If you’re not catching themes, you’re just trading tickers.

Risk management keeps you in the game.

Position sizing keeps you solvent.

But catching 2–3 real themes a year is what compounds capital.

I made this point clearly almost 6 years ago in a video most people watched and then ignored:

👉

The market hasn’t changed. Human behavior hasn’t changed.

Only the themes do.

Over the weekend, markets digested major geopolitical news:

-

The arrest of Nicolás Maduro

Most traders made the obvious move:

-

Chase oil stocks

That’s first-order thinking.

Second-order effects are where the money is made.

The Stocks That Reacted Immediately (and Why)

MercadoLibre

Latin America’s Amazon.

Regime instability historically leads to:

-

Capital flight

-

Currency stress

-

Increased reliance on digital commerce

The stock didn’t wait. It moved right away.

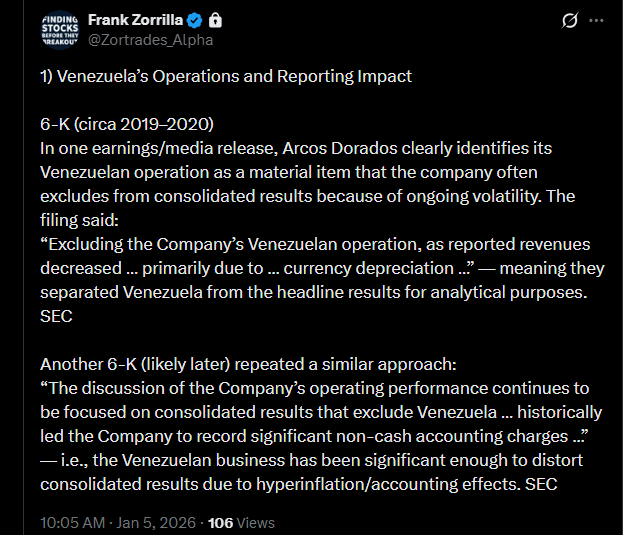

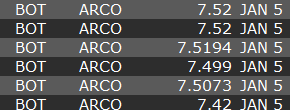

Arcos Dorados, this is the one we nailed.

Another clean example:

-

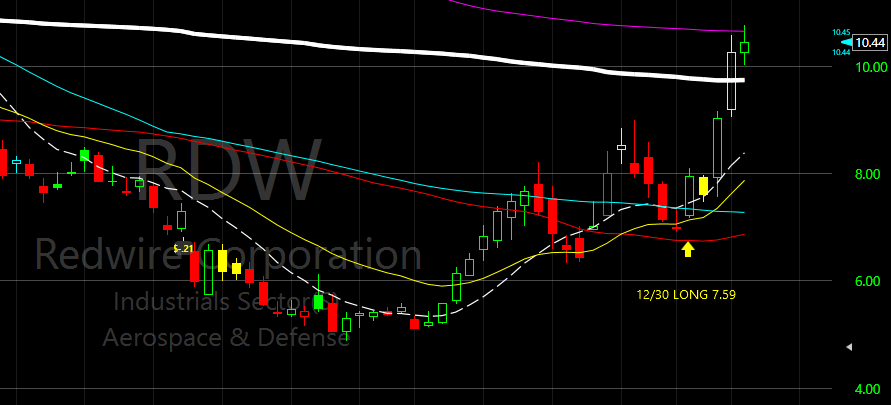

Redwire ($RDW) SPACE

Up ~45% in 5 days after we flagged it.

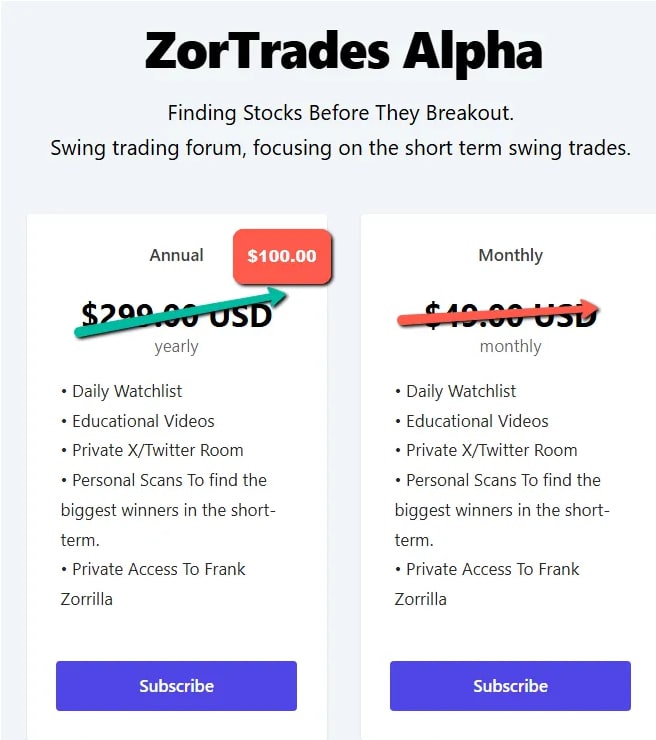

If you want to see:

-

How I identify themes early

-

What I’m watching before they move

-

How I size and manage risk when themes confirm

-

CLICK ON THE PICTURE

-