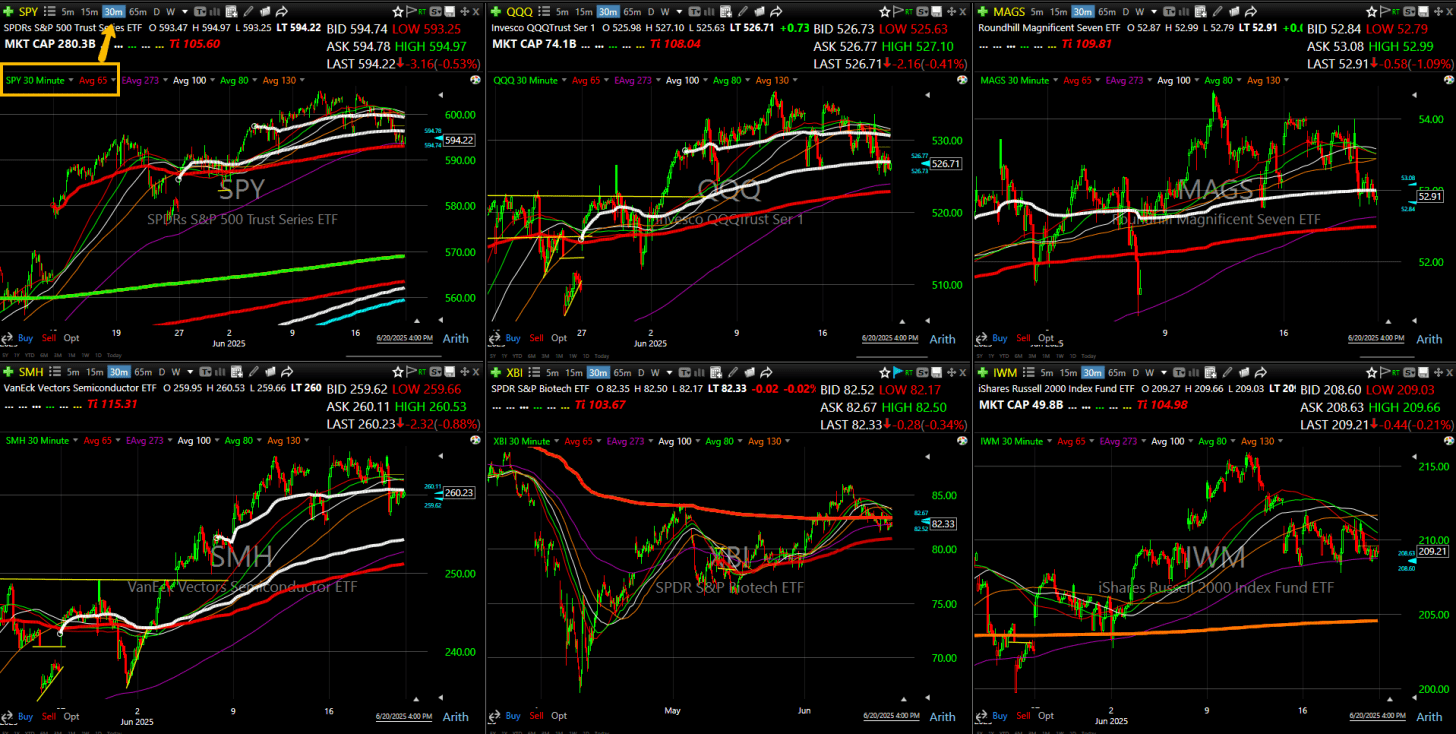

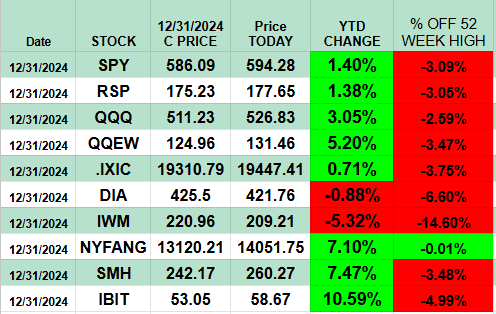

Monday morning started with a gap higher, but the tone remained cautious. The $SPY had closed the previous week at 596.94 and opened Monday at 600.52, just under its 5-day moving average. Despite the strong open, breadth remained below trend, keeping us on the sidelines for short-term swing trades.

The $QQQ also gapped up nearly $4, but like SPY, it stayed below its 5-day moving average — another sign to pass on short-term setups.

Meanwhile, nuclear stocks came out of the gate hot:

-

NNE jumped +15% in the first 30 minutes

-

CEG +3.35%

-

VRT +4%

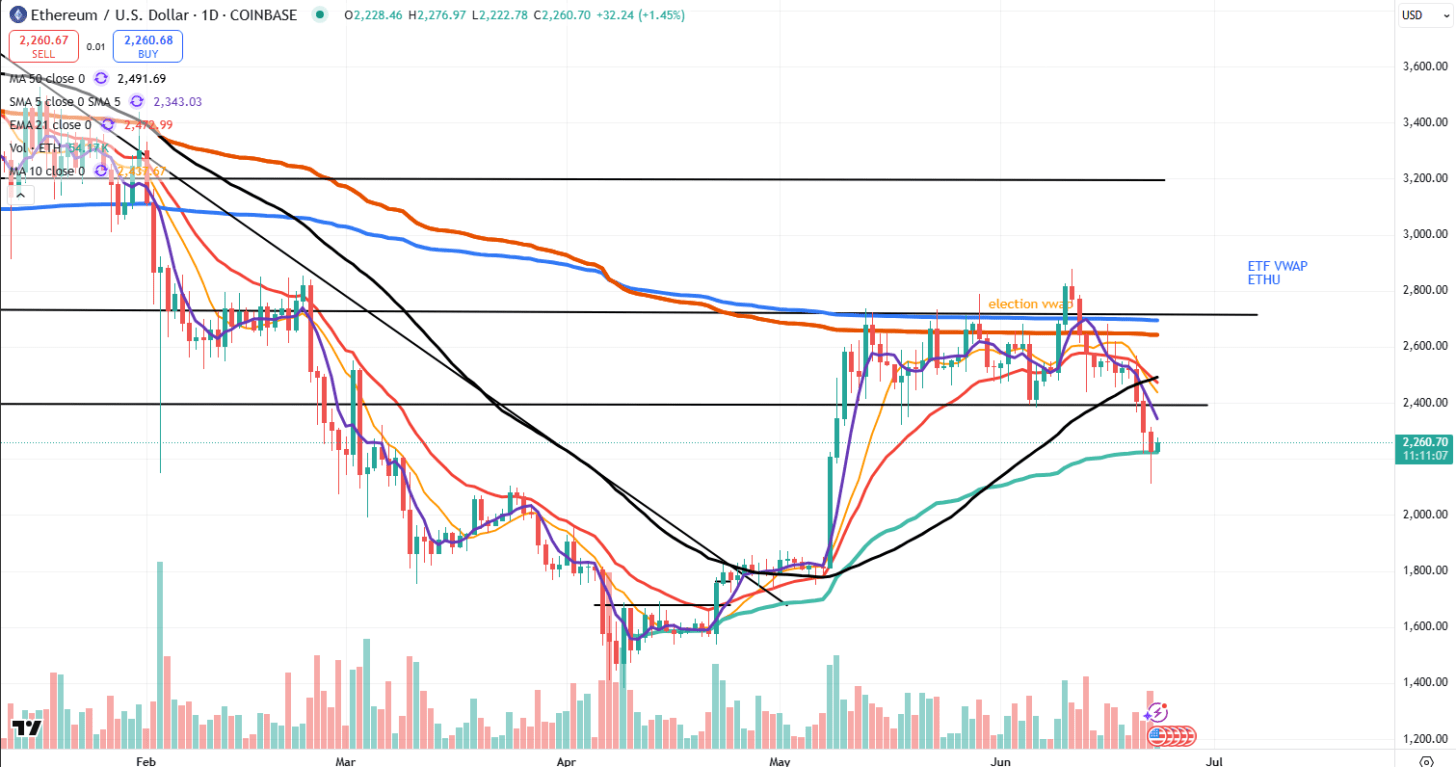

Ethereum continued to act well, battling at the Election AVWAP level. I still think it will eventually reach $3,200.

But by Monday evening, sentiment turned. Trump tweeted, futures rolled over, and crypto volatility spiked, rallying hard then fading just as fast.

🗓️ Midweek Macro

Tuesday’s headlines were dominated by Iran-Israel tensions, driving the S&P 500 back below the 6,000 level. May retail sales came in soft, another signal that consumer spending is tightening.

Solar stocks got hit after news broke that the Senate tax bill proposes phasing out clean energy credits by 2028.

Meanwhile, JetBlue slumped on a gloomy 2025 outlook, dragging down the airline group.

On Wednesday, the Fed held rates steady at 4.25%–4.5%, with the dot plot still showing two rate cuts expected this year, though seven Fed officials now forecast no cuts at all.

Markets briefly rallied on the decision but gave back gains. Rising inflation expectations for 2026, Middle East tensions, and tariff worries all weighed.

One bright spot: Coinbase gained over 22% after the Senate passed the GENIUS Act, and the company launched Coinbase Payments, allowing businesses to accept USDC.

🇺🇸 Holiday, Headlines & Volatility

Markets were closed on Thursday for Juneteenth, but futures remained cautious heading into a Triple-Witching Friday.

Friday was choppy.

Fed Governor Waller hinted at a possible July rate cut, but this was offset by reports that the U.S. is considering new chip tool export restrictions to China.

Tesla watchers were tuned into Sunday’s launch of the Robotaxi pilot program in Austin — a move that could be significant for the EV and AI narrative.

🧭 The Week Ahead

A lot is going on this week, but I don’t expect a crash like some are predicting on X.

Yes, the market is overdue for a pullback, and participation has weakened, but the bigger story will be how investors respond to the macro and event-driven headlines.

Here’s what’s on tap:

🔍 Key Events:

-

NATO Summit in the Netherlands (Trump attending)

-

Multiple Fed speeches — likely to include comments on inflation and oil supply risks

-

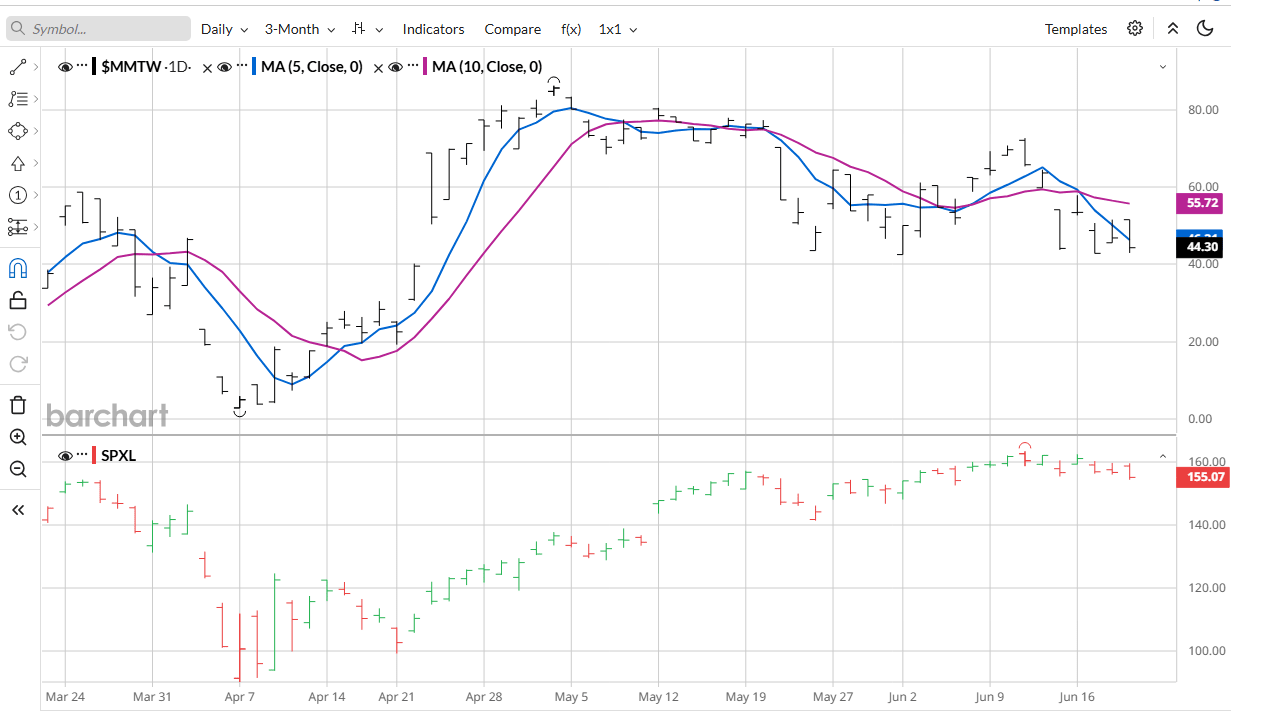

Bitcoin looks like it’s rolling over — keep it on watch

📅 Economic Calendar:

-

Monday: US PMIs at 9:45 AM, Home Sales at 10:00 AM

-

Tuesday & Wednesday: Powell testifies to Congress at 10:00 AM

-

Friday: PCE inflation data at 8:30 AM

📰 Headlines to Watch:

-

Tesla: Robotaxi rollout + India showroom plans + China power deals

-

GLP-1 Stocks: Positive mentions around NVO and LLY

-

Apple: Rumors of a potential PerplexityAI acquisition

-

Shipping/Oil: If Middle East tensions escalate, those sectors could move fast — but also fade fast

-

Earnings: Relatively quiet. Eyes on MU, NKE, FDX, and maybe AVAV (drones)

Stay ready, stay patient — there will be trades. Let the tape set up.

📬 Enjoying these recaps? Get tactical swing setups, real-time market reads, and institutional-level insights directly in your inbox and private feed.