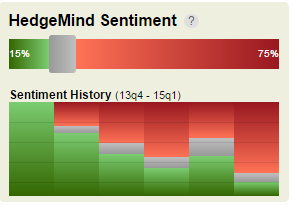

Ever since American Airlines came out of bankruptcy and started to trade publicly again hedgefunds jumped all over it. Effectively the stock became a hedgefund hotel, ever since the 4th quarter of 2013 a large amount of hedgefunds held the stock as you can see from the chart below. Hedgefunds held steady for 5 quarters and enjoyed healthy gains.

Fast forward to today, American Airlines was under distribution in the first quarter of this year, the stock traded between $45-$55 and became volatile as oppose to the steady rise it had the previous quarter. The funds owning the stocks decreased from 24% to 14% and some of its largest holders to profits on the stock.

The concern here is that many hedgefunds tend to check in and check out of stocks together, and with American Airlines now under its 50 and 200 day moving averages one can assume that the selling will continue. Any rallies to the underside of those averages should be consider as an opportunity to sell for traders.

This information is issued solely for informational and educational purposes and does not constitute an offer to sell or a solicitation of an offer to buy securities. None of the information contained in this blog constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. From time to time, the content creator or its affiliates may hold positions or other interests in securities mentioned in this blog. The stocks presented are not to be considered a recommendation to buy any stock. This material does not take into account your particular investment objectives. Investors should consult their own financial or investment adviser before trading or acting upon any information provided. Past performance is not indicative of future results.

Leave A Comment