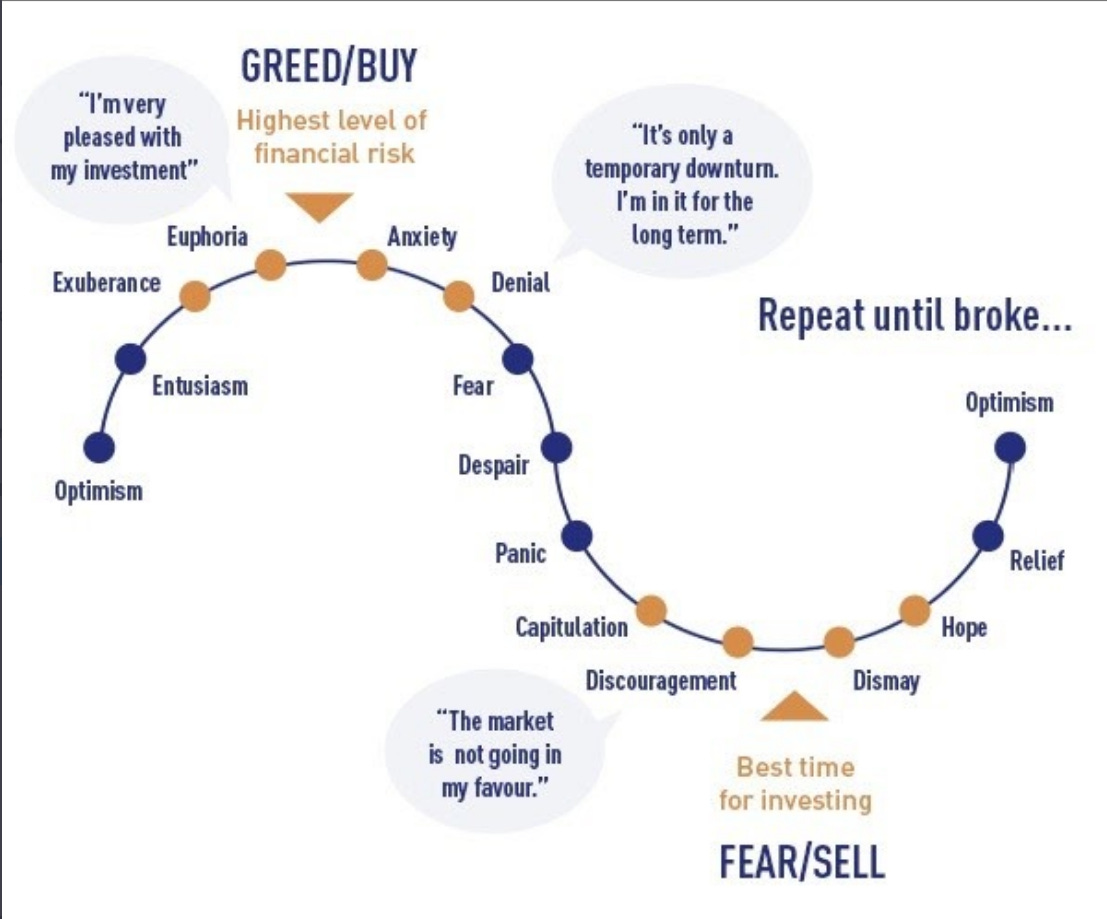

Let’s review a few things that we tend to forget when the market goes down and we get emotional.

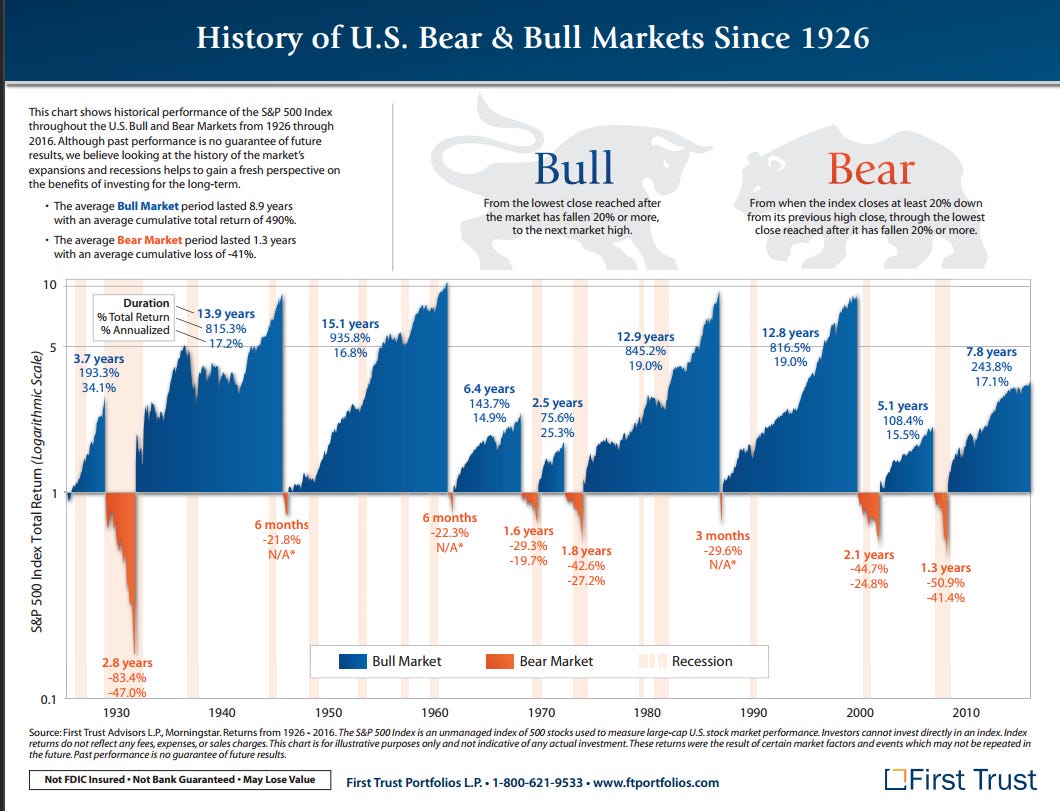

• The market goes up and down, not up or down. The average bull market lasts about 8.9 years, and the average bear market about 1.3 years.

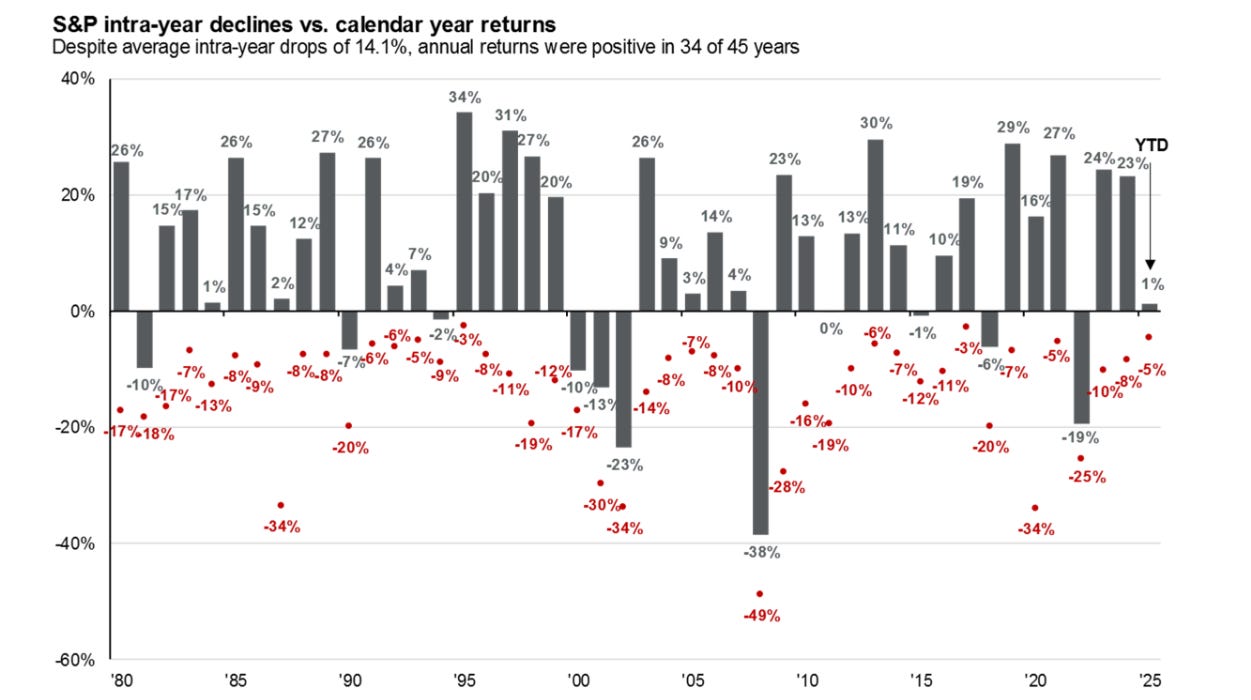

• The average intra-year decline in the S&P 500 is 14%, and despite that, on a calendar-year basis, the S&P 500 closed higher 75% of the time.

• Individual stocks are not the market. You need a plan for individual stocks. If you don’t know what to do, then set a 25% trailing stop that will move higher as the stock ticks higher while at the same time giving the stock enough wiggle room and taking the emotions out of the way.

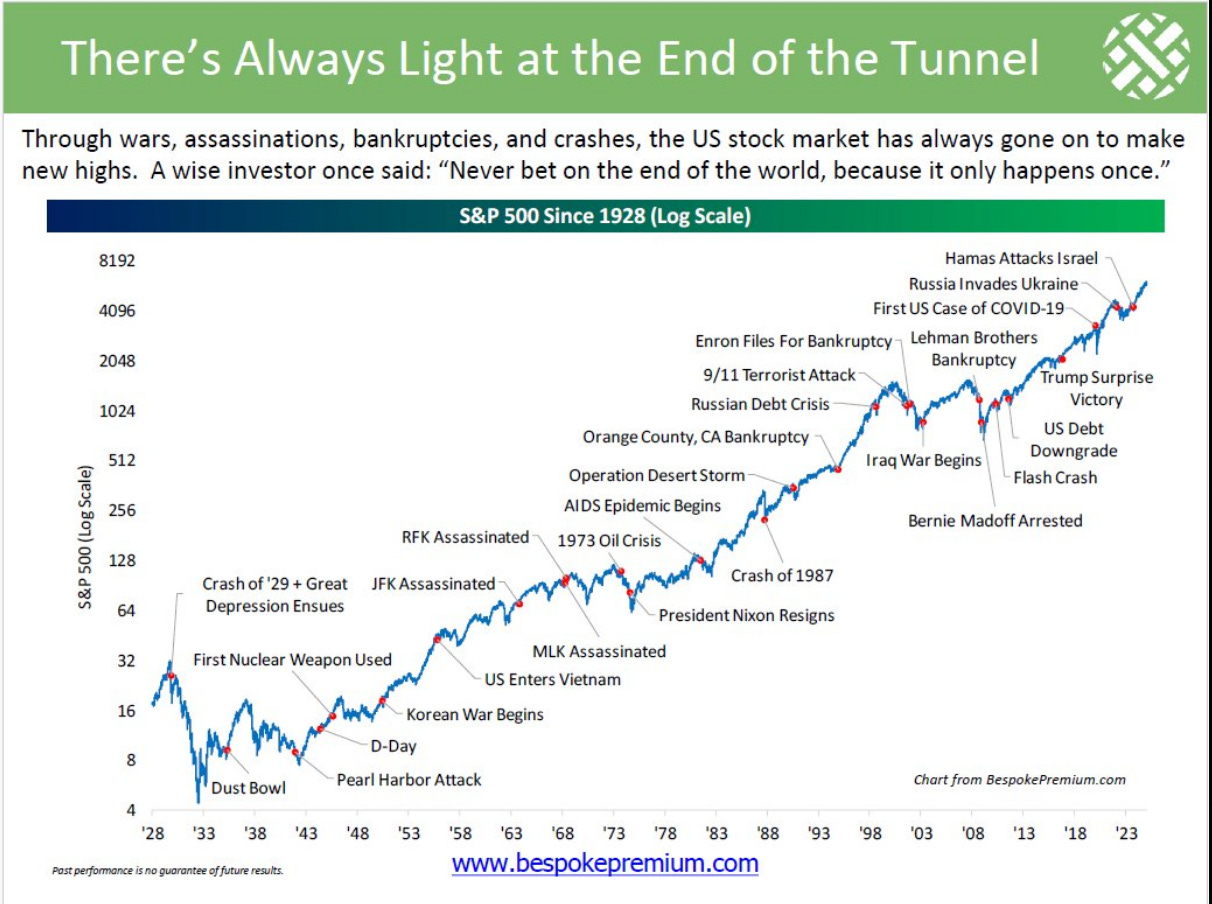

• There is always a reason/narrative; it’s different every time, as you see below. Now more than EVER, the media will elevate the fear levels to generate more ratings. Do not tune in, tune out.

The S&P 500 is down 7.87% from its 52-week highs, and another -7% to reach its annual intra-year average decline takes you from 5656 to 5261, back to August 2024 levels.

-

Does it have to get there? No.

-

Can it go down further than 14%? YES

-

Will it get there in a straight line? It could.

-

The bigger and the faster the flush, the better it is. Yes.

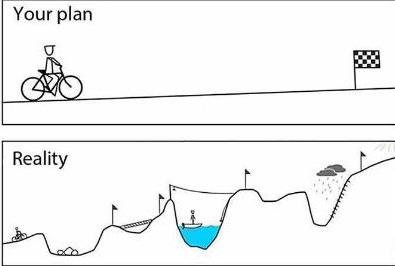

And I know that sometimes the way we plan it doesn’t always plan out perfectly.

GET IN TOUCH:

Book a call, Calendly.

ZorTrades_Alpha actionable trade ideas.

On X ZorTrades

YouTube (tons of educational videos, many detailing my favorite scans).