✅ Breadth Flipped Bullish, ✅ 3x ETFs Outperformed, ⛔️ Signal Closed – Now What?

On June 23rd, we got the signal.

Two of our three breadth indicators turned positive, and that was our green light to lean into the short side of risk, via high-beta 3x ETFs like $SOXL, $TQQQ, $FNGU, and $SPXL.

📈 Entries:

$SOXL at $21.55

$TQQQ at $74.66

$SPXL at $159.83

Breadth was improving despite geopolitical noise, and the tape leaned constructive as long as it remained above its 5-day moving average. That was our line in the sand.

Click here for actionable ideas.

📆 July 1st: Stocks Still Not Participating

Even though the breadth signal flipped, individual stocks weren’t taking the baton yet.

“We are sitting on the 5-day, and the stocks really need to take the baton and run with it; otherwise, we will fall below the 5-day.”

– July 1, 2025

That told us to stick with the 3x ETFs—they were outperforming and easier to size up without the need to pick the perfect stock.

⛔️ July 7th: Breadth Closed Below the 5-Day

That was our exit signal. The 10-day window closed.

“Breadth closed below the 5-day moving average. It lasted 10 days—not bad.”

– July 7, 2025

Here’s how the trades worked out:

-

$SPXL: +9.74%

-

$SOXL: +15.87%

-

$TQQQ: +11.06%

-

$FNGU: +16.62%

While individual names began to shine after July 7th, the breadth structure no longer supported aggressive risk-taking. The strategy did its job.

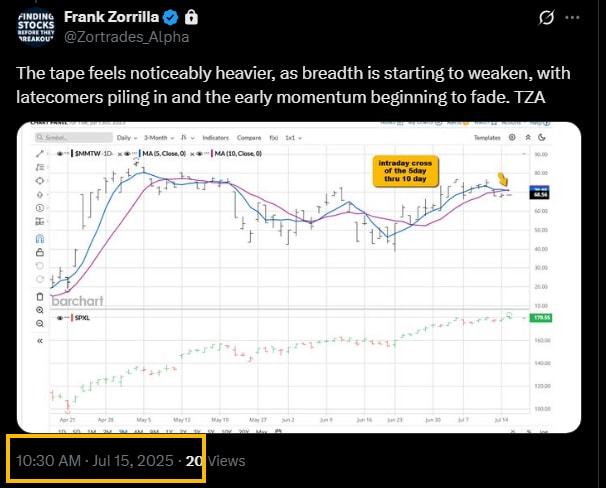

⚠️ July 15th: Tone Shift Confirmed

Today, we finally saw confirmation of weakening tape.

“The tape feels noticeably heavier, as breadth is starting to weaken, with latecomers piling in and the early momentum beginning to fade.”

– July 15, 2025

This opens the door for potential short setups or hedges. The momentum that carried the 3x ETFs higher is fading. Late entrants are getting in while internal strength is deteriorating.

🎯 The Takeaway

-

When breadth flips bullish, lean on liquid 3x ETFs to size up and simplify.

-

Exit when breadth closes below the 5-day MA.

-

Don’t overstay—signals are mechanical, not emotional.

-

Individual stock strength lagged on the way in and may now be catching up, but the tape is heavy.

📌 Stay Nimble. Stay Tactical.

If you want real-time updates like these, including entries, exits, and tactical commentary—subscribe to the Private Feed or join the newsletter below.