Let’s talk about a company that just reported 400% revenue growth and nearly 700% ARR growth — and the market barely blinked.

In a world drunk on AI promises, this one is quietly building the war machines. While others push slide decks and sizzle reels, these individuals are pouring concrete, lighting up data centers, and shipping over 50 real products — all within one quarter.

Here’s what they just dropped on the table:

-

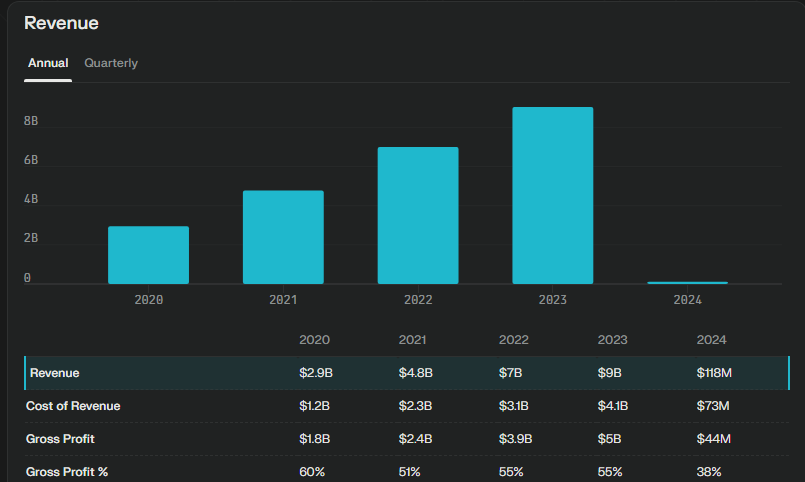

📈 Q1 2025 Revenue: +400% YoY

-

⚡ ARR: $310M in April → Targeting $750M–$1B for 2025

-

🏗️ New data centers live in NJ, Kansas City, Iceland, Finland, Israel

-

🧠 NVIDIA launch partner for Blackwell Ultra & Dynamo

-

💾 Over 50 new software releases to boost performance and integration

-

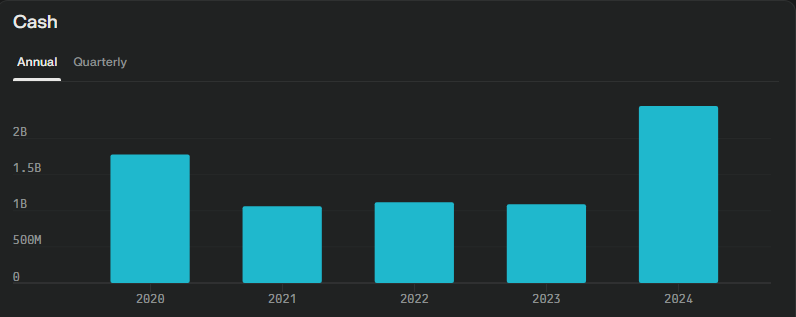

💰 $1.44B in cash and ramping to $2B in CapEx for the year

Let that sink in: They’re spending billions to build capacity before the tsunami of AI demand hits full force.

And here’s the kicker — profitability is coming. They expect positive adjusted EBITDA in 2H 2025, with mid-single-digit billions in revenue and 20–30% EBIT margins in the crosshairs.

Most investors are staring at the wrong screens. They’re chasing headlines. Meanwhile, this company is laying the fiber, spinning the fans, and staking its claim as the foundational layer of the AI economy.

Think Amazon AWS before anyone took cloud seriously.

There’s still time to get in before the rest of the world catches on.

For the name, our trading approach, and portfolio strategy →

🔒 Join our private X group or explore our managed portfolios.

📨 info@zorcapital.com