While the indices held up, market breadth quietly deteriorated. It was a tale of two markets—mega-cap tech soared while most stocks struggled.

On April 9, breadth flipped positive above its 5-day moving average and remained there until May 6.

Since then, short-term trading has been choppy, despite the indices appearing fine on the surface.

This simple breadth indicator acts like a green light or red light system for me.

Green light? I push the gas. Red light? I back off and preserve capital.

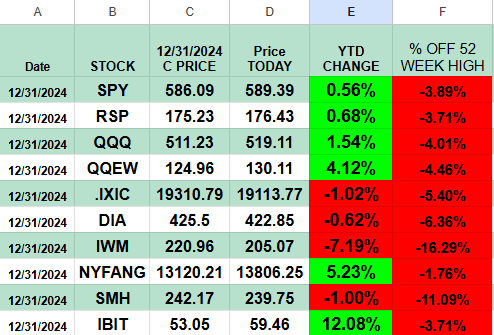

Year-To-Date

🧠 Weekly Market Recap: May 27–31, 2025

📅 Monday – A Calm Before the Storm

U.S. markets were closed for Memorial Day, but beneath the surface, rumors of China’s stimulus efforts stirred optimism. Meanwhile, traders were already bracing for a pivotal week in software earnings and inflation data.

📅 Tuesday – Salesforce Sparks a Software Sell-Off

Salesforce ($CRM) stunned the market by cutting full-year guidance after the close, triggering a wave of selling in software names. The report cast doubt on enterprise IT spending and shook confidence across the cloud space.

Also on Tuesday:

-

🇺🇸 Consumer Confidence rose unexpectedly—another sign the economy remains resilient, keeping the Fed on edge.

📅 Wednesday – Breadth Cracks

The major indices masked what was happening under the hood. Market breadth broke down, with fewer stocks participating in the rally. Traders began to rotate toward large-cap ETFs and defensive sectors as short-term swings lost momentum.

📅 Thursday – Nvidia Hits $3 Trillion

Nvidia ($NVDA) briefly passed a $3 trillion market cap, putting it in striking distance of Apple. The AI trade remains dominant, but the concentration risk is rising—more investors are starting to ask: what happens if NVDA sneezes?

Also Thursday:

-

📉 Q1 GDP was revised lower to 1.3% from 1.6%—not recessionary, but a clear sign of cooling growth.

📅 Friday – Inflation Cools (Slightly)

Core PCE, the Fed’s preferred inflation gauge, came in at +0.2% MoM, slightly below expectations. That was enough to ignite a modest rally in tech, and expectations for a rate cut shifted toward September.

🌍 Weekend Risk – Ukraine Escalates, Russia on Edge

In a potential game-changer, Ukraine reportedly struck Russian early-warning radar sites, including those tied to Moscow’s nuclear defense systems. This marks a major escalation and introduces fresh geopolitical risk that markets may begin to price in next week.

🚁 Drone Stocks to Watch

Given the recent geopolitical tensions and the increasing role of unmanned aerial vehicles (UAVs) in modern warfare and logistics, here are some drone-related stocks to keep an eye on:

Defense and Military Focused:

-

AeroVironment Inc. (AVAV): A leading supplier of small drones to the U.S. military, including the Raven and Switchblade systems.

-

Kratos Defense & Security Solutions Inc. (KTOS): Specializes in affordable, high-performance drones for military applications, including hypersonic systems.

-

Others: JOBY, ACHR, ONDS, ZENA, UAVS, RCAT.

💡 What It All Means

Breadth is fading. Chop is rising.

ETFs and mega-cap exposure are providing cover, while most individual stocks have struggled.

📽️ If you missed it, here’s a quick explainer on why holding market ETFs as core positions can keep you in the game when the tape turns messy:

👉 Watch: HOLDING ETF’s AS CORE HOLDINGS