Warren Buffett’s Berkshire Hathaway just filed its Q1 2025 13F — and while he’s still holding Apple tight, there were major shifts under the hood.

Here’s what The Oracle of Omaha did this quarter:

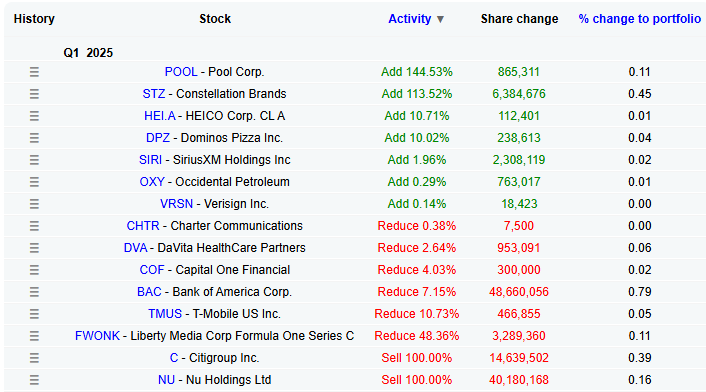

🔻 Trimming the Financials

Buffett continues to distance himself from bank stocks.

Sold Entirely:

-

🏦 Citigroup (C): 14.6M shares gone

-

🏦 Nu Holdings (NU): 40M shares exited

Trimmed Down:

-

🏦 Bank of America (BAC): -48.6M shares

-

🏦 Capital One (COF): -300K shares

This marks a clear move away from financials — potentially reflecting concern over consumer credit, rising delinquencies, or narrow margins.

📦 Loading Up on Brands & Energy

Buffett rotated hard into consumer staples, leisure, and energy names:

Increased Stakes:

-

🍷 Constellation Brands (STZ): +113% to 12M shares

-

🍕 Domino’s Pizza (DPZ): +240K shares

-

🏊♂️ Pool Corp (POOL): +145%

-

🛢️ Occidental Petroleum (OXY): Continued to buy

These are strong brands with pricing power — classic Buffett.

🍏 Holding Apple Steady

No surprise here: Apple (AAPL) remains untouched.

-

300M shares

-

Valued at ~$66.6B

-

Still Berkshire’s #1 holding

🕵️♂️ Secret Buys

Berkshire filed for confidential treatment on new holdings, which likely means Buffett (or Ted/Todd) is building a major position.

Estimates peg this mystery stake between $1–$2B.

💰 Cash Is Still King

Buffett now has a record $348B in cash.

That’s dry powder if markets crack or deals emerge.

🧠 What It All Means

-

✅ Getting defensive with strong consumer names

-

❌ Stepping back from banks

-

🧴 Quietly loading into inflation-resistant businesses

-

👑 Holding Apple as a core asset

-

💣 Prepping for something bigger (via cash + confidentia

GET IN TOUCH:

Book a call, Calendly.

Actionable trade ideas are on X, in the private feed. Sign up HERE.

YouTube (tons of educational videos, many detailing my favorite scans).

Zor Capital LLC, a registered investment adviser, publishes the content presented on this blog. It is intended solely for informational and educational purposes and should not be construed as personalized investment advice or a recommendation to buy, sell, or hold any security. Nothing on this site constitutes investment, legal, tax, or other professional advice, and it should not be relied upon as such.

All opinions expressed are those of the author and are subject to change without notice. While we make reasonable efforts to provide accurate information, Zor Capital LLC makes no representations or warranties regarding the accuracy, timeliness, or completeness of any information on this blog.

Investing involves risk, including the potential loss of principal. Past performance is not indicative of future results. Any references to specific securities or investments are for illustrative purposes only and do not constitute a solicitation or offer to transact in any security.

Clients or prospective clients should consult with a Zor Capital advisor directly regarding their financial situation before making investment decisions. Zor Capital may have positions in the securities or strategies discussed.