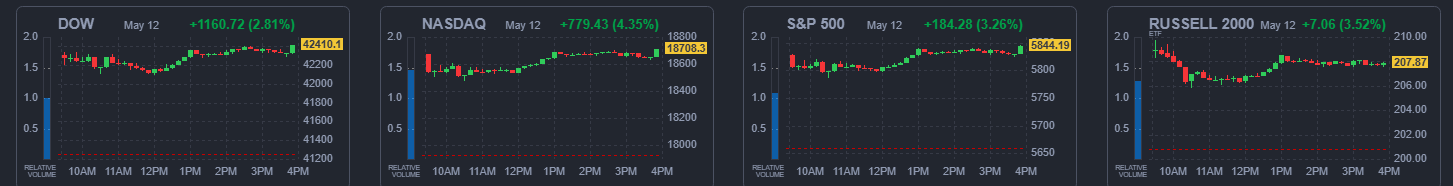

📈 U.S. Markets Surge on U.S.-China Tariff Truce

U.S. stocks soared after the U.S. and China agreed to a 90-day reduction in tariffs, easing trade tensions and boosting investor confidence.

🔍 Key Drivers

-

Tariff Reductions: The U.S. will lower tariffs on Chinese imports from 145% to 30%, while China will reduce tariffs on U.S. goods from 125% to 10% for 90 days.

-

Tech and Consumer Discretionary Rally: Major tech stocks like Apple (+6.2%), Nvidia (+4.7%), and Tesla (+7%) led gains. Consumer discretionary stocks rose 5.5%, with companies like Amazon and Nike posting significant increases.

-

Market Indicators: The S&P 500 crossed its 200-day moving average for the first time since March, signaling a potential bullish trend.

🔮 Looking Ahead

Investors will monitor upcoming economic data, including the May 13 U.S. Consumer Price Index report, for insights into inflation and potential Federal Reserve policy actions.

While the market rally reflects optimism over the tariff truce, analysts caution that the agreement is temporary, and uncertainties remain regarding long-term trade relations.

Key Earnings Tomorrow

Before the open: JD, ONON, SE, TME, UAA.

POPS AND DROPS

💥Pops of the Day:

🔹 $RGC +28% – Regencell exploded again, low-float mania continues. Up over 6,500% YTD.

🔹 $WRD +27% – WeRide surged on EV hype and autonomous vehicle partnerships.

🔹 $NRG +26% – Announced strategic review + activist investor Elliott takes stake.

🔹 $SOUN +23% – AI momentum + chatter about new enterprise contracts.

🔹 $FIVE +21% – Earnings leak? Rumors are swirling of a beat + raised guidance.

🔹 $W +21% – Short squeeze + positive housing sentiment.

🔹 $WRBY +20% – Up on cost-cutting plan and better margins ahead.

🔹 $MATX +18% – Pacific shipping strength and bullish upgrade.

🔹 $ASO +18% – Retail bounce + strong Q1 comp sales.

🔹 $NBIS +18% – Continued momentum in AI data centers.

🔹 $RUN +17% – Solar names bounce on clean energy subsidies chatter.

🔹 $RH +16% – Big short squeeze + insider buying buzz.

🔹 $AFRM – No data pulled yet, but likely sympathy with retail + fintech bounce.

🔻 $SATS -17% – EchoStar tumbled after DISH Network debt concerns resurfaced.

🔻 $PAAS -16% – Pan American Silver sank with gold/silver pullback.

🔻 $ORLA -16% – Gold miners got wrecked on metal price drop + weak guidance.

🔻 $HMY -11% – Harmony Gold down with global miners amid rate worries.

🔻 $GFI -10% – Same theme: gold slide + investor rotation out of miners.

🔻 $AU -10% – AngloGold hit hard by downgrade and FX exposure fears.

🔻 $IAG -10% – IAMGOLD followed sector lower, no unique catalyst.

🔻 $AEM -9% – Agnico Eagle beat estimates, but profit-taking took hold.

🔻 $ESLT -9% – Elbit Systems fell after reports of military contract delays.

🔻 $EGO -9% – Eldorado lost steam with metals, despite solid earnings.

🔻 $KGC -9% – Kinross gave back recent gains as gold reversed.

🔻 $TFPM -9% – Precious metals royalty names not immune to sector dump.

🔻 $SSRM – Awaiting catalyst update, but got swept in gold miner flush.

After-Hours News:

🚨 BREAKING: Coinbase ($COIN) is joining the S&P 500 — the first crypto company ever to do so.

Shares jumped 9% after hours on the news, after gaining 4% during the regular session.

🟠 Bitcoin last traded near $103K

🔁 $COIN replaces $DFS (merging w/ $COF)

GET IN TOUCH:

Book a call, Calendly.

On X https://zortrades.memberful.com/checkout?plan=105133, actionable trade ideas.

YouTube (tons of educational videos, many detailing my favorite scans).

Zor Capital LLC – Investment Disclaimer

Zor Capital LLC, a registered investment adviser, publishes the content presented on this blog. It is intended solely for informational and educational purposes and should not be construed as personalized investment advice or a recommendation to buy, sell, or hold any security. Nothing on this site constitutes investment, legal, tax, or other professional advice, and it should not be relied upon as such.

All opinions expressed are those of the author and are subject to change without notice. While we make reasonable efforts to provide accurate information, Zor Capital LLC makes no representations or warranties regarding the accuracy, timeliness, or completeness of any information on this blog.

Investing involves risk, including the potential loss of principal. Past performance is not indicative of future results. Any references to specific securities or investments are for illustrative purposes only and do not constitute a solicitation or offer to transact in any security.

Clients or prospective clients should consult with a Zor Capital advisor directly regarding their financial situation before making investment decisions. Zor Capital may have positions in the securities or strategies discussed.