The Indexes Lied All Week. Individual Stocks Told the Truth.

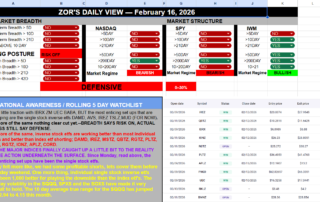

S&P 500 down 1.5%. Nasdaq down 2%. Dow lost 50,000. None of this was a surprise if you were reading the Daily View. Individual stocks had been screaming chop, not trend since January. This week, the indexes finally caught up. The Daily View Called It Feb 10: “The most enticing setups are the single stock inverse ETFs: DAMD, AVS, IREZ, TSLZ, MUD.” Feb 11: “BREADTH SAYS RISK ON, ACTUAL SWINGS STILL SAY DEFENSE.” Feb 12: “Inverse stock ETFs are working better than most individual names and better than index ETF shorting.” Feb 13: S&P drops 1.6%. Nasdaq drops 2%. Dashboard [...]