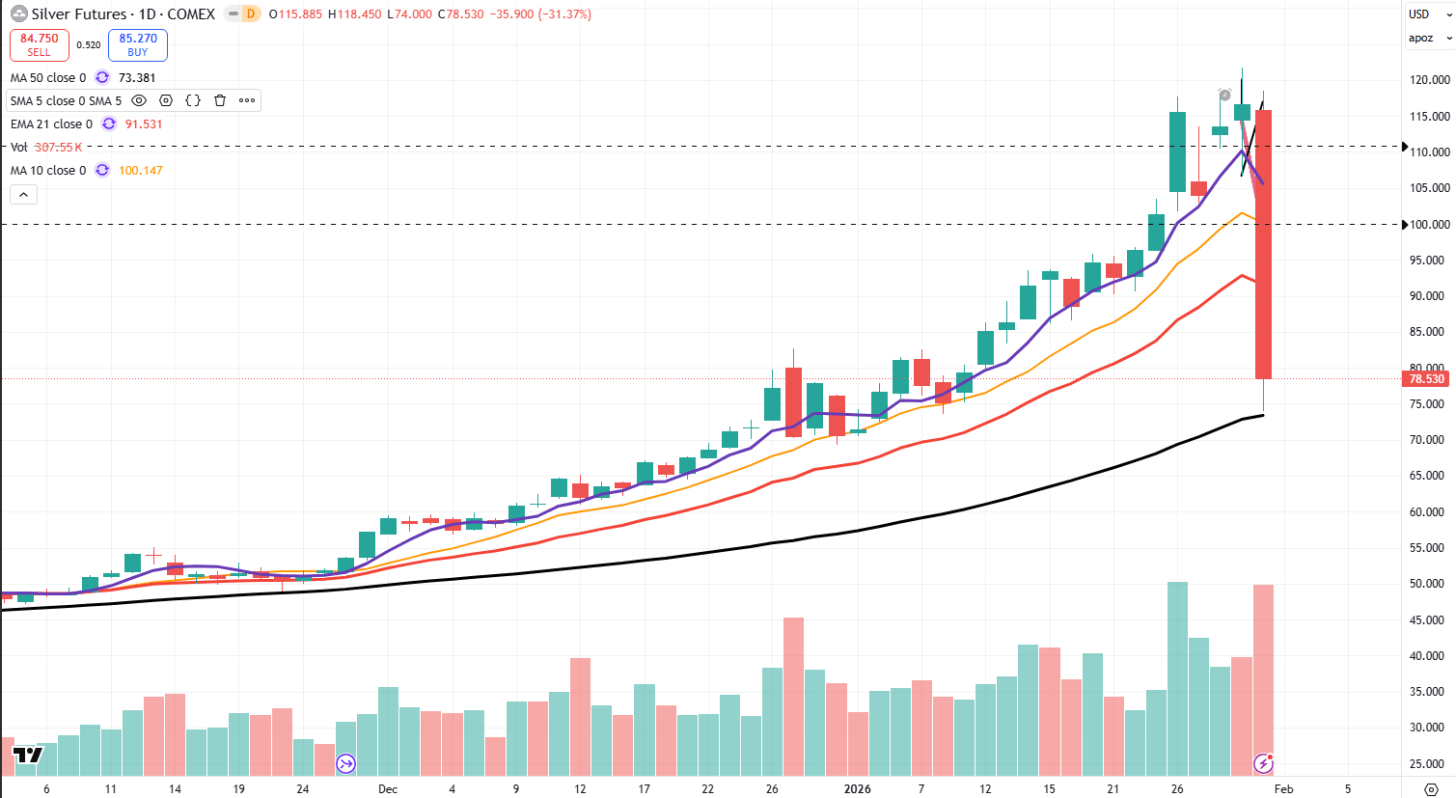

Silver was down as much as 35% from the peak.

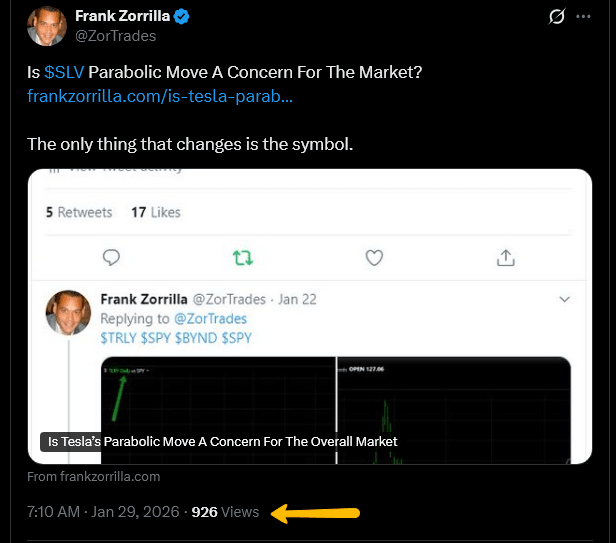

From the moment I woke up and saw silver futures, I locked in. We’ve seen this movie before. I’ve written about it countless times—the only thing that ever changes is the symbol: https://frankzorrilla.com/is-tesla-parabolic-move-a-concern-for-the-overall-market/

What Always Happens in Parabolic Phases

I’ve written this many times, across cycles and symbols:

-

Logic disappears.

-

The language gets extreme: “This time is different.”

-

Price targets go vertical.

-

Every pullback is “the last chance.”

Sound familiar?

If you been around long enough, you can actually feel it in the air.

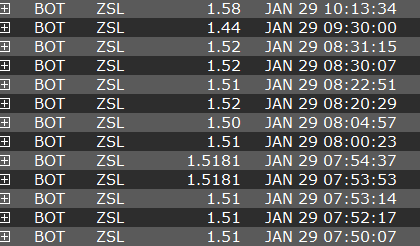

The weapon of choice was ZSL.

ZSL offered clean downside exposure without the complexity of futures or options.

ZSL’s range on Friday was $1.40ish to $2.80.

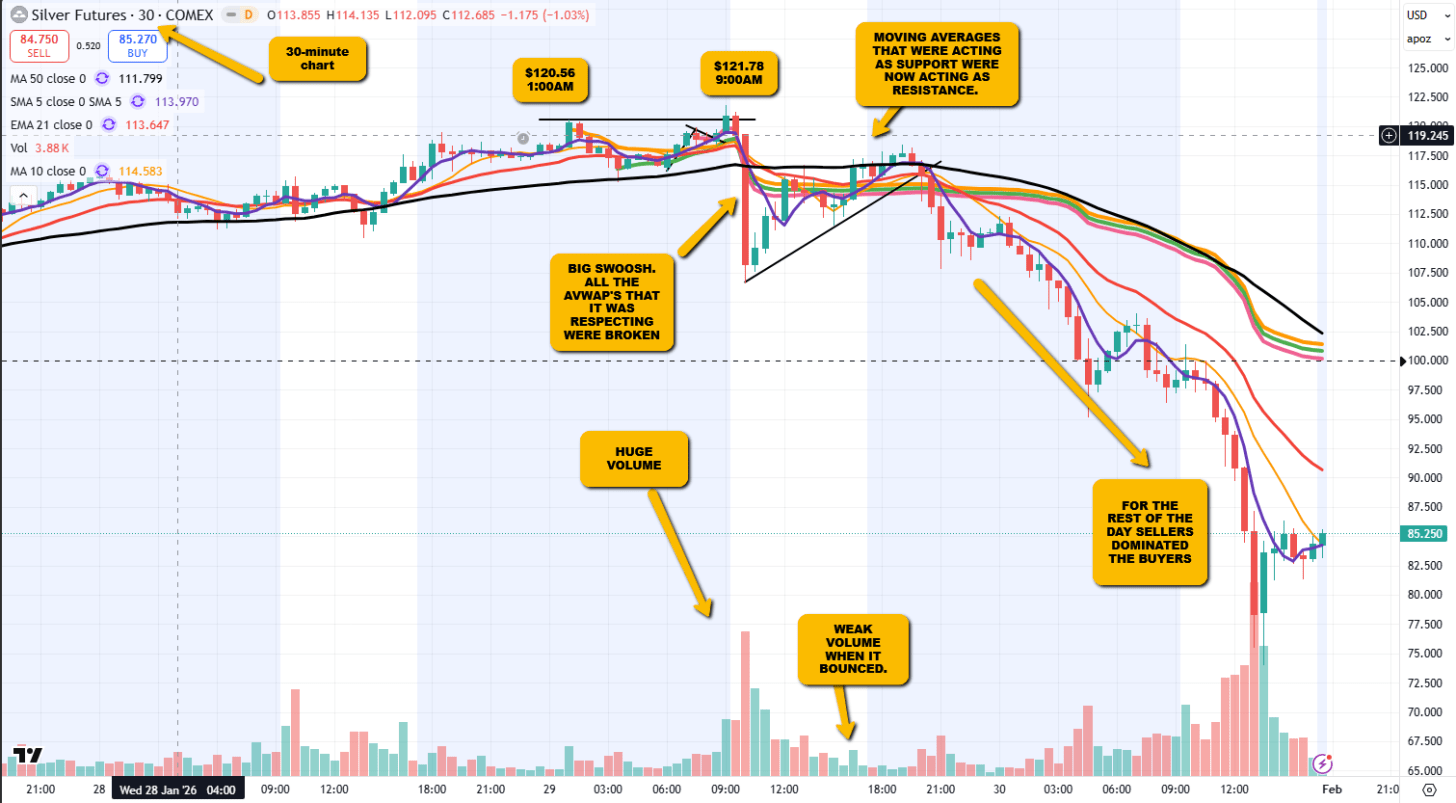

Throughout the day, silver traded in a textbook parabolic blow-off pattern—the exact behavior you want to see if you’re short and something we’ve seen countless times before.

-

Double Top

-

Big red candle on huge volume

-

Weak bounce on low volume

-

Moving averages and AVWAP that were acting as support are now acting as resistance.

-

Sellers controlled the tape for the rest of the session.

Parabolic moves don’t end because of bad news.

They end when everyone who wanted in is already in.

Moving Forward, We Need To Focus On The Market

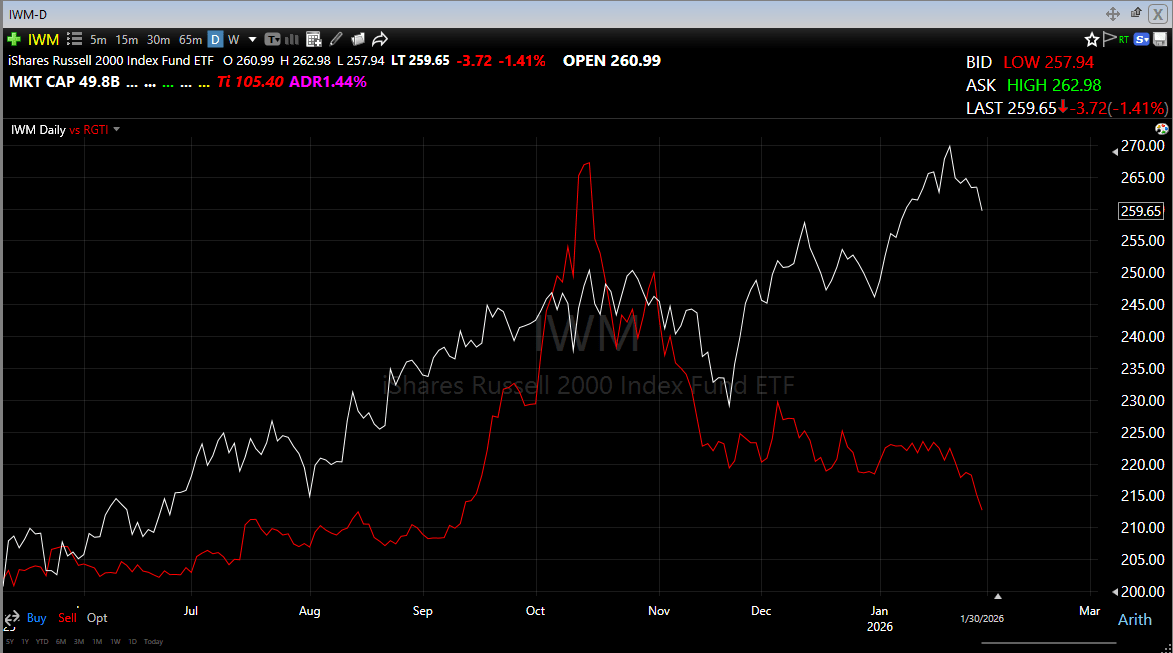

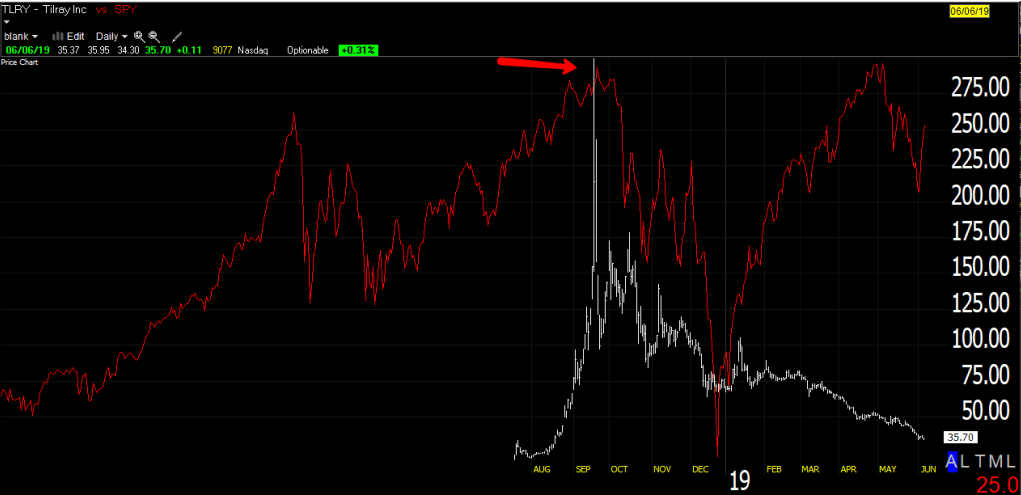

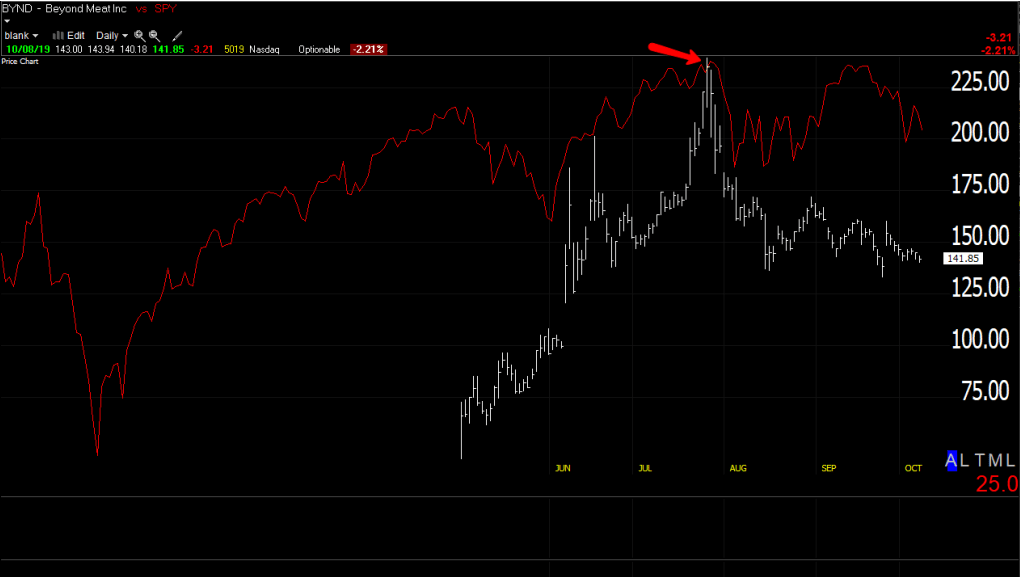

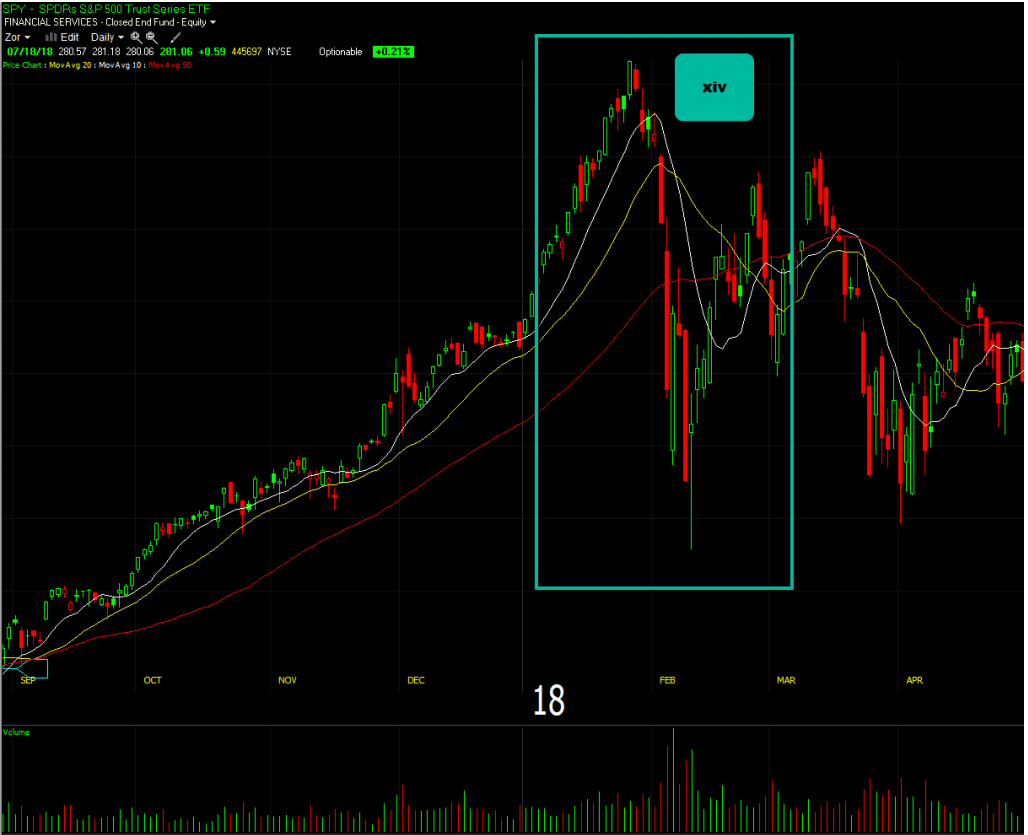

As I’ve said before, parabolic moves often coincide with market weakness. The most recent example was the quantum names. While those moves were smaller and lacked the kind of delusional crowd participation we’ve seen in past cycles, they still preceded broader market softness—and meaningful, decisive weakness across individual stocks.

RGTI vs. IWM

TLRY vs. SPY

BYND vs SPY

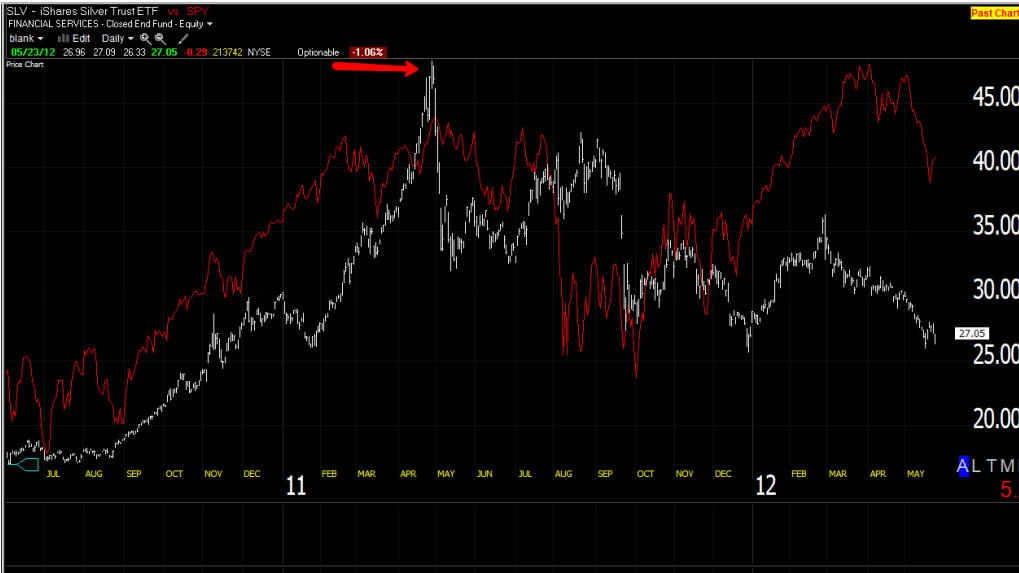

SLV 2011 vs SPY

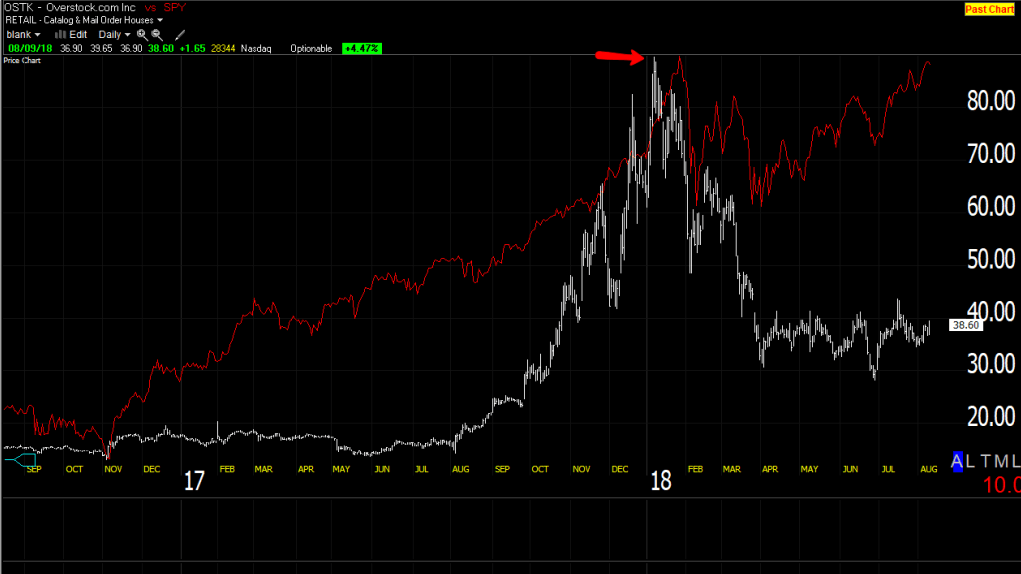

OSTK vs SPY

XIV vs SPY

BITCOIN 2017 vs SPY