The U.S. stock market experienced notable declines during the week ending March 28, 2025, influenced by escalating trade tensions, rising inflation concerns, and weakening consumer sentiment.

Market Performance:

-

S&P 500: The SPDR S&P 500 ETF Trust (SPY) closed at $555.66, down 2% for the week.

-

Dow Jones Industrial Average: The SPDR Dow Jones Industrial Average ETF (DIA) ended at $415.62, marking a 1.7% weekly loss.

-

Nasdaq Composite: The Invesco QQQ Trust Series 1 (QQQ) finished at $468.94, declining 2.7% over the week.

Weekly Market Vibes:

Mon:

📈 Markets started strong as Trump’s tariffs weren’t as harsh as feared. 23andMe exits stage left, while CoreWeave & eToro hype IPO debuts.

Tues:

📉 Consumer confidence hit a 12-year low — big yikes for sentiment. GameStop went full crypto.

Wed:

⚠️ AI demand worries from TD Cowen pulled markets down — rumors say Microsoft backed out of some data center deals. China targeted Nvidia, and auto stocks got hit by fresh tariffs.

Thurs:

🥇 Gold surged 💰 as investors fled risk. Lululemon waved a red flag on the U.S. consumer, CoreWeave slashed IPO terms, and GameStop popped again.

Fri:

🤯 Stocks tanked into the close. CoreWeave’s IPO flopped, one scammer got locked up while another walked free.

Key Factors Influencing the Market:

-

Trade Tensions: President Donald Trump’s announcement of impending tariffs on imported automobiles and auto parts, set to take effect in early April, heightened investor uncertainty.

-

Inflation Concerns: The core Personal Consumption Expenditures (PCE) price index, the Federal Reserve’s preferred inflation measure, rose 0.4% in February, pushing the year-over-year rate to 2.8%, surpassing the Fed’s 2% target.

-

Consumer Sentiment: The University of Michigan’s consumer sentiment index fell to 57.0 in March, the lowest since November 2022, indicating growing consumer pessimism about inflation and employment prospects. The Guardian

Sector Highlights:

-

Technology: Major tech stocks, including Meta Platforms, Amazon, Netflix, and Alphabet, experienced significant losses, contributing to the Nasdaq’s underperformance.

-

Automotive: Automaker stocks declined amid concerns over the impending auto tariffs.

-

Commodities: Gold prices surged to record highs, reflecting increased demand for safe-haven assets amid market volatility.

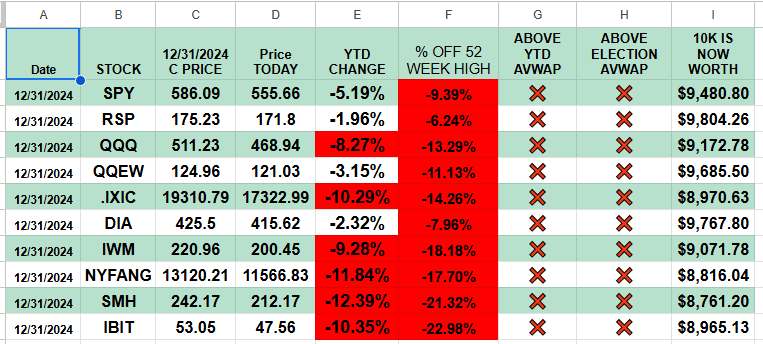

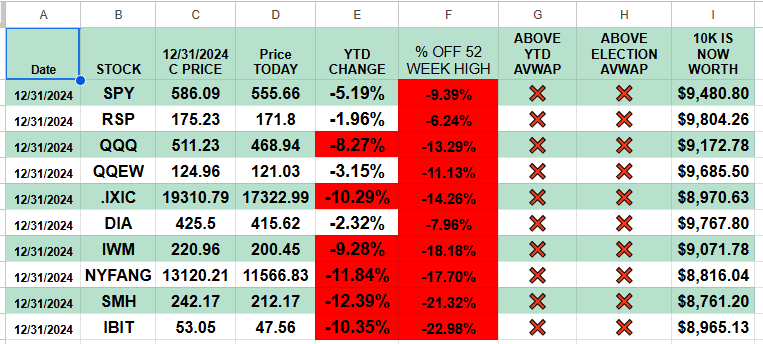

YTD Figures:

📆 This Week’s Economic Rundown (all times ET):

Mon 3/31

📉 Chicago PMI → 45.5 est. = regional contraction (9:45 AM)

Tues 4/1

🏭 Final Mfg PMI → 52.7 (9:45 AM)

💼 JOLTS → 7.7M openings est (10:00 AM)

⚙️ ISM Mfg → 50.3 est (10:00 AM)

🚧 Construction Spend → -0.2% est (10:00 AM)

Wed 4/2

👷 ADP Jobs → +77K est (8:15 AM)

📦 Factory Orders → +1.7% est (10:00 AM)

Thurs 4/3

🌐 Trade Deficit → -$131.4B est (8:30 AM)

📉 Jobless Claims (no est) (8:30 AM)

🧾 Final Services PMI → 51 (9:45 AM)

📊 ISM Services → 54.4 est (10:00 AM)

Fri 4/4

💰Wages YoY → +4.0% | MoM → +0.3% (8:30 AM)

📉 Unemployment → 4.1% est (8:30 AM)

🧑🏭 NFP Jobs Report → +151K est (8:30 AM)