

-

First: $BTC.X caught fire → $MARA, $RIOT started ripping

-

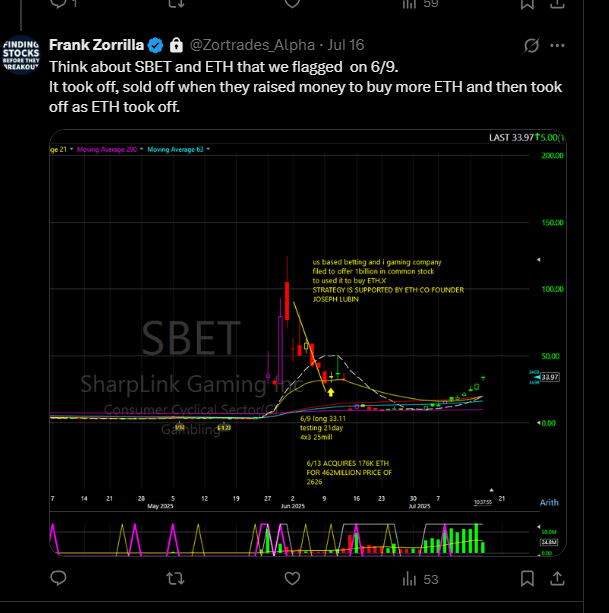

Then: $ETH.X followed → $SBET spiked big as a treasury play

-

Next up? $SOL.X — which was coiling and looked ready to explode

The idea is that if $SBET can move on ETH exposure, then surely someone would benefit from a Solana breakout.

That’s when I dropped this chart to the private feed 👇

📍 The Call: $UPXI, $DFDV, $BTCM

From there, I posted the equities that had exposure to Solana on July 16:

-

$UPXI

-

$DFDV

-

$BTCM

$UPXI had the right setup: low float, crypto exposure, and connection to Solana. The stage was set.

📈 The Outcome: +40% Trade in $UPXI

It didn’t take long.

$UPXI ripped +40% intraday. The trade unfolded exactly as we had anticipated.

Here’s the actual trade, timestamped and shared:

🔗 UPXI Trade Breakdown on TraderVue

This wasn’t about luck.

It was about:

✅ Anticipating rotations.

✅ Understanding treasury exposure.

✅ Acting early — before the crowd.

🔁 The Repeatable Framework

This is a model I use repeatedly across sectors, themes, and volatility cycles.

It works in:

-

Crypto

-

AI

-

Energy

-

Macro themes

→ The index or token moves

→ Then you find the public stock exposure

→ Then you ride the sympathy wave

🚀 Want These Plays in Real-Time?

This idea — and many others — was shared first on my private X feed.

If you want access to:

✅ High-conviction trade ideas

✅ Theme-based setups before they run

✅ Tactical entries & exits

👉 Click here to learn more or join now

Don’t wait for CNBC to tell you what moved — get ahead of the move.