The drip selling grinds on. A swift flush is always better than death by a thousand cuts.

After today’s nasty Thursday, brace yourself for the inevitable chatter about the 1987 playbook: a sharp drop on Thursday, a flat Friday, a market crash on Monday, a Turnaround Tuesday, a retest of the lows a month later—then liftoff.

Could another Black Monday happen? Absolutely. Given the current administration’s rhetoric, they may not mind seeing the market tumble 20% if it means securing rate cuts and possibly even some fresh quantitative easing.

1990

1998

1999

2002

2003

2008

2010

2011

Here is a refresher course on “CRASHES”.

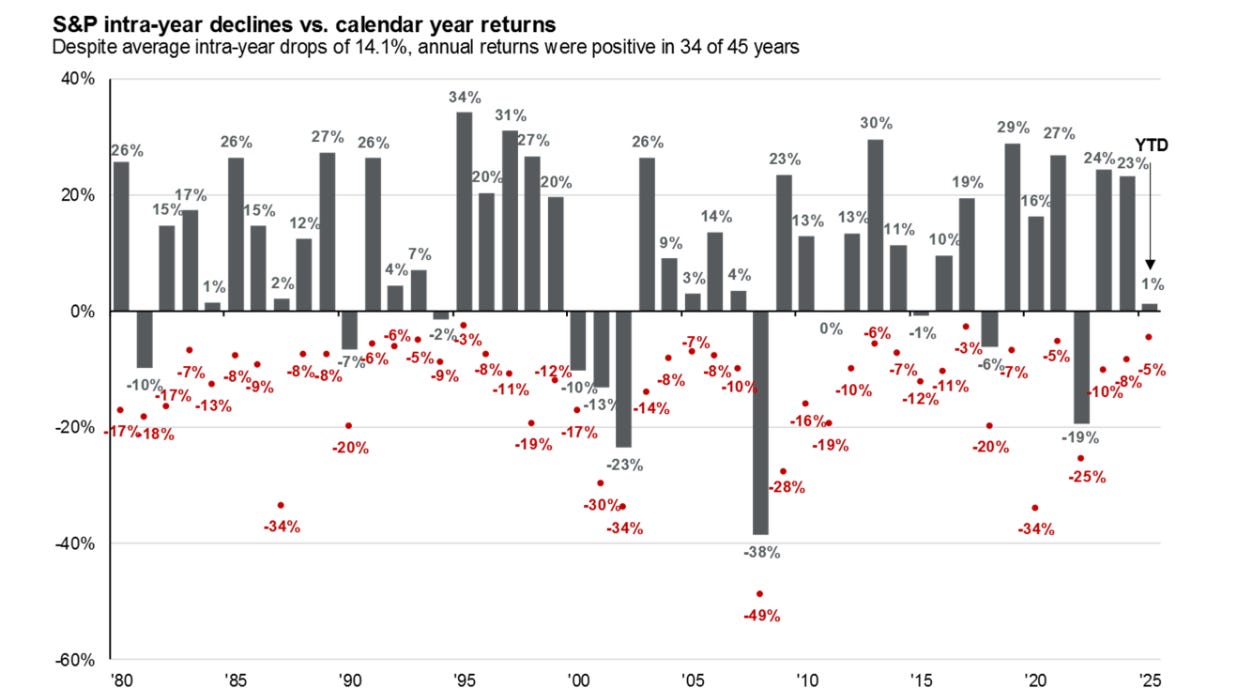

So far, the market really has done nothing out of the ordinary; remember that the average intra-year decline in the S&P 500 since the 1980s is 14%.

Read more HERE

Stock Spotlight: $BRKB

Yesterday, the market was up, and $BRKB lagged. Today, the market is down, and $BRKB is leading.

Despite the S&P 500 dropping 10% in the last 17 days, $BRKB has held up extremely well—it is just 3% away from all-time highs.

That’s the beauty of Buffett’s $325 billion war chest—it’s a winner either way.

On the way down, it shines because of its massive cash pile. And, of course, everyone will give Buffett credit for raising cash before the correction, calling it a masterclass in patience and discipline.

Then, when he starts buying, people will assume he has the magic touch again—just like in 2009. The headlines will write themselves: “Buffett Strikes Again—Echoes of 2009.”

But we don’t know when that will be. Only Buffett does. And when he finally pulls the trigger, expect a callback to his famous 2009 letter:

“Though the path is not predictable, America’s best days lie ahead. I’ve been buying American stocks. And my expectation is that—over time—we will be very glad we did.”

History doesn’t repeat, but it sure does rhyme.

Embrace the full range of possibilities. Study past corrections, internalize them, and come to terms with how markets move (see above).

Stay level-headed—don’t get caught thinking only in one-day timeframes. Stretch your vision further.

Now, imagine you could turn back time. After the ’87 crash, the 2000 bubble, or any major selloff—knowing what you know now—what would you have done differently?

The answer to that question is your playbook for today.

Time is on your side.

GET IN TOUCH:

Book a call, Calendly.

ZorTrades_Alpha actionable trade ideas.

On X ZorTrades

YouTube (tons of educational videos, many detailing my favorite scans).