Q1 2025 Market Recap 🧵

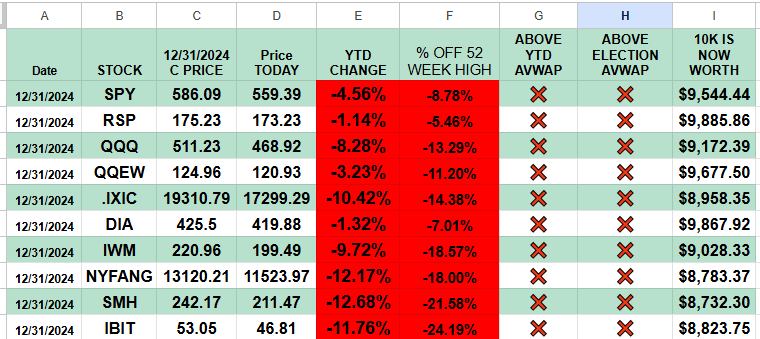

1/ 📉 S&P 500: -4.6% — worst quarter since 2022.

2/ 💥 Tech tumbles:

• Tesla ($TSLA): -36%

• Nvidia ($NVDA): -20%

• Apple ($AAPL): -13%

• Microsoft ($MSFT): -13%

• Amazon ($AMZN): -15%

• Alphabet ($GOOGL): -20%

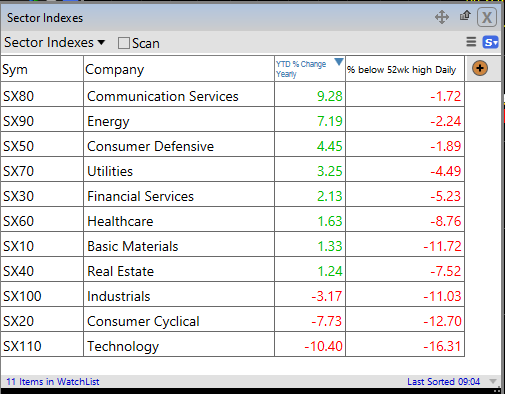

3/ 📈 Energy sector: +9.3% — quarter’s standout performer.

4/ 💸 Tariff tensions and stagflation fears roiled markets.

5/ 📊 Cboe Volatility Index ($VIX): up 28% to ~22 — fear gauge elevated.

6/ 🏦 Recession odds: 35% — Federal Reserve expected to cut rates. Reuters

7/ 📉 Invesco QQQ Trust ($QQQ): -8.2% — tracking Nasdaq-100’s decline.

8/ 📉 Nasdaq Composite: -10.4% —

9/ 📉 Dow Jones Industrial Average: -1.3% — relatively modest decline.

10/ 🪙 Bitcoin ($BTC): -11.8% — crypto faced headwinds amid market volatility

Sector Performance:

Top S&P 500 Performers YTD 2025 🚀📈

1/ CVS 🏥 +49.6% — Medicare Advantage changes + strong earnings

2/ NEM 🪙 +29.2% — Gold rally = mining boom

3/ PM 🚬 +28.9% — Global sales & smokeless growth

4/ T 📱 +23.8% — 5G rollout & subscriber growth

5/ COR 💊 +22.5% — Healthcare demand powering ahead

6/ VRTX 🧬 +22.4% — Biotech wins on trial results

7/ ED ⚡️ +21.9% — Safe utility play in shaky market

8/ WRB 🛡️ +21.8% — Strong insurance underwriting

9/ WELL 🏡 +21.7% — Senior housing comeback

10/ VRSN 🌐 +21.2% — Domain name dominance

11/ GILD 💉 +21.0% — Expanding antiviral lineup

12/ UBER 🚗 +20.6% — Profitability & delivery growth

13/ BRO 🧾 +20.5% — Insurance brokerage strength

14/ AJG 🤝 +20.0% — Smart M&A moves

15/ TMUS 📶 +20.0% — Subscriber growth post-merger

16/ WBA 🧪 +19.9% — Healthcare pivot paying off

17/ GE 🛠️ +19.8% — Restructuring = results

18/ HES 🛢️ +19.1% — Crude prices lifting energy

19/ ORLY 🚘 +18.8% — Aging cars = parts demand

20/ EXC ⚙️ +18.8% — Reliable utility revenues

21/ RSG ♻️ +18.6% — Waste management = steady gains

22/ TPL 🌾 +18.1% — Land + royalties = $$$

23/ AMGN 🧪 +17.8% — Biologics & pipeline strength

24/ AIG 💼 +14.9% — Better underwriting & margins

25/ CI 🏥 +17.7% — Health plan growth on point

Bottom S&P 500 Performers YTD 2025 📉

1/ DECK 👟 -45.6% — Weak outlook despite hype around HOKA; growth cooling

2/ TSLA 🚗 -36.2% — Slowing deliveries & demand concerns for EVs

3/ ON 🔌 -35.8% — Chip glut & macro pressure hitting semi demand

4/ TER 🧪 -34.6% — Semi test equipment demand drying up

5/ WDC 💾 -33.0% — Storage biz struggles with pricing & inventory

6/ MRNA 💉 -32.6% — Vaccine demand fades, pipeline still speculative

7/ WST 🧫 -32.6% — Post-COVID normalization + slower medical sales

8/ VTRS 💊 -30.9% — Generics under pressure + lack of growth spark

9/ ANET 🌐 -30.0% — Cautious cloud capex hitting networking

10/ UAL ✈️ -28.6% — Margin pressure + rising fuel & labor costs

11/ FSLR ☀️ -28.4% — Policy uncertainty dims solar outlook

12/ DAL ✈️ -27.8% — Similar story: cost creep, soft demand

13/ EPAM 💻 -28.5% — Global macro + Eastern Europe exposure hurting

14/ AVGO 📡 -28.2% — Broad semi selloff despite AI tailwinds

15/ HPE 🖥️ -25.8% — Legacy hardware biz can’t catch a break

16/ SWKS 📶 -27.7% — Apple exposure dragging w/ weak iPhone cycle

17/ ZBRA 🧾 -27.4% — Industrial tech hit by capex slowdown

18/ NCLH 🛳️ -26.9% — Debt load + weaker bookings weigh

19/ EIX ⚡ -27.2% — Legal risks + fire liability fears

20/ LULU 🧘♂️ -23.2% — Sales miss + inventory concerns

21/ CZR 🎰 -23.7% — Vegas cools, macro weighs on discretionary

22/ NOW ☁️ -25.7% — High multiple names getting derated

23/ LVS 🎲 -25.1% — Macau bounceback not enough

24/ NTAP 🗄️ -24.1% — Cloud competition, hardware soft

25/ ALGN 😬 -24.8% — Ortho slowdowns & margin compression

What lies ahead?

“You don’t need to be able to predict the future to make money in the stock market. You just need to know what to do if something happens.”—William O’neil.

GET IN TOUCH:

Book a call, Calendly.

ZorTrades_Alpha actionable trade ideas.

On X ZorTrades

YouTube (tons of educational videos, many detailing my favorite scans).