Last night I posted something simple:

“Critical mining has my eye.”

No headline.

No news.

Just what the screens were telling me.

Less than 12 hours later, Bloomberg hit with this:

The Trump Administration is planning to take additional stakes in U.S. minerals companies.

That’s the narrative. But the important part is this:

The trades were already on before the story broke.

This is exactly what “finding stocks before they break out” actually means in practice — not prediction, not hype, just theme → execution → confirmation.

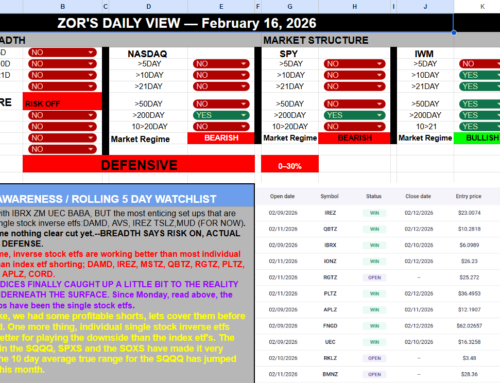

The Theme Came First

Critical metals and domestic resource independence have been quietly tightening under the surface. The setups were showing up across multiple names at once — that’s the tell.

Not one stock.

A cluster.

The Executions (Before the Headline)

Here’s what was actually traded before the Bloomberg catalyst:

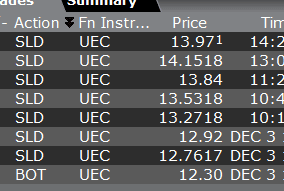

✅ UEC (Uranium Energy Corp)

-

Entry: 12.30

-

Scale-outs: 12.76 → 12.92 → 13.27 → 13.53 → 13.84 → 14.15

-

Result: Clean, double-digit gain with controlled scale-outs

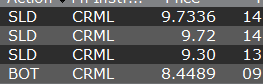

✅ CRML (Critical Metals Corp)

-

Entry: 8.44

-

Exits: 9.30 → 9.72 → 9.73

-

Result: ~10%–15% same-day move

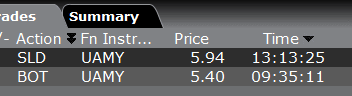

✅ UAMY (United States Antimony)

-

Entry: 5.40

-

Exit: 5.94

-

Result: Another clean single-day gain

Three separate stocks.

Same theme.

Same timing window.

All before the policy catalyst.

That’s not random. That’s rotation velocity.

And a few other stocks from that sector triggered today.

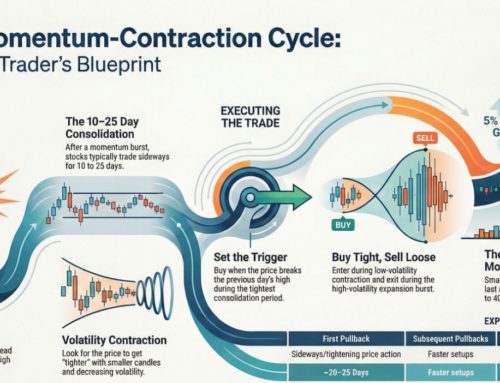

If this is something that might interest you, you can find stocks before they breakout in these two places: