The market opened with a gap down this morning, but bulls stepped in to fuel a solid intraday rebound. The SPDR S&P 500 ETF ($SPY) rallied off the lows at $554.81, climbing as high as $567.42 before settling at $564.65 by the close. However, sentiment shifted sharply after hours, with $SPY sliding to $544.82 in extended trading.

The reason for the sentiment shift:

Trump Declares “Liberation Day” with Sweeping Tariffs on U.S. Trade Partners

“April 2, 2025, will forever be remembered as the day American industry was reborn, the day America’s destiny was reclaimed and the day that we began to make America wealthy again,” Trump says.

“For decades, our country has been looted, pillaged, raped and plundered by nations near and far, both friend and foe alike. American steel workers, auto workers, farmers and skilled craftsmen — we have a lot of them here with us today. They really suffered gravely.”

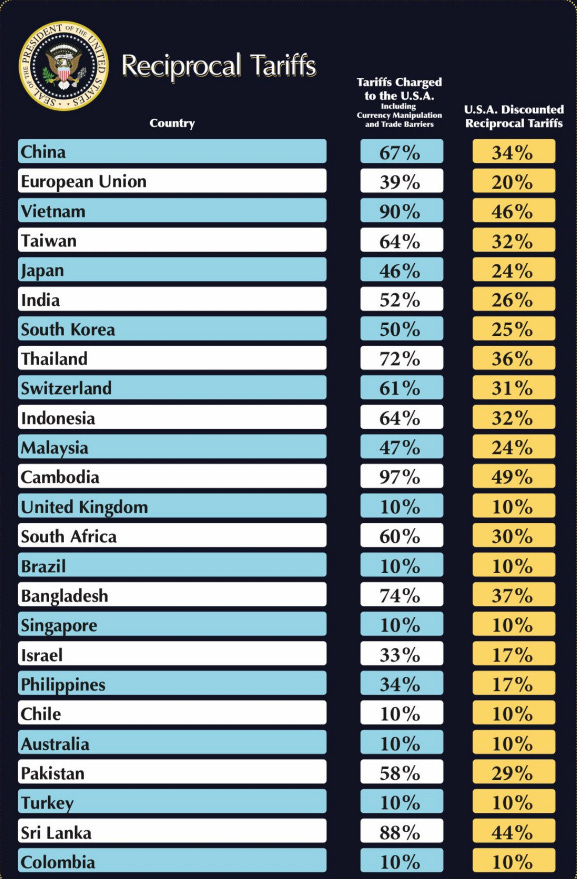

After months of build-up, President Trump pulled the trigger on a sweeping new trade policy Wednesday, announcing a baseline 10% tariff on all U.S. trade partners, with even higher rates for countries he labeled as “bad actors.” He dubbed the moment “Liberation Day.”

A few standout changes:

-

Steel & Aluminum: A 25% tariff on all steel and aluminum imports kicked in Wednesday, March 12.

-

Canada & Mexico: Tariffs are on hold for goods that fall under the USMCA, but only until April 2.

-

Foreign Autos: A 25% tariff on all non-U.S. made vehicles is expected to take effect this week.

-

Venezuela: Starting April 2, the U.S. will apply a 25% “secondary tariff” on any nation that continues buying oil or gas from Venezuela.

The market didn’t take the news well—overnight futures are plunging as I write this.

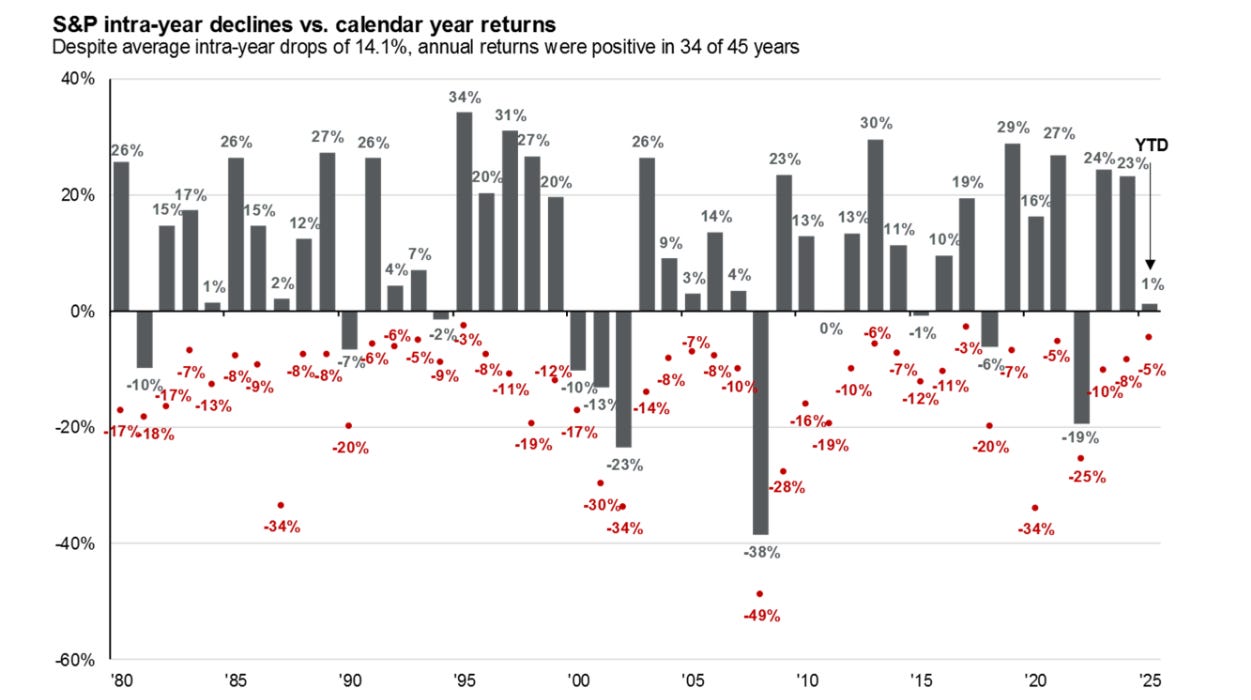

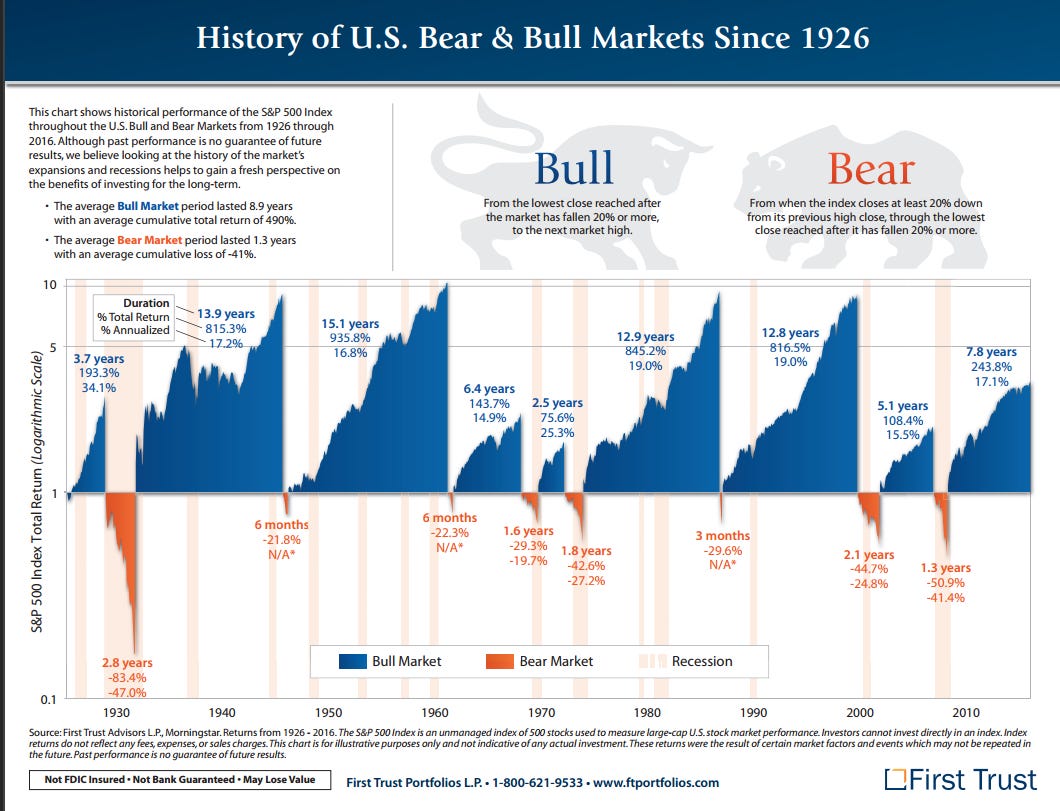

Bottom line: Historically, the S&P 500 averages a 14% intra-year pullback. After factoring in the latest after-hours action, the index is now down 11.25% from its February 19, 2025 high—putting us within striking distance of a typical correction.

Despite average intra-year declines of 14%, the S&P 500 has finished positive in 34 of the past 45 years. With April just underway, there’s still plenty of time on the clock to keep that 75% win rate alive.

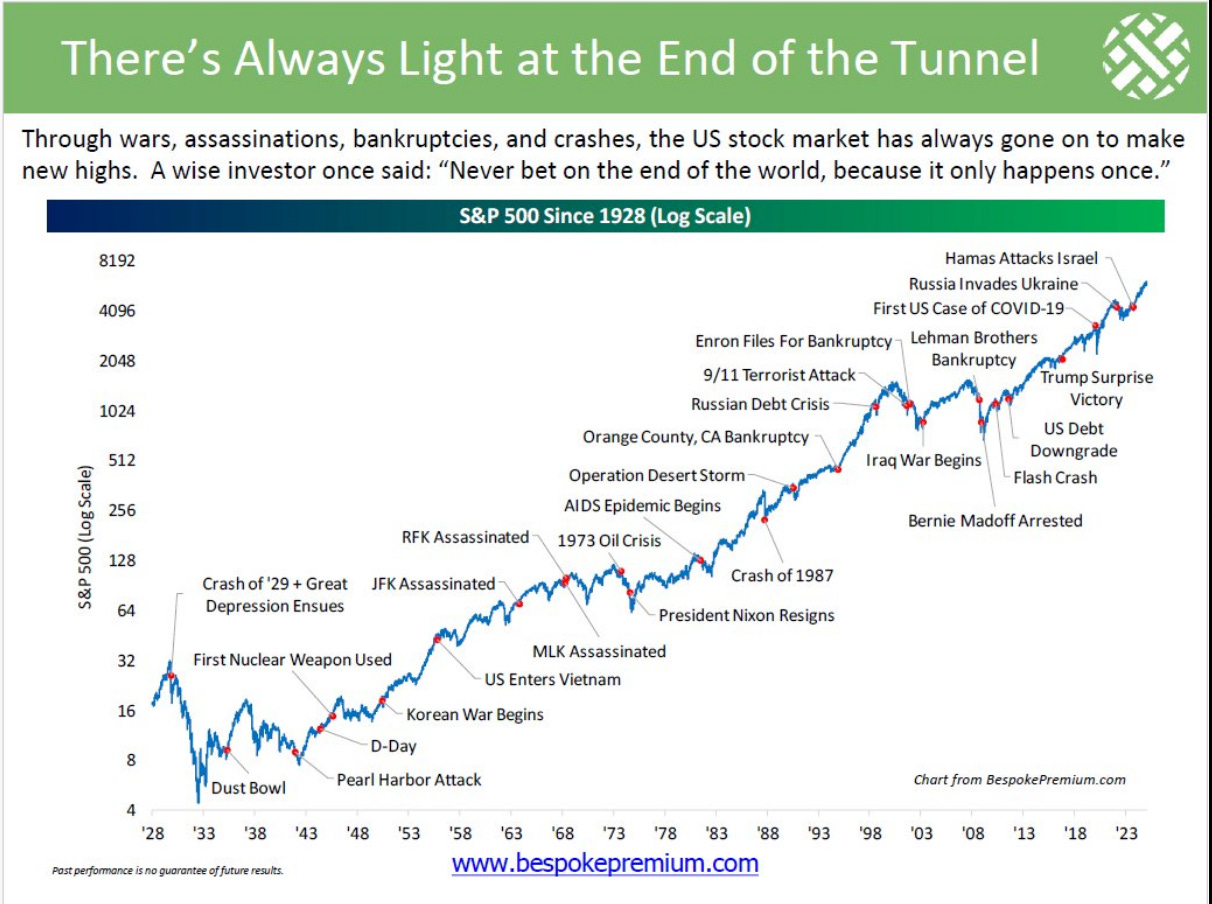

And now, we have a new headline to add to the S&P 500’s long-term chart. Every dip has its reason—wars, crises, bankruptcies, shocks—but history shows the market has always recovered and gone on to make new highs. This latest decline will eventually be just another red dot on the path of long-term progress.

The stock market is a forward-looking discounting machine. It will find a level that reflects current headwinds—whether that’s here, 5% lower, or 10% lower. It always does.

As Warren Buffett once said, “In the short run, the market is a voting machine. In the long run, it’s a weighing machine.” Eventually, price catches up with reality—and opportunity tends to follow.