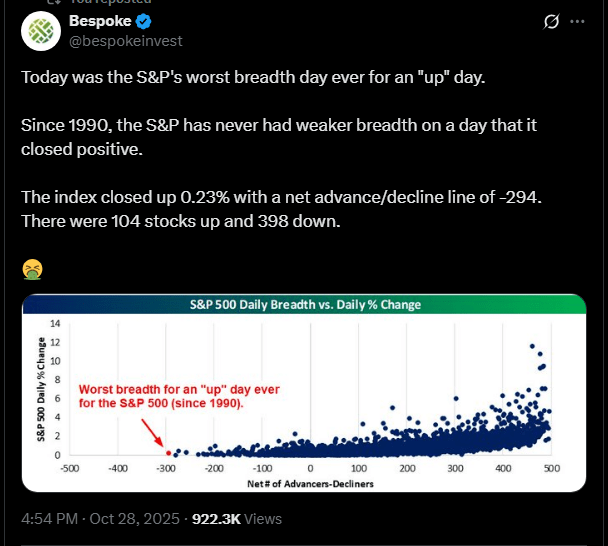

Yesterday marked the worst breadth day ever for an “up” day in the S&P 500 — the index closed +0.23%, but under the surface, only 104 stocks were up while 398 were down. Since 1990, the S&P has never had a weaker internal reading on a positive day.

Today: Same Story, Slight Bounce

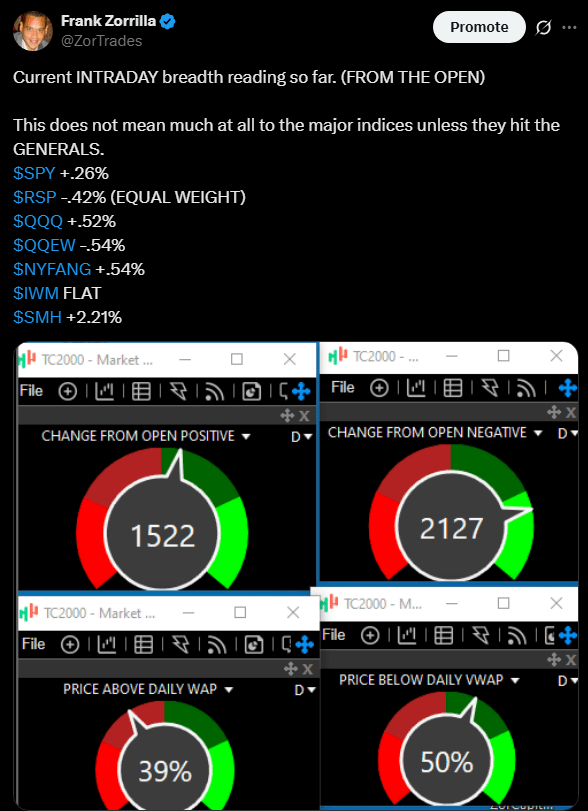

The divergence continues.

The Nasdaq 100 ($QQQ) is up +0.52%, but the Equal Weight Nasdaq ($QQEW) is down –0.54% — that’s a massive split.

Negative breadth doesn’t matter much to the indices until it hits the generals — $AAPL, $MSFT, $NVDA, $GOOGL, $AMZN — but it matters if you’re actually trading.

When the field narrows like this, it’s a warning to protect your capital and your mental capital.

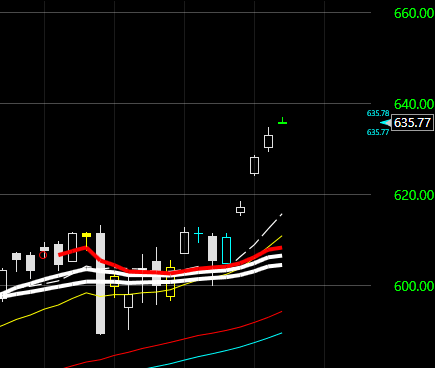

I’m Leaning Short in the short-term (1-5 days).

I’m pressing some individual stock shorts via single inverse ETFs.

And I’m really not opposed to starting some positions in inverse index ETFs. I believe short-term, they are extended and are pricing in a lot of good news.

Final Thoughts

When you see the indices green but most stocks red, remember — it’s not a stock market, it’s a market of stocks.

The generals can only march alone for so long.

If you want to stay in tune with the market’s internal health and positioning, reach out.

📈 My Managed Assets Program is open to new clients, even though I am trying to finish the year super strong to improve my standing in the U.S. Investing Championship.

🔒 My Private X Feed

The goal isn’t just another chat room — it’s a focused trading army.

A group of traders who:

-

Share a passion for the market

-

Use the two scans + setups that consistently produce the biggest short-term winners.

-

Work together to catch every theme, every move — without missing the breakout

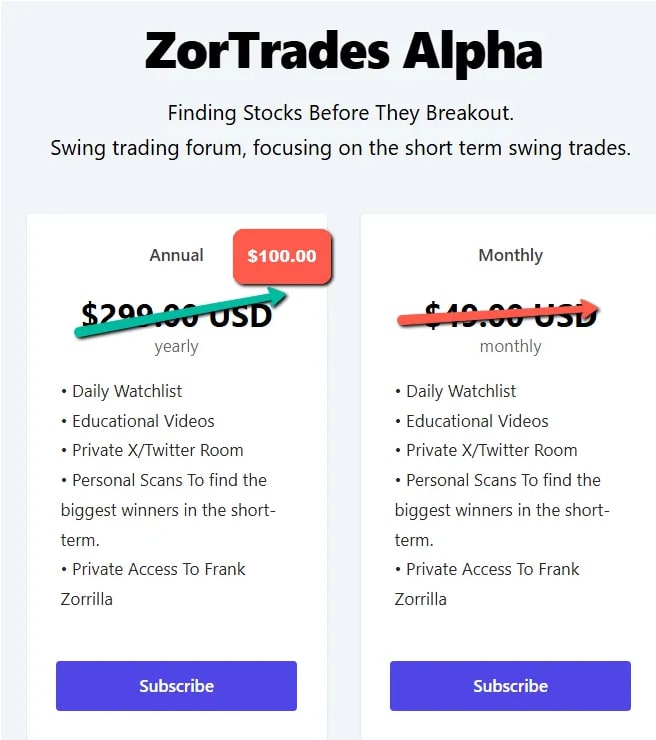

I’ve done this for the last couple of years — offering a deep discount so people can join for just $100 a year.

At that price, I promise you — it’s the best deal on the web.

👉 Join us here: Zortrades_Alpha

📞 Too busy during the day for trading alerts?

Let’s talk about money management → Book a call