Daily Market Recap: Week of June 30 – July 4, 2025

Executive Summary

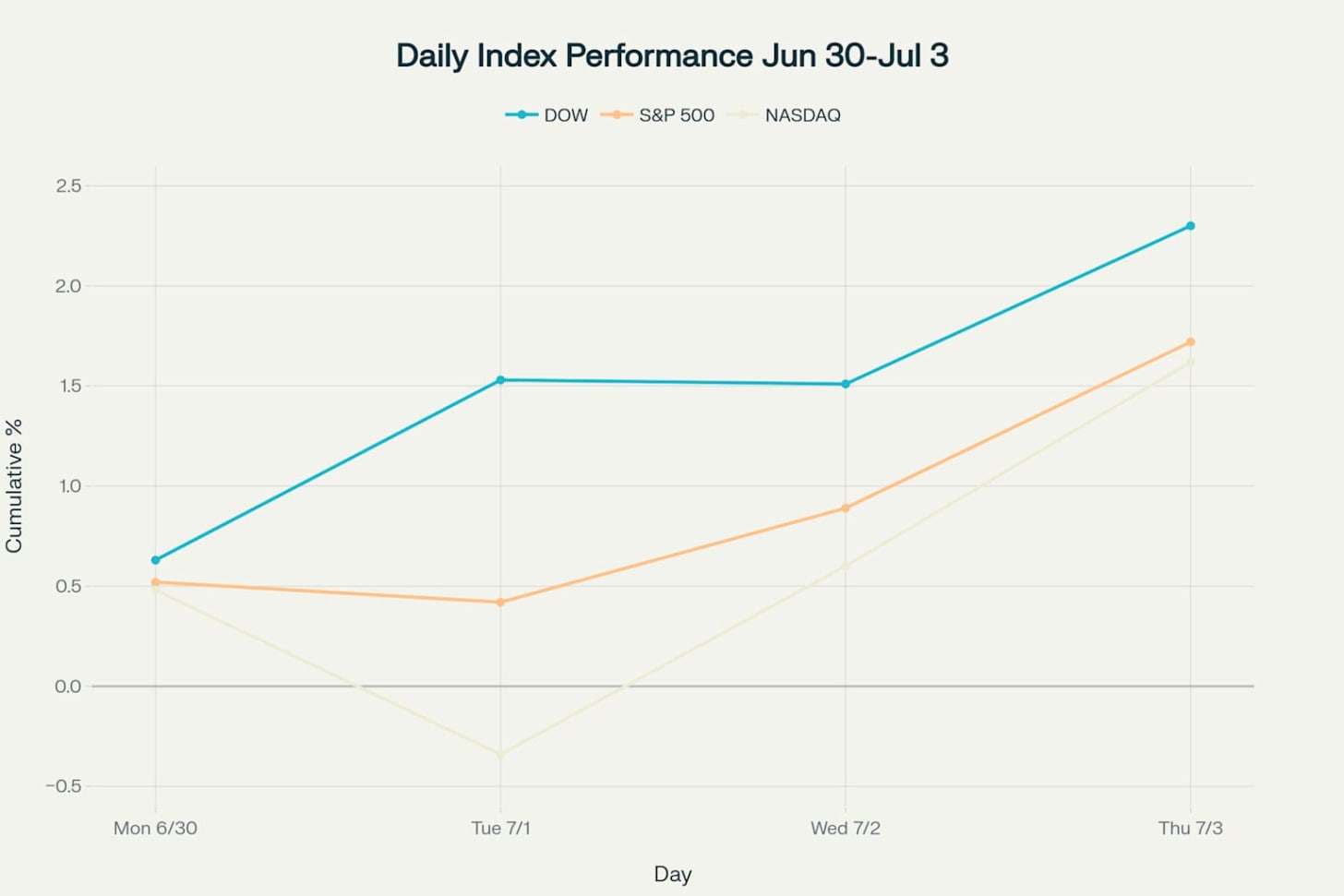

The holiday-shortened week delivered strong gains across all major indices, with the S&P 500 setting four record highs in five trading days. Markets demonstrated remarkable resilience despite ongoing trade uncertainties, culminating in a robust jobs report that exceeded expectations. The week was characterized by significant sector rotation from technology into cyclical sectors, trade deal optimism with Vietnam, and a major selloff in the healthcare sector.

Weekly Performance:

-

DOW: +1,009 points (+2.30%)

-

S&P 500: +106 points (+1.72%)

-

NASDAQ: +327 points (+1.62%)

For tactical and actionable ideas, go HERE

Market Performance and Sector Rotation – Week of June 30-July 4, 2025

Monday, June 30: Strong Quarter-End Rally

Market Performance:

-

DOW: +275.50 (+0.63%)

-

S&P 500: +31.88 (+0.52%)

-

NASDAQ: +96.84 (+0.48%)

Key Events: Markets closed out Q2 with record highs as Canada rescinded its digital services tax targeting U.S. tech companies, easing trade tensions. The move came as Ottawa sought to restart trade negotiations with the U.S.

Two Major Pops:

-

Oracle (ORCL): +2.8% – Continued momentum from strong cloud business performance

-

Goldman Sachs (GS): +2.5% – Led financial sector gains on rate environment optimism

Two Major Drops:

-

Tesla (TSLA): -1.0% – Early signs of volatility ahead of Musk-Trump tensions

-

Consumer Discretionary Sector: -0.6% – Weakness in retail and consumer spending stocks

Tuesday, July 1: Tech Rotation Accelerates

Market Performance:

-

DOW: +400.17 (+0.90%)

-

S&P 500: -6.17 (-0.10%)

-

NASDAQ: -166.84 (-0.82%)

Key Events: A major sector rotation occurred, with investors repositioning from technology stocks to cyclicals as they prepared for the second half of 2025. Trump-Musk tensions escalated over government spending bill disagreements.

Two Major Pops:

-

Dow Components: +400 points – Blue-chip industrials led the rally

-

Materials & Healthcare Sectors – Beneficiaries of the tech rotation trade

Two Major Drops:

-

Tesla (TSLA): -5%+ – Plunged on renewed Musk-Trump feud over spending bill

-

Technology Sector: -1%+ – Broad-based selling in tech megacaps

Wednesday, July 2: Vietnam Deal Provides Relief

Market Performance:

-

DOW: -10.52 (-0.02%)

-

S&P 500: +29.41 (+0.47%)

-

NASDAQ: +190.24 (+0.94%)

Key Events: President Trump announced a trade agreement with Vietnam, imposing 20% tariffs (vs. the previously feared 25-30%), which is significantly lower than the April’s threatened 46% rate. ADP private payrolls disappointed with a loss of 33,000 jobs.

Two Major Pops:

-

Nike (NKE): +15% – Major beneficiary of Vietnam trade deal, given 50% of production there

-

Tesla (TSLA): +2.5% – Rebounded from the previous day’s Musk-Trump tensions

Two Major Drops:

-

Centene (CNC): -33.7% – Withdrew 2025 guidance due to $1.8B marketplace revenue shortfall

-

Healthcare Insurers – UnitedHealth, Elevance, and Molina all declined on sector concerns

Thursday, July 3: Jobs Report Delivers

Market Performance:

-

DOW: +344.00 (+0.77%)

-

S&P 500: +52.60 (+0.83%)

-

NASDAQ: +209.00 (+1.02%)

Key Events: The strong jobs report showed 147,000 jobs added (vs. the expected 110,000) with unemployment falling to 4.1%. Markets closed early at 1 PM for the July 4th holiday.

Two Major Pops:

-

Datadog (DDOG): +15.3% – Surged on announcement of S&P 500 inclusion effective July 9

-

SolarEdge (SEDG): +16.6% – Solar stocks rallied as Trump’s tax bill excluded the controversial solar excise tax

Two Major Drops:

-

Blue Gold (BGL): -20.7% – Commodity-related selloff despite strong economic data

-

GoodRx (GDRX): -6.8% – Healthcare technology weakness continued

Sector Performance Analysis

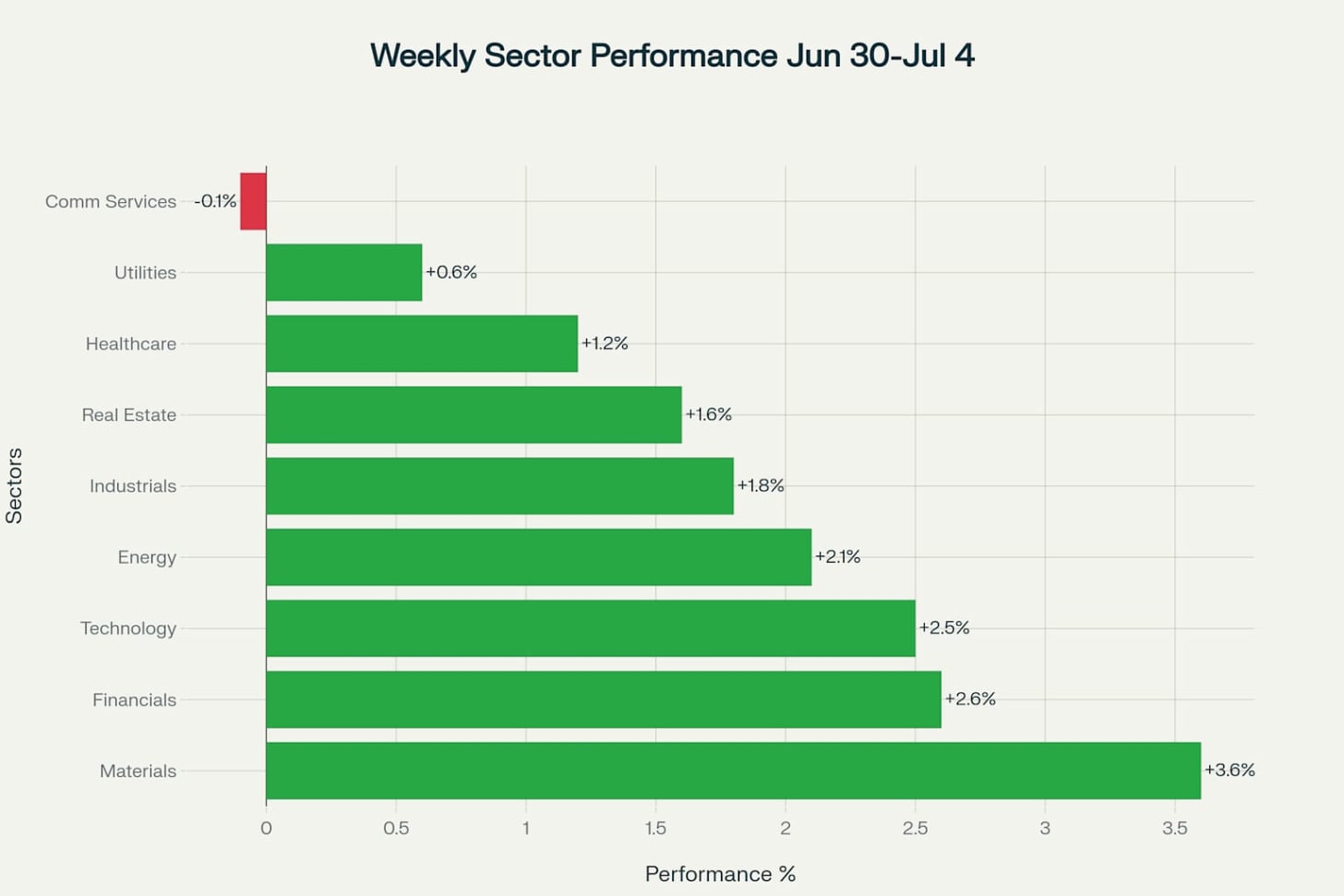

The week showcased a dramatic shift from growth to value, with cyclical sectors leading the performance while technology lagged, despite a late-week recovery.

(FOR THIS WEEK’S WATCHLIST, CHECK OUT FRANK-ZORRILLA.COM)

Weekly Sector Performance – July 1-4, 2025

Top Performing Sectors:

-

Materials: +3.6% – Benefited from economic strength and infrastructure optimism

-

Financials: +2.6% – Rate environment and economic resilience are supportive

-

Technology: +2.5% – Recovered from Tuesday’s selloff

Lagging Sectors:

-

Communication Services: -0.1% – Only negative sector for the week

-

Utilities: +0.6% – Underperformed in risk-on environment

Key Investment Themes

Trade Deal Optimism

The Vietnam agreement significantly reduced tariff uncertainty, with the 20% rate well below market fears of 25-30%. This particularly benefited companies with significant manufacturing exposure in Vietnam, such as Nike, Under Armour, and other apparel manufacturers.

Healthcare Sector Stress

Centene’s guidance withdrawal highlighted ongoing challenges in the healthcare insurance sector, with elevated medical utilization and risk adjustment revenue pressures affecting multiple players, including UnitedHealth and Elevance.

Economic Resilience

The strong jobs report demonstrated labor market strength despite tariff uncertainties, with 147,000 jobs added and unemployment declining to 4.1%. This data pushed Fed rate cut expectations from July to September.

Sector Rotation Momentum

The week marked a significant shift from technology leadership to cyclical outperformance, suggesting investors are positioning for sustained economic growth rather than defensive positioning.

Looking Ahead

The strong finish to the holiday-shortened week sets up interesting dynamics for the remainder of July, with key factors including:

-

Trade Deadline Approach: July 9 marks the end of Trump’s 90-day tariff delay period

-

Earnings Season: Q2 results will test whether companies can maintain margins amid trade uncertainties

-

Fed Policy: Strong jobs data likely delays rate cuts, supporting cyclical sectors

-

Healthcare Sector: Ongoing utilization trends and policy developments remain key watchpoints

The market’s ability to achieve multiple record highs while navigating trade uncertainties and sector rotation suggests underlying economic resilience that could support continued gains through the summer months.