Yesteryear’s market is not today’s market. The headline indices have lulled people into thinking things are “fine,” but under the surface, it’s been a completely different story.

Breadth has been atrocious. While the S&P barely blinked, a massive chunk of individual stocks quietly fell 30–40%. This past month was a perfect example: concentration masked the damage. Ten stocks are responsible for roughly 60% of this year’s S&P 500 gains. When the generals hold up, the army can collapse and nobody notices—until they check their portfolio.

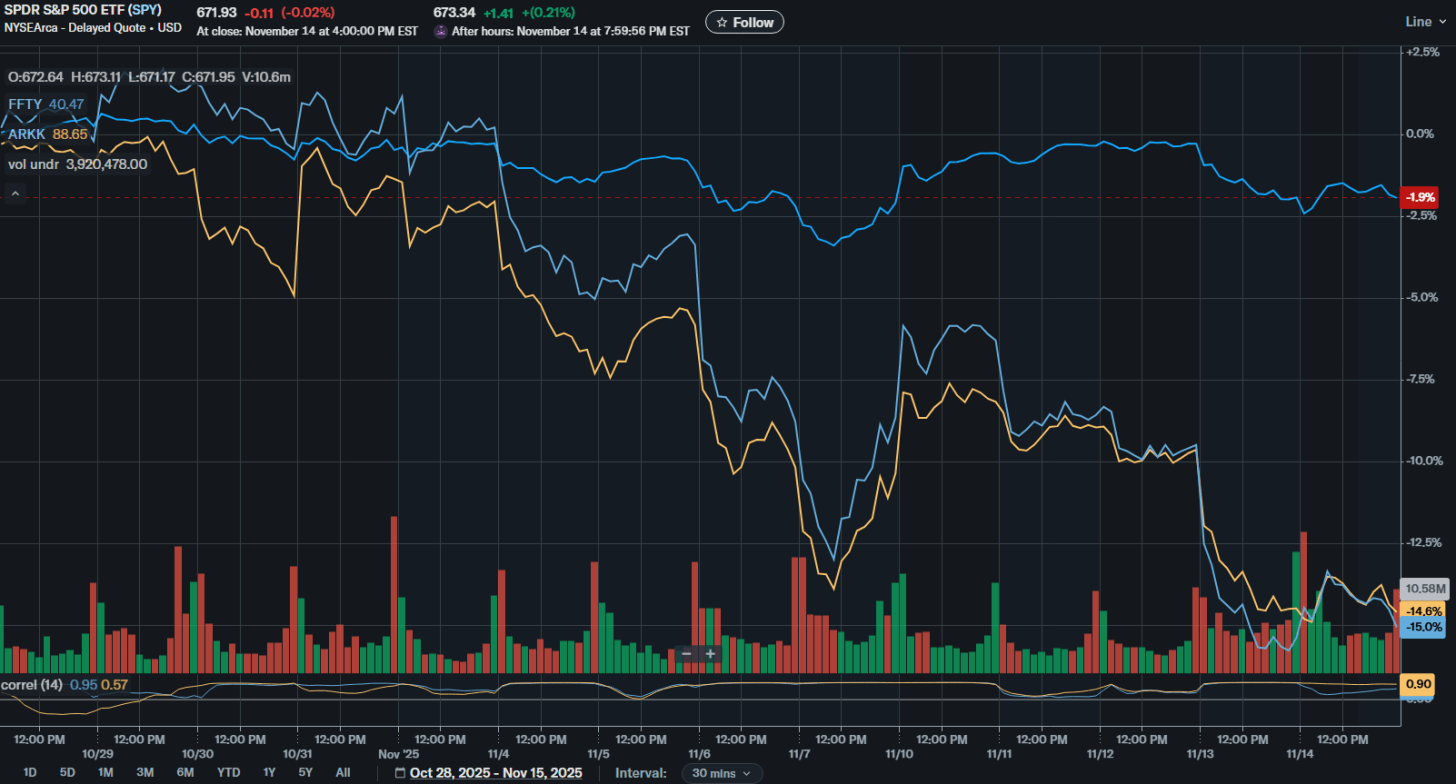

From the 10/29 peak to Friday’s trough, the S&P 500 slipped by just -3.82%.

Meanwhile, high-beta ETFs like ARKK fell by 17.52% and 20.27%, depending on the sleeve. That’s not a small gap—it’s a totally different market.

This is why I’m a believer in keeping index ETFs as core positions, especially in markets with top-heavy leadership. I lay out the logic clearly in this video:

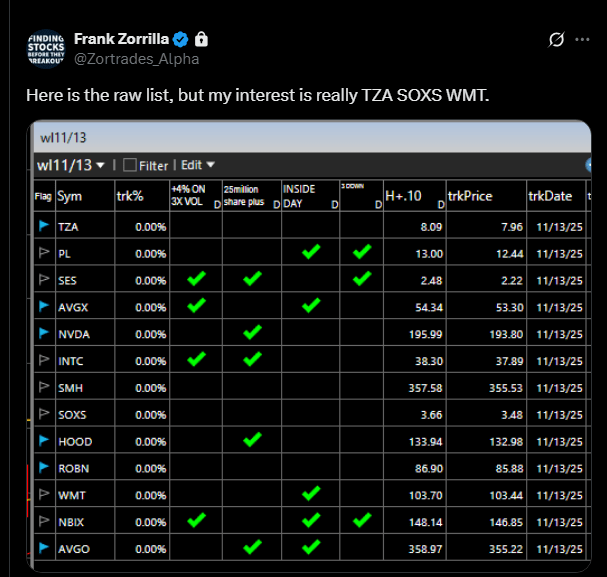

The good news: we’re now heading into a traditionally strong seasonal window. And we already capitalized on the downside via TZA, SOXS, and inverse single-stock ETFs like QBTZ and IONZ. If you didn’t know those opportunities existed—or didn’t know how to trade them—you left real money on the table.

If these are the types of trades you should be catching, then take the free trial and get in the flow.