From June 23rd to July 15th, the market gave us one of the cleanest windows of opportunity we’ve had in a while. Breadth was strong, volatility was low, and the tape rewarded risk. You could size up with confidence. But just like that — the rhythm changed.

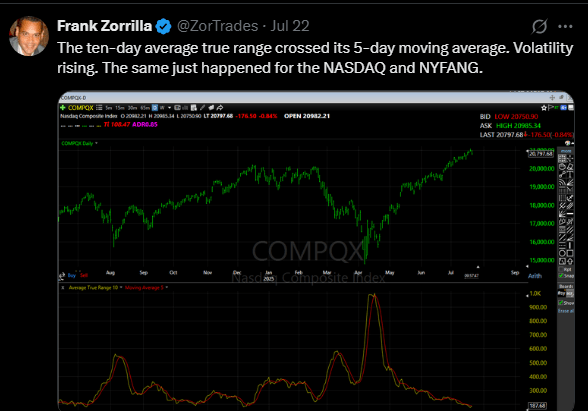

By July 22nd, something subtle but important happened: the 10-day average true range (ATR) on the Nasdaq crossed above its 5-day moving average — a signal that volatility was rising across key indices like the NASDAQ, NYFANG, and eventually SPY/QQQ as well.

Then things got weird.

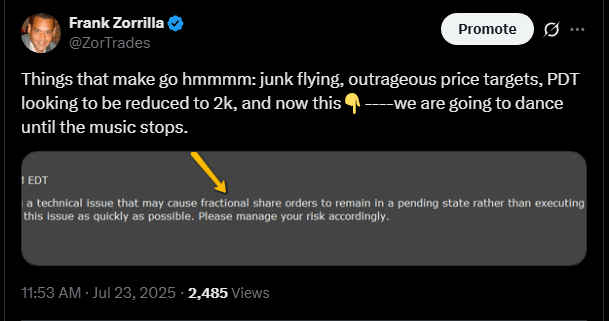

On July 23rd, Interactive Brokers flagged a technical issue: fractional orders were being delayed. That may seem like a minor hiccup, but fractional trading is primarily a phenomenon driven by retail flows.

Translation? Retail was piling in hard. Combine that with junk stocks flying, ridiculous price targets on stocks like OPEN, and the PDT rule potentially being lowered to $2,000, and you’ve got all the ingredients for a speculative blowoff top.

As the week progressed, breadth fell off a cliff. On July 29th, more than 2,600 stocks opened lower, and only 25% of stocks were trading above their VWAP. The surface looked calm, but underneath, it was leaking everywhere.

At the same time, divergences were becoming extreme:

That’s not bullish. That’s concentration. Breadth is narrowing fast — a handful of names doing all the heavy lifting.

Meanwhile, the number of fresh 1-month lows hit 1,254 — and almost nobody was talking about it.

I tried a few trades — $CONL, $SMR, $BBAI, $CRCL — with a small size and a tight leash. They all bit me. Sometimes, that’s the market telling you to step aside.

When the data, the feel, and the behavior all start to rhyme — you listen. We don’t get extra points for overtrading. In times like these, the best trade is often no trade at all.

Shut it down. Take a walk. Don’t even turn the screens on.

Until the environment changes again.

🚀 Want These Plays in Real-Time?

This idea — and many others — was shared first on my private X feed.

If you want access to:

✅ High-conviction trade ideas

✅ Theme-based setups before they run

✅ Tactical entries & exits

👉 Click here to learn more or join now

Don’t wait for CNBC to tell you what moved — get ahead of the move.