Market Recap:

Stocks ripped higher across the board.

• $SPY +2.05%, snapping a 4-day slide

• $QQQ +2.39%, tech led the way

• $DJIA +1.8% (+740 pts) on tariff delay + upbeat consumer confidence

• $VIX -7.83%, fear eased

Tech was the engine—$TSLA +7%, $NVDA ran ahead of earnings. EU Tariff delay to July 9 gave the market breathing room. Risk appetite returned.

YTD:

• $SPY +0.86%

• $QQQ -0.58%

• $NDX +1.95%

• $NYFANG +5.21%

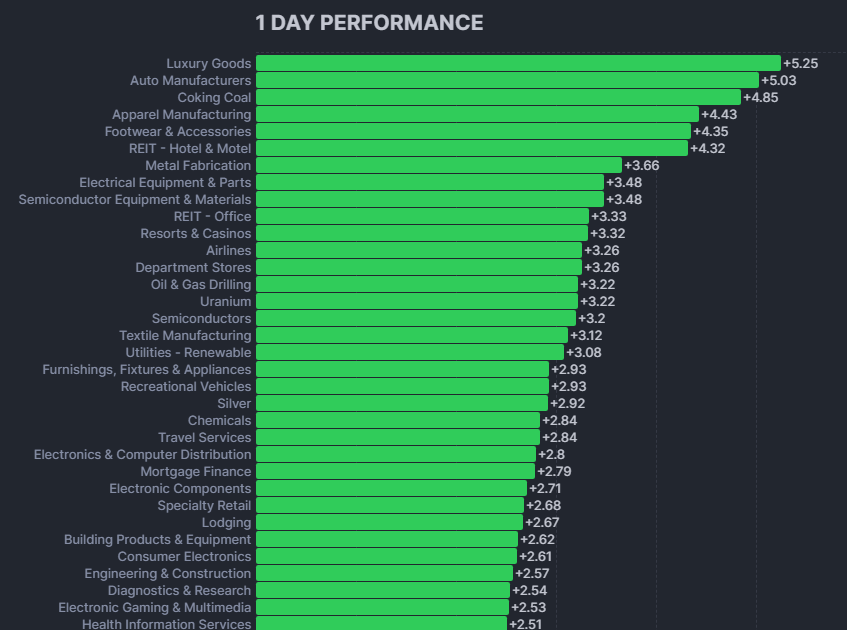

HEAT MAP

1-DAY PERFORMANCE INDUSTRY GROUP

What’s Next: A Big One

$NVDA Earnings (Wed, May 28 after the close)

Nvidia is expected to post Q1 revs of $43.3B (up from $26B YoY), with EPS around $0.88. Data Center is the growth engine—projected to bring in $39.2B (+74% YoY). Gaming revs expected at $2.8B (+7.7%).

Key things to watch:

• Slower growth vs. previous triple-digit runs

• AI/Data Center demand is still strong

• Blackwell rollout could boost revs but weigh on margins

• China exposure remains a wildcard (up to $5.5B risk)

• Margins expected 70–71%, might tighten with new products

• Options market pricing in a 7% move either way

A big question: Can Nvidia maintain the AI momentum, or is growth starting to decelerate? Guidance will be everything.

Other Earnings to watch tomorrow:

Pre-Market:

$DKS 🏀

$ANF 👕

$M 🛍️

$PHR 🏥

After-Hours:

$CRM ☁️

$AI 🤖

$ELF 💄

$VEEV 💊

$S 🔐

$PSTG 💾

📈 Pops & 📉 Drops

📉 $DJT -10.38%

Announced $2.5B capital raise to build a Bitcoin treasury—$1.5B in equity, $1B in convertible notes. BTC custody via Crypto.com & Anchorage. Deal closes May 29.

📈 $INFA +6.08%

Salesforce is buying Informatica for $8 billion, $25/share cash deal. AI + data stack will plug into Agentforce, Tableau, and more. Closes fiscal ‘27.

📉 $PDD -14%

Q1 miss: Rev $13.3B vs $14.3B est. Net income down 47%. Spending up, growth slows. Tariff worries and soft demand spook the Street.

GET IN TOUCH:

Book a call, Calendly.

Actionable trade ideas are on X, in the private feed. Sign up HERE.

YouTube (tons of educational videos, many detailing my favorite scans).

Zor Capital LLC, a registered investment adviser, publishes the content presented on this blog. It is intended solely for informational and educational purposes and should not be construed as personalized investment advice or a recommendation to buy, sell, or hold any security. Nothing on this site constitutes investment, legal, tax, or other professional advice, and it should not be relied upon as such.

All opinions expressed are those of the author and are subject to change without notice. While we make reasonable efforts to provide accurate information, Zor Capital LLC makes no representations or warranties regarding the accuracy, timeliness, or completeness of any information on this blog.

Investing involves risk, including the potential loss of principal. Past performance is not indicative of future results. Any references to specific securities or investments are for illustrative purposes only and do not constitute a solicitation or offer to transact in any security.

Clients or prospective clients should consult with a Zor Capital advisor directly regarding their financial situation before making investment decisions. Zor Capital may have positions in the securities or strategies discussed.