In a week filled with 13F fireworks, Rocket Companies (NYSE: RKT) just grabbed the spotlight.

Why? Because one of Wall Street’s most respected activist hedge funds is now on board. And that’s just the start.

🏛️ ValueAct Takes a Position

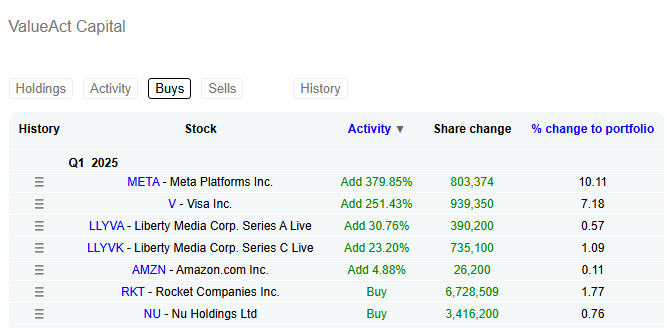

ValueAct Capital, a San Francisco-based activist hedge fund with a reputation for long-term strategic bets, just revealed a 6.73 million share position in Rocket Companies.

That’s approximately 4.5% of Rocket’s outstanding Class A shares.

For context, ValueAct is known for deep operational involvement. They don’t just invest — they influence.

This move signals one thing: they see untapped value in Rocket’s vertically integrated real estate platform.

📣 Citron Research: “The Amazon of Housing”

In addition, Citron Research—once a notorious short-seller but now a selective bull—called RKT its “Call of the Year.”

Here’s what they said:

“Rocket is the sleeping juggernaut of real estate — vertically integrated, AI-powered, and built to scale. Think Amazon, but for housing.”

Citron sees:

-

A future enterprise value of $60 billion

-

A price target of $33/share

-

Rocket’s AI + data advantage as a moat

Their thesis? Rocket Mortgage isn’t just a lender — it’s a platform.

🧠 CEO Varun Krishna Speaks

At The Gathering 2025 conference this week, CEO Varun Krishna doubled down on Rocket’s transformation story.

In his words:

“We’re building a fintech platform to modernize the entire homeownership journey — from search to close.”

Key takeaways from Krishna’s talk:

-

Rocket is investing heavily in AI for personalized mortgage matching

-

Focus on simplifying the customer experience

-

Long-term strategy revolves around tech enablement, not just rate optimization

💡 Final Thoughts

So what do we have?

✅ Activist hedge fund buying in

✅ Research firm going all-in bullish

✅ CEO laying out a disruptive tech roadmap

Rocket Companies is no longer just a mortgage originator. It’s trying to become the “Amazon of Housing.”

The street might just be waking up to it.

📈 Ticker: $RKT

💰 Last Price: ~$13.51

📎 Source: ValueAct 13F, Citron Research, Rocket Q1 IR presentation

GET IN TOUCH:

Book a call, Calendly.

Actionable trade ideas are on X, in the private feed. Sign up HERE.

YouTube (tons of educational videos, many detailing my favorite scans).

Zor Capital LLC, a registered investment adviser, publishes the content presented on this blog. It is intended solely for informational and educational purposes and should not be construed as personalized investment advice or a recommendation to buy, sell, or hold any security. Nothing on this site constitutes investment, legal, tax, or other professional advice, and it should not be relied upon as such.

All opinions expressed are those of the author and are subject to change without notice. While we make reasonable efforts to provide accurate information, Zor Capital LLC makes no representations or warranties regarding the accuracy, timeliness, or completeness of any information on this blog.

Investing involves risk, including the potential loss of principal. Past performance is not indicative of future results. Any references to specific securities or investments are for illustrative purposes only and do not constitute a solicitation or offer to transact in any security.

Clients or prospective clients should consult with a Zor Capital advisor directly regarding their financial situation before making investment decisions. Zor Capital may have positions in the securities or strategies discussed.